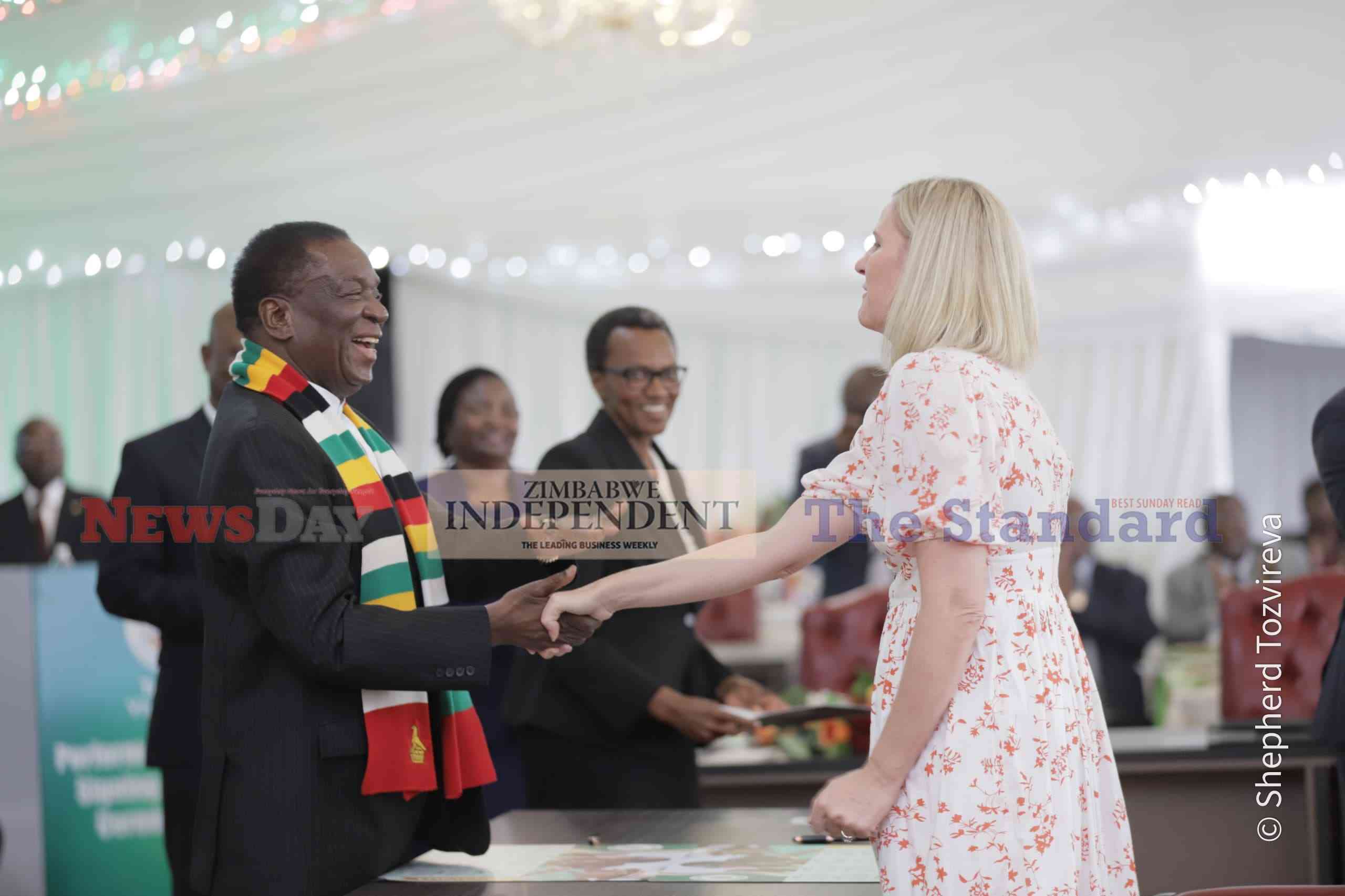

President Emmerson Mnangagwa announced the removal of Chief Felix Nhlanhlayamangwe Ndiweni through Zvinechimwe Churu, then Local Government and Public Works secretary.

Zanu PF chefs invade gold claims

FOREIGN investor Forbes and Thompson (Pvt) Ltd has filed an urgent application at the High Court in Bulawayo, seeking a spoliation order against several Zanu PF leaders in Matabeleland South

By Desmond Chingarande

7h ago

Zanu PF official loses Gwanda mine

By Silas Nkala

Jan. 26, 2026

Flash floods ravage Binga South’s Tinde ward

By Nokuxola Mbangeni and Berita Kafesu

Jan. 26, 2026

Zanu PF chefs invade gold claims

FOREIGN investor Forbes and Thompson (Pvt) Ltd has filed an urgent application at the High Court in Bulawayo, seeking a spoliation order against several Zanu PF leaders in Matabeleland South

By Desmond Chingarande

7h ago

Flash floods ravage Binga South’s Tinde ward

By Nokuxola Mbangeni and Berita Kafesu

Jan. 26, 2026

Zanu PF official loses Gwanda mine

By Silas Nkala

Jan. 26, 2026

Will Litecoin Grow in the Future?

By The Standard

May. 4, 2021

Why is Golix the best exchange in Zimbabwe?

By The Standard

May. 4, 2021

What are the best ways to store cryptocurrency?

By The Standard

May. 4, 2021

5 Best Altcoins to Make High Profits.

By The Standard

May. 4, 2021

Kenya’s ivory burning raises questions

By The Standard

May. 3, 2016

Grace, a virtual law unto herself

By The Standard

Mar. 29, 2016

Salute to MPs for stopping minister’s abuse of power

By Southern Eye

Dec. 4, 2025

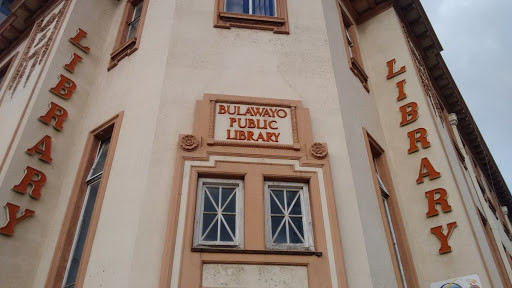

Save Bulawayo’s iconic library

By Southern Eye

Nov. 13, 2025

Illegal mining scarring Shurugwi’s land and future

By Southern Eye

Oct. 23, 2025

Bulawayo deserves leadership renewal

By Southern Eye

Oct. 15, 2025

Gweru cannot survive on colonial relics

By Southern Eye

Oct. 1, 2025

Makokoba redevelopment: Another empty promise

By Southern Eye

Sep. 24, 2025

How Billy Markus invented Dogecoin

If you know anything at all about cryptocurrencies, you can’t have failed to notice their dramatic increase in value of late. Of course, the original of these cryptos is Bitcoin and this is still the one that steals the headlines and sets the standards. Wherever Bitcoin may go, the anticipation is that this is where […]

By The Standard

Jan. 19, 2022

Liquid joins forces with Google for Congolese adventure

By The Standard

Sep. 22, 2021

Musariri’s vision to transform PSL

Musariri’s blend of practical club management experience and ambitious commercial vision positions him as a compelling contender for the top job.

By Munyaradzi Madzokere

Jul. 17, 2025

Festive lights, political fights: A week in the city

By Ink Whispers

Dec. 4, 2025

Alan Redfern Primary School revels in its success

By Margaret Lubinda

Dec. 4, 2025

AMH journo publishes award-winning IsiNdebele novel

By Margaret Lubinda

Dec. 4, 2025

Inside Lungile Bonga’s powerful debut Umakhelwane

The Kwaito Boy mentioned that he was inspired by artists such as Skhu and Pozeey, Mandoza, Brown Dash, and Arthur Mafokate.

By Nokuxola Mbangeni

Nov. 27, 2025

Discipline of delay

By Mthulisi 'khulugatsheni' Ndlovu

Nov. 27, 2025

No favourites: Insist female poets

By Mpumelelo Moyo and Langelihle Nyathi

Nov. 27, 2025

Mzansi Magic’s Inimba tackles taboo of male infertility

By Mpumelelo Moyo

Nov. 20, 2025

Esther Zitha throws her hat in

By Ink Whispers

Nov. 20, 2025

Youth group promotes heritage tourism

By Nokuxola Mbangeni

Nov. 13, 2025

.

Videos

Zimbabwe VS Scotland U19 opener

By The NewsDay

Jan. 15, 2026

The story behind the attempt to block Riverside Academy: as told by Chief Murinye

By The NewsDay

Jan. 15, 2026

ED government pours millions into cars with no roads

By The NewsDay

Jan. 12, 2026

Zimsec touts higher ‘A’ Level pass rate

By The NewsDay

Jan. 9, 2026

Zim’s largest inland reservoir, Tokwe Tugwi-Mukosi dam, has reached 100% capacity

By The NewsDay

Jan. 6, 2026

Thebe Ikalafeng, Founder and Chairman of Brand Africa In Conversation With Trevor

By The NewsDay

Dec. 9, 2025

Thelma Chimbganda,Co- Founder& Chief Logistics Officer of Beyond Borders In Conversation With Trevor

By The NewsDay

Nov. 12, 2025

Nedbank Zimbabwe MD Sibongile Moyo quits

Nedbank Zimbabwe has announced the resignation of its Managing Director, Sibongile Moyo, who has stepped down to pursue private interests after nearly six years at the helm.

By Staff Reporter

Jan. 26, 2026

NAMA organisers promise world-class showcase

“Let’s all brace for a universally followed up and memorable entertainment from our local artists and creatives, including surprises.”

By Tendai Sauta

Jan. 23, 2026

Importance of reviewing Zimbabwe’s public procurement

By Kevin Tutani

Jan. 23, 2026

Leveraging inventory for cost reduction, efficiency

By Charles Nyika

Jan. 23, 2026

ZGC must act now on AI’s impact on women and girls

By Evans Sagomba

Jan. 23, 2026

Zimura distances itself from ‘caucus meeting’

The caucus meeting was called by axed Zimura board members Derreck Mpofu, Joseph Garakara and Gift Amuli.

By Style Reporter

Jan. 26, 2026

Broke Highlanders had no choice but bow down to Chivayo

Initially Bosso rejected the offer, but made a U-turn in what was viewed as an act of desperation from an institution that is no longer able to stand on its own feet.

By Michael Kariati

Jan. 26, 2026

ZCF to launch ‘Chess Kumusha’ in 2026

By Munyaradzi Madzokere

Jan. 26, 2026

Owit hosts climate awareness training

By Takemore Mazuruse

Jan. 26, 2026

Outcry as producer Maselo snubbed in Zanu PF freebie drive

By Style Reporter

Jan. 26, 2026

China’s President Xi writes to veterans of Zimbabwe's national liberation war

China and its African friends have respected and supported each other, weathered arduous times together, and jointly embarked on a new journey toward modernization, Xi noted.

By Staff Reporter

2h ago