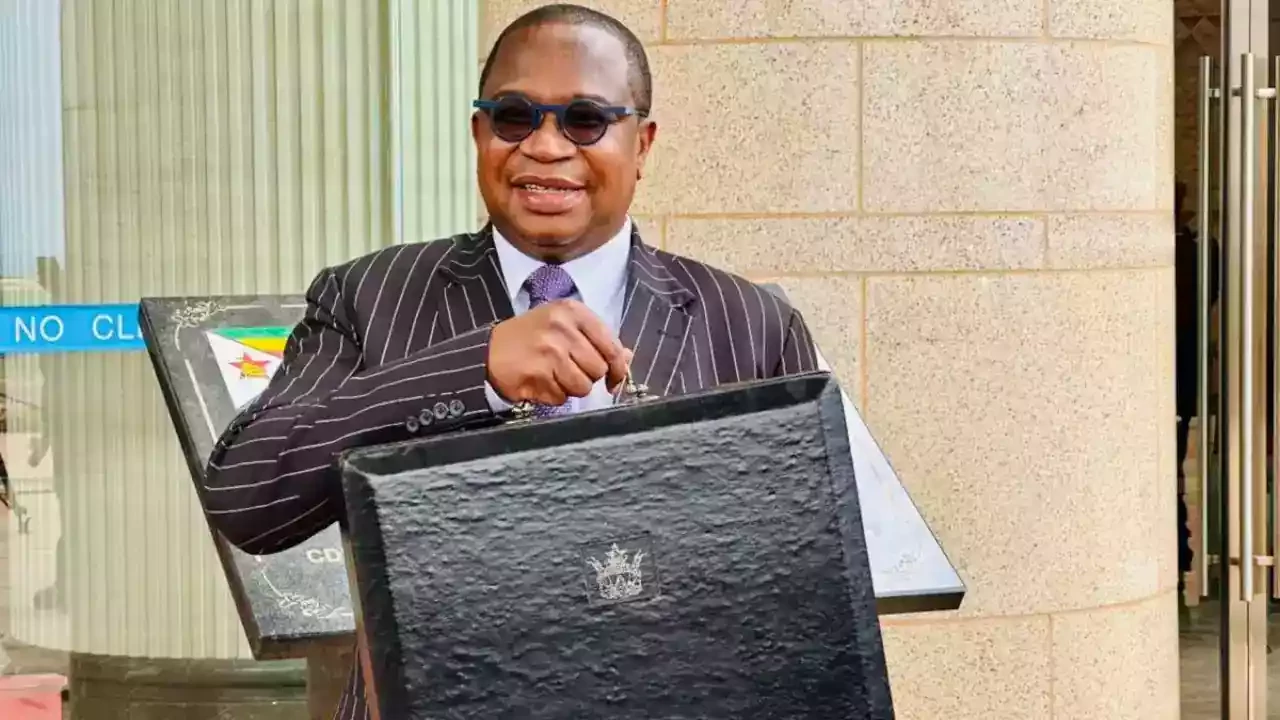

IN the 2025 national budget proposal presented last week on Thursday, Finance minister Mthuli Ncube sought to improve the country’s fiscal position through the imposition of further taxes on the already burdened formal economic players.

This is because any tax targeted at informal market players will always end as wishful talk, while the formal market players are faced with no option other than compliance.

Improving Zimbabwe’s fiscal position requires a multifaceted and pragmatic approach that balances immediate revenue needs with long-term economic stability.

Instead, a more balanced approach that incentivises formal sector growth while gradually integrating the informal sector may yield better long-term results.

As startling as it may sound, one effective strategy could be the full dollarisation of the economy. By adopting the United States dollar as the official currency, Zimbabwe could eliminate the volatility and instability associated with the local currencies, which was the case with ZWL and now the Zimbabwe gold (ZiG).

Dollarisation can provide much-needed currency and inflation stability, which would attract investment and restore confidence in the banking sector.

This stability is essential for creating a predictable economic environment where businesses can plan and operate without the constant threat of devaluation and inflation. Simultaneously, exempting formal sector businesses from certain duties and taxes will give them a competitive edge over the informal sector. This approach allows formal businesses to leverage economies of scale, reduce operational costs, and increase market share.

As formal businesses grow and thrive, the tax base naturally expands, enhancing government revenue without the need to impose punitive taxes. By fostering a robust formal sector, the government can create a more sustainable source of revenue.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

- Letters: How solar power is transforming African farms

Keep Reading

While the formal sector thrives in the stable and predictable environment, the informal sector will not necessarily be squeezed out but will rather be incentivised to formalise - attracted by rebates and a stable currency regardless of sector.

Presently, the main competitive edge of the informal market is the ability to only trade in foreign currency, evading exchange losses and compliance through cash-only dealings.

Another critical component of this strategy is improving financial transparency and reducing cash transactions. Dollarisation can help achieve this by making electronic transactions more prevalent and traceable.

By dollarising, the informal sector will be forced to accept soft money, which makes it almost impossible to completely evade compliance.

Enhanced financial transparency will also help combat corruption, a significant barrier to formal sector growth. The gradual introduction of these measures can transition the informal sector into the formal economy.

As formal businesses become more competitive and attractive, informal players will be incentivised to formalise in a bid to compete effectively. This natural progression is more sustainable than forcing compliance through regulation, which is often and, oblivious to some policy-makers, leads to resistance and evasion.

Addressing the underlying economic issues that drive businesses into the informal sector is also crucial. Zimbabwe’s current economic structure heavily relies on exporting raw materials, particularly minerals, which are less affected by local currency dynamics as they depend on global commodity prices.

This reliance limits the benefits of a weak local currency. With a weak local currency, Zimbabwe should be enjoying a trade surplus through the exportation of finished products priced against a weak currency, yet the country largely exports goods not affected, anyhow, by exchange rate.

To address this, the country needs to invest in industrial development and value-added production. A vibrant industrial sector can produce finished goods for export, leveraging the benefits of a stable, albeit initially more expensive, currency.

To attract such investment, a stable currency and economic market is essential, which is not possible under the current volatile local currency/currencies.

The government's recent budget proposals, which include various new taxes, may seem like immediate solutions to improve the fiscal position. However, these measures sound too theoretical as in practice, they will, at best, exacerbate the problem by driving more businesses into the informal sector to escape the increased tax burden.

For instance, the proposed registration requirements for corporate and income tax, new taxes on plastic grocery bags, sales of certain foods, betting winnings, and rental income will discourage compliance and increase tax evasion through innovative means, if not closure of business.

Instead of adding new taxes, the government should focus on creating a conducive environment for business growth and formalisation.

This includes enhancing infrastructure, providing access to affordable credit, and offering training programmes to improve business management skills.

By supporting businesses in becoming more competitive and efficient, the government can indirectly boost tax compliance and revenue. Long-term structural reforms are also necessary to create a more resilient economy.

These reforms should focus on improving governance, reducing bureaucratic red tape, and enhancing the legal framework to protect property rights and enforce contracts.

A transparent and efficient legal and regulatory environment will encourage both domestic and foreign investment, driving economic growth and expanding the formal sector.

According to a recent risk and return survey, Zimbabwe ranked the worst country to invest in as it was regarded to have the lowest returns yet the highest risk mainly due to property rights issues and governance, which renders this ‘disease’ an urgent consideration.

Streamlining business registration and licencing processes can also encourage informal businesses to formalise. Simplifying and reducing the cost of these processes, setting up one-stop-shop services for business registration, offering online registration options, and providing clear, easy-to-follow guidelines can make formalisation more attractive.

Additionally, offering tax incentives, such as reduced tax rates for newly formalised businesses or tax holidays, can motivate informal businesses to transition to the formal sector. However, this will only be practical if the above measures are implemented as presently, there are zero benefits to formalising and every benefit in informalising operations.

Expanding access to affordable credit and financial services for small businesses can encourage formalisation. Financial institutions can offer tailored financial products for small and medium enterprises (SMEs), with government guarantees or subsidies lowering borrowing costs.

However, again, this can only be achieved with the revival of confidence and viability in the financial sector, which can only be attained through a stable currency.

Investing in infrastructure, such as transportation, electricity, and digital connectivity, makes it easier for businesses to operate formally.

Enhanced infrastructure reduces operational costs and increases efficiency, encouraging businesses to formalise to take advantage of these benefits.

Recently, Innscor reported to have used 8,1 million litres of diesel in the year to June 2024, with five million litres attributable to

production and three million litres to generators.

At an average fuel price of US$1,50 per litre, this translates to a US$4,5 million charge for alternative power generation, which could have been avoided with the right infrastructure in place.

In the face of immense competition, which would typically increase the elasticity of prices, Innscor would be contemplating options to import most of what it produces locally if it meets its target cost.

Furthermore, and less talked about, helping informal businesses access international markets can drive growth and formalisation.

Providing support for export activities, such as trade missions, export financing, and market research, can help businesses expand and necessitate formalisation to comply with international trade regulations.

Developing social safety nets, such as health insurance, unemployment benefits, and retirement plans, can reduce the economic insecurity that drives individuals to participate in the informal sector.

A robust social safety net can make formal employment more attractive. Engaging with informal sector associations and cooperatives can help bridge the gap between informal businesses and formalisation efforts.

These associations can provide support and information to their members and advocate for policies that facilitate formalisation.

Ultimately, Zimbabwe's approach to improving its fiscal position should prioritise stability, growth, and transparency.

Full dollarisation, combined with duty exemptions for formal businesses, can provide the necessary stability and competitive edge to grow the formal sector.

Enhanced financial transparency and gradual formalisation of the informal sector will expand the tax base without imposing additional burdens on compliant businesses.

By addressing structural issues and creating a supportive business environment, Zimbabwe can achieve sustainable economic growth and improved fiscal health.

Implementing these comprehensive strategies will ensure a more resilient economy, capable of supporting a broader tax base and reducing the strain on formal economic players.

- Equity Axis is a financial media firm offering business intelligence, economic and equity research. The article was first published in its latest weekly newsletter, The Axis.