Zimbabwe’s swing into relentless turmoil since the announcement in November of the 2024 national budget points to several important things.

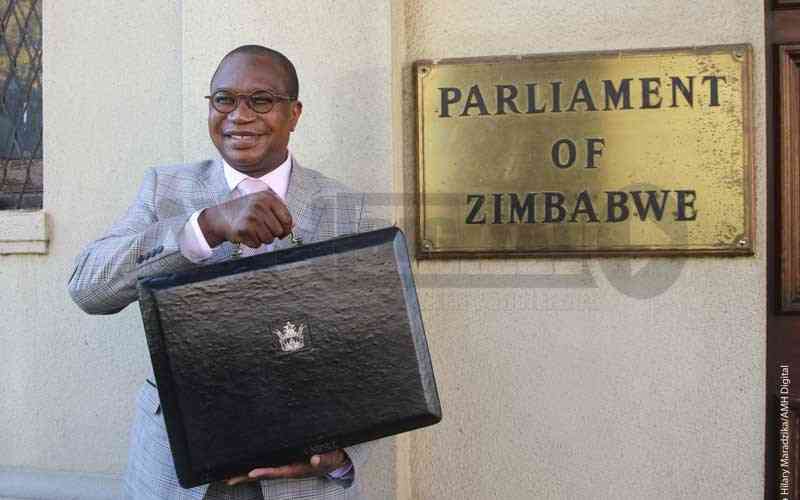

The first is that government has failed to attract economists with capacity to predict the impact of policies and counsel ministers accurately, which is a sham for a highly literate country. If such experts were available, Finance, Economic Development and Investment Promotion Minister Mthuli Ncube would surely have avoided coming up with policies that end up being abandoned.

This turmoil, triggered by serious policy making deficiencies, is something that everyone in Treasury including Ncube, may have anticipated, but political decisions may have taken precedence, which is another sham. Under the circumstances, it could be difficult not to believe those saying mistakes such as those made in the 2024 national budget were deliberate.

They argue that there appears to be a trend were authorities deliberately create crises so that when markets revolt, they quickly make corrections to give an impression that government listens. If these theorists are wrong, such madness must immediately end.

It is serving none’s interest other that the selfish ends of those in power. In a country where over half are struggling to make ends meet, Ncube introduced shocking taxes and levies in the national budget, to drain funds from companies and individual tax payers in order to make up for the mess that government has created for a period spanning over 20 years. The most controversial of these were the wealth tax, where those with properties would be forced to pay annual taxes, and the sugar levy, a complex cost head requiring government to take US$0,02 per gramme of sugar contained in beverages.

It is one of the harshest taxes ever introduced recently. If it had not been reversed this week, it was due to push firms to the brink. As the Confederation of Zimbabwe Industries says, it was going to take out much more from companies than they can shoulder.

For many companies, it was a relief to see Ncube summersault this week and trim the figure to US$0,001/gramme, which remains high given the state of the economy.

As we report elsewhere, up to US$1,6 billion was due to be drained from beverages firms this year alone, while thousands of jobs were at stake. This is a policymaking blunder that must not be repeated.

- US$200K armed robber in court

- Massive ZRP vehicle theft scam exposed

- Building narratives: Chindiya empowers girls through sports

- SRC move, an exercise in futility

Keep Reading

The policy flip flops that have taken place in the past week were avoidable. Ncube knows what this means for the economy.

Instead of rebuilding, his actions will scare investors away and dent ongoing efforts. Zimbabweans are likely to redirect funds earmarked for investments into property to other destinations where harsh taxes are not charged.

By demanding tougher actions on the informal sector, he will push them further into the dark market. This is why there had been a backlash from all corners in the past few weeks, with business lobbies seeking public and private meetings with the minister.

This must be the last time such kindergarten blunders are made.