Generally, nations must keep their debt levels at sustainable levels so as not to negatively impact the economy and citizens' welfare.

Recently, the Zimbabwe Public Debt Management Office (ZDMO) published the 2023 Annual Public Debt Bulletin (APDB), a report showing the nation’s total debt stock, including terms and conditions of contracted loans.

This week's column, therefore, seeks to analyse whether these debt statistics show a worrisome trend.

Debt transparency, accountability

According to the International Budget Partnership (IBP) Open Budget Survey (OBS) findings, Zimbabwe has significantly improved its global rankings in terms of debt transparency.

It scored 63 100 in 2023, up from 59 100 in 2021, 49 100 in 2019, and 23 100 in 2017 — an upward trend. In Sub-Saharan Africa (SSA), Zimbabwe was ranked third after South Africa and Benin.

Globally, Zimbabwe jumped from 41 out of 120 countries in 2021 to 30 out of 125 countries in 2023.

The improvement in rankings means that the nation is providing substantial information and allowing citizens to participate in the budgeting process.

- Zimbabwe needs to rethink economic policies

- Zimbabwe needs to rethink economic policies

- Forex demand continues to fall

- Digital platforms transfer ZW$8tn

Keep Reading

The preceding is highly commended. However, there is a need to continue improving transparency and accountability in public financial management.

For instance, the annual Open Budget Surveys (OBS) by the Zimbabwe Coalition on Debt and Development (Zimcodd) indicate that many communities are unaware of and do not participate in the budget process.

The Treasury also acknowledged that many state-owned enterprises (SOEs) and local authorities (LAs) continue to violate Section 30 of the Public Debt Management Act (PDM) Act, which requires them to submit the latest audited financial statements and management accounts.

These gaps must be fully addressed to attain fiscal discipline, improve allocative and operational efficiency to increase citizens' value for money, and increase transparency and accountability, particularly access to information and creating space for social accountability like participatory budgeting.

Debt statistics

The latest Annual Public Debt Bulletin (APDB) shows that the total public and publicly guaranteed (PPG) debt stock jumped massively by 19,8% to US$21,2 billion at the end of June 2024 from US$17,7 billion in September 2023.

Of this total, the government’s own debt (non-guaranteed) accounts for about 93,2% (US$19,7 billion), while guaranteed debt accounts for a paltry 6,8% (US$1,4 billion).

Again, the latest total PPG debt stock equals 96,7% of the 2023 national output (GDP). Also, a close analysis of the 2023 APDB statistics shows that about 97,2% of total PPG debt stock is denominated in foreign currency.

External PPG debt stock constitutes 61,6% (US$13 billion) of the total PPG debt. It has slightly jumped by 2,4% from US$12,7 billion reported by the Public Debt Management Office (PDMO) as of Sept 2023. Of total external PPG debt, bilateral creditors account for a larger share (47,8% or about US$6,2 billion), followed by RBZ debts assumed by Treasury (28,1% or about US$3,66 billion) and multilateral creditors (24,1% or about US$3,14 billion).

Treasury spent US$57,3 million on external debt servicing in 2023, disaggregated as follows: Active portfolios (47,5%), legacy debts (33,9%), and token payments (18,6%).

As of December 2023, domestically raised PPG debt accounted for 38,4% (US$8,1 billion) of the total PPG debt. This domestic PPG debt comprises government securities (US$4,54 billion), former farmer compensation (US$3,5 billion), and domestic arrears (US$0,11 billion).

It has registered a massive spike, mounting 62% from US$5 billion in Sept 2023. The jump was primarily driven by US$924 million Treasury Bonds issued to expunge the Reserve Bank of Zimbabwe (RBZ) legacy debts and a US$1,92 billion capitalisation loan for Mutapa Investment Fund.

Status and drivers of PPG debt

A granular analysis of the latest 2023 debt bulletin statistics indicates that Zimbabwe is severely struggling with debt unsustainability.

The nation’s debt-to-GDP ratio is now estimated at 96,7%, which far exceeds the stipulated threshold in the Public Finance Management Act. Also, the total PPG debt-to-GDP ratio significantly exceeds the 60% threshold per the SADC macroeconomic convergence targets.

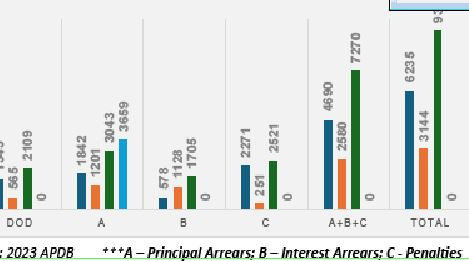

Consequently, the capacity to repay the debts has collapsed. Of the US$9,4 billion combined bilateral & multilateral debt, a staggering 77,7% (US$7,3 billion) are principal arrears, interest arrears, and penalties.

The bulletin indicates that arrears and penalties are the major drivers of PPG debt. Of the total external debt, A, B, and C account for 51,4%, 13,1%, and 19,3%, respectively. A+B+C combined accounts for a staggering 83,8%, while Disbursed Outstanding Debt (DOD) (new loans) accounts for a paltry 16,2% of the total external PPG debt.

The reliance on foreign currency loans also contributes to difficulties in debt servicing, hence ballooning debt. Of the US$21,2 billion total PPG debt stock, 97,2% are forex-denominated loans. Furthermore, the 2023 fiscal year’s huge overall deficit of 6,5% of GDP indicates that fiscal pressures exert immense pressure on debt to increase.

Again, reliance on resource-backed loans like the US$400 million Afreximbank loan contracted in February 2023 contributes to the increase in total debt stock.

In addition, State-Owned Enterprises (SOEs) reforms spearheaded under the Mutapa Investment Fund (MIF) and cleaning of RBZ's balance sheet by expunging legacy debts have added US$1,92 billion and US$924 million to debt stock, respectively.

Last but not least, non-performing guarantees are significantly contributing to unsustainable debt. Of the US$364,48 million foreign currency-denominated loan guarantees issued between 2020 and 2022, about 72,3% were outstanding as of December 2023.

Implications of debt unsustainability

Zimbabwe’s debt burden has affected the country’s credit rating.

As a result, the nation has lost several funding opportunities from international creditors, suspending or canceling many projects.

The stalled projects include the US$500 million Rapid Social Response Programme and the US$10 billion Infrastructure Crisis Facility. Thus, public debt has stalled national economic growth alongside national development strategy (NDS) 1 and Vision 2030 to a greater extent.

As alluded to earlier, Zimbabwe’s total PPG debt stood at USD$21,2 billion. Servicing this debt would mean that other essential infrastructural developmental projects are not financed. Excessive borrowing imposes a high debt service bill, which would see resources diverted from potential growth-enhancing sectors to service PPG debt.

Thus, the government's fiscal capacity to respond to national growth through financing the NDS1 and Vision 2023 will remain constrained as long as these legacy debts remain in place.

The cost of servicing debt crowds out fiscal resources that could have been invested in critical social services such as health care and education.

From January to September 2021, debt service payments amounting to US$44,2 million were made to external creditors. Additionally, during the 2023 financial year, the government made external debt service payments amounting to US$57,3 million. These resources could have been used to finance capital projects such as roads, electricity, housing, and water.

Consequentially, this has entrenched more than 62,2% of the population into abject poverty and widened the inequality gap between the rich and the poor.

Thus, high debt-servicing costs create economic and financial uncertainties and discourage foreign investment, inhibiting national economic growth and development.

High, unsustainable public debt levels lead to higher borrowing costs, as lenders demand higher returns to compensate for perceived risks.

In Zimbabwe, this has led to a situation where the government’s budget is increasingly consumed by debt servicing, leaving fewer resources for productive investments.

Elevated borrowing costs also deter foreign investment, further constraining economic growth.

Additionally, arrears and penalties on existing debt have prevented Zimbabwe from accessing concessional credits. Compounding the issue, at least 90% of the country’s total PPG debt is denominated in foreign currencies, raising the likelihood of exchange rate risk and subdued service delivery.

The nation's overreliance on borrowing has entrenched it in a detrimental cycle of debt overhang and frequent defaults.

The debt overhang accumulates payment burden, directly impacts capital inflows, and increases investment risk premium. Moreover, debt overhang increases debt servicing costs, fuels the cost of money, and constrains the nation from raising funds to support developmental programs.

Consequently, the country may end up relying excessively on resource-backed loans (RBLs). RBLs are dangerous as they exert dire developmental impacts by fuelling corruption and unsustainable resource extraction, leading to environmental degradation and pollution.

In addition, the unsustainable extraction of natural resources is an injustice to future generations. It deprives them of nature's value and causes humanity's benefits to be distributed unequally across time.

The government may resort to increased taxation or reduced public spending to manage high debt levels. Both strategies can have adverse effects on economic growth.

High taxes can reduce disposable income and consumption, while reduced public spending can undermine infrastructure development and social services, which are crucial for long-term growth.

- Sibanda is an economic analyst and researcher. He writes in his personal capacity. — brasibanda@gmail.com or X: @bravon96.