ANY Zimbabwean, given what is happening on the currency market, who experienced the economic turmoil of 2008 leading to the abandonment of the local currency a year later, would not only be quaking in their boots, but enduring sleepless nights as well.

It is still unknown to what extent the Zimbabwe dollar fall during the hyper-inflation of 2008 which prompted the authorities to ditch the unit for a basket of currencies that was dominated by the United States dollar.

The victims of the demise of the local currency then have never recovered. They watched helplessly as their savings were decimated.

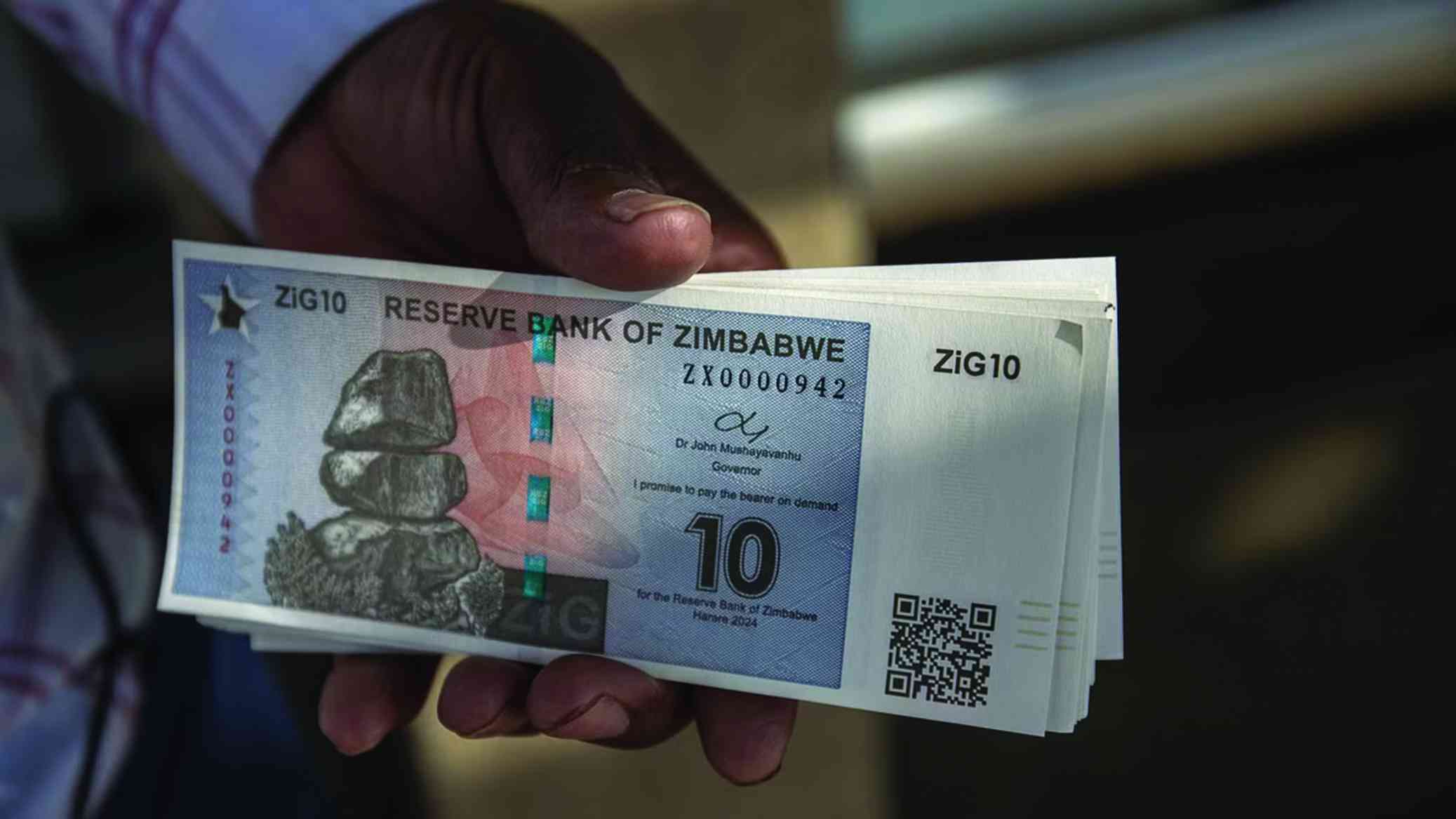

The recent depreciation of the Zimbabwe Gold (ZiG) on the formal and informal markets is a stark reminder of what happens if we don’t put our house in order.

The Reserve Bank of Zimbabwe (RBZ) last Friday devalued the ZiG to 24,3 per United States dollar from 14.

After the devaluation of the ZiG, some quarters have been calling on authorities to scrap the United States dollar and adopt the ZiG, introduced five months ago, as the sole currency of trade.

The local currency is fast becoming irrelevant, with some players in the informal sector shunning it.

The government has said it will be working torwards total removal of foreign currencies to pave way for the exclusive use of the ZiG. However, as has been enunciated by retailers, one of the most important sector in Zimbabwe’s economy, de-dollarisation might trigger shortages of fuel and basic commodities and cripple the retail sector as well as other industries.

- Rampaging inflation hits Old Mutual . . . giant slips to $9 billion loss after tax

- Monetary measures spur exchange rate stability: RBZ

- Zim deploys IMF windfall to horticulture

- Banker demands $21m from land developer

Keep Reading

“Any move to switch the currency of transaction, without adequate reserves and systems in place, will inevitably lead to scarcity, causing significant disruptions across all sectors,” the retailers argue.

“The transportation industry, a critical player in the retail supply chain, would also be affected, driving up logistical costs and causing inflationary pressures.”

In August, Cabinet approved a fresh de-dollarisation roadmap, with a monocurrency expected to come into force before 2030.

President Emmerson Mnangagwa has indicated that it could even come earlier than 2030.

It is understandable that Zimbabweans are concerned over the latest devaluation of the ZiG, including plans by the authorities to de-dollarise when the local currency is struggling.

The challenges Zimbabwe is facing are due to a myriad of issues, especially at government level.

We are worried that government continues to ignore concerns raised by citizens.

Government needs to start working with the people to get their buy-in which is vital in the acceptance of any policy or programme.

The currency issue has become emotional over the years. Some Zimbabweans have been forced to leave the country after failing to provide basics for their families.

It is with this in mind that we ask Treasury, Reserve Bank of Zimbabwe and Cabinet to come up with measures that ensure ordinary Zimbabweans do not relive the ordeals of 2008.

The scars of 2008 are still very fresh.