BY TANYARADZWA NHARI ZIMBABWE’S biggest agricultural lender said on Thursday it had been granted a 12-month grace period to shore up its capital to regulator prescribed benchmarks.

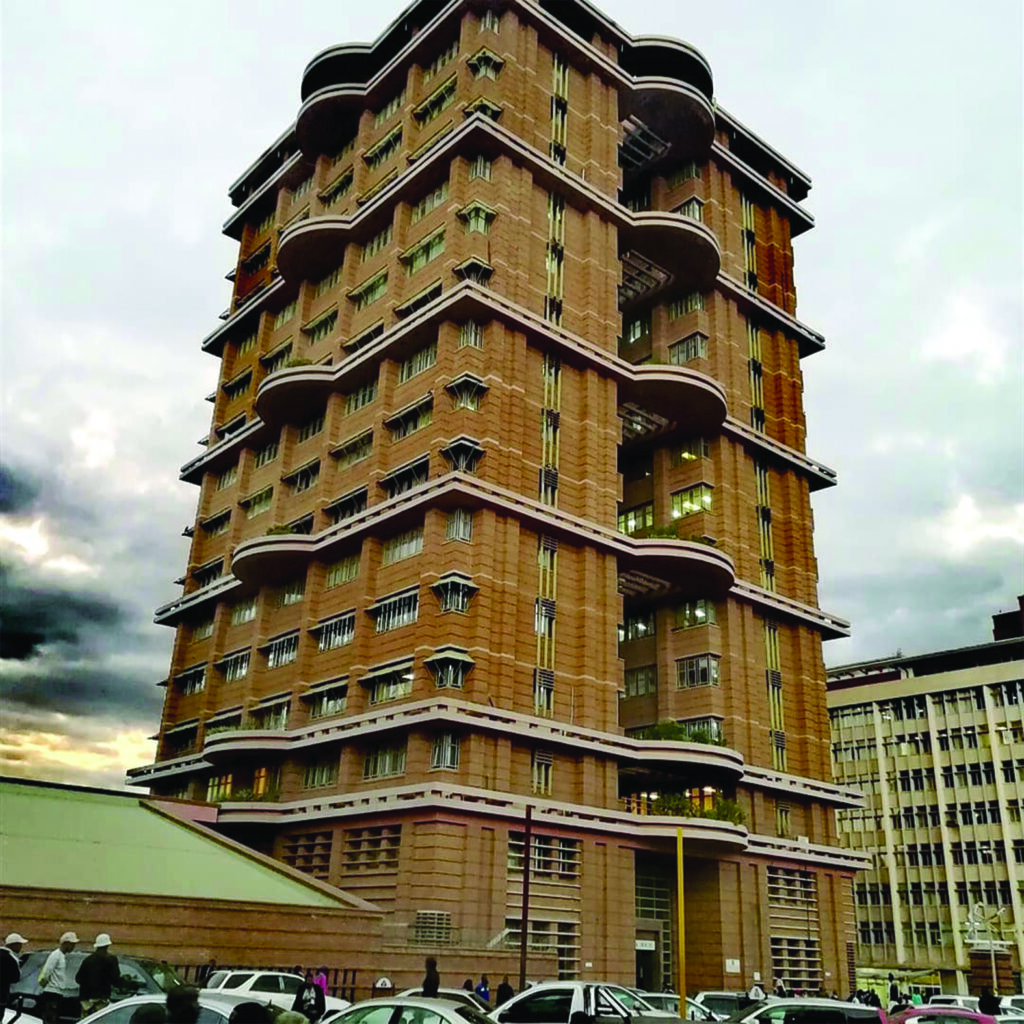

AFC Commercial Bank, which bounced back to profit during the year ended December 31, 2021 said it submitted a recapitalisation plan to the Reserve Bank of Zimbabwe (RBZ) to raise its capital threshold to US$30 million.

Lenders had until December 31, 2021 to meet new capital benchmarks.

But a few requested grace periods after the deadline passed.

Last week, ZB Financial Holdings Limited said it would merge its banking units before year end to create an operation that conformed to central bank capital requirements.

Similar plans have been announced by other banks.

“The bank’s tier 1 capital was $2,1 billion in historical cost translating to US$19,5 million against regulatory minimum of an equivalent of US$30 million,” said AFC Bank managing director Kenneth Chitando in a commentary to the financial statements.

“The bank submitted the board approved capitalisation plan as required by the Reserve Bank of Zimbabwe. The RBZ granted the bank an extension of 12 months to comply with minimum capital requirements.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The bank’s inflation adjusted operating income increased to $5,6 billion during the review period, compared to $3,2 billion during the comparable period in 2020.

AFC Bank, which was presenting it first full-year financial statements after rebranding from Agribank, posted $1,3 billion inflation adjusted profit after tax during the review period, compared to a $209 million loss during the comparable period in 2020.

Total deposits increased by 57% to $8,9 billion, from $5,7 billion previously.

“We are expanding our core competencies in leading edge technology, advancing digital transformation and core banking system capabilities. The bank’s strategy entails a new structure, re-organisation of the bank’s functions and culture transformation,” Chitando said on the bank’s outlook.

“The new bank architecture seeks to elevate customer experience while offering endless customer touch points that speed up service delivery. The bank will continue to leverage on AFC Holdings group synergies and its subsidiaries for business growth and new business development. Management will continue to drive value preservation strategies as part of sustainability and going concern.”

- Follow Tanyaradzwa onTwitter @t_anya_nhari