VICTORIA Falls Stock Exchange-listed resources outfit Bindura Nickel Company (BNC) is projected to post a full year loss in the financial year 2023, market analysts Morgan & Co have said.

BNC, which is part of Kuvimba Mining House, posted a 7,8% decline in turnover, according to the reviewed financial results for the half year ended September 30, 2022.

This was on the back of a 16% decline in sales volumes that was slightly cushioned by a 40% increase in the average nickel selling price.

Direct costs surged as a result of inflation-driven pressures and led to a 90% in the gross profit.

The poor performance was further compounded by a decline in other relative price incomes and an increase in overheads and exchange losses.

Subsequently, BNC reported a net loss of US$5,4 million.

Growth in the value of non-current assets was offset by a decline in current assets and resulted in a marginal increase in total assets.

In their analysis of the firm’s financial results for the half year ended September 30, 2022, Morgan & Co researchers said the delayed capital expenditure and electricity woes in the country would perpetuate the company’s poor production volumes.

- Pension funds generate US$29 million

- Caledonia to restart key Bilboes operation

- Simbisa Brands mulls VFEX listing

- Simbisa Brands listing boost for VFEX

Keep Reading

“The global price of nickel continues to surge as a result of the growing focus on cleaner energy following energy disruptions by Russia.

“In the last five years, the average selling price achieved by BNC has moved upwards by 312%, from US$6,198 per tonne to US$25,542 tonne. However, production challenges continue to weigh on BNC’s ability to take advantage of the stronger global nickel price.

“Nickel production in the last five years has declined by 31% because of a decline in ore grade and we expect the delayed capex and electricity woes to perpetuate the poor production volumes. Further, the widening gap between the official and market rates is likely to add to margin pressures in the second half. We expect BNC to post a full year loss in FY2023.”

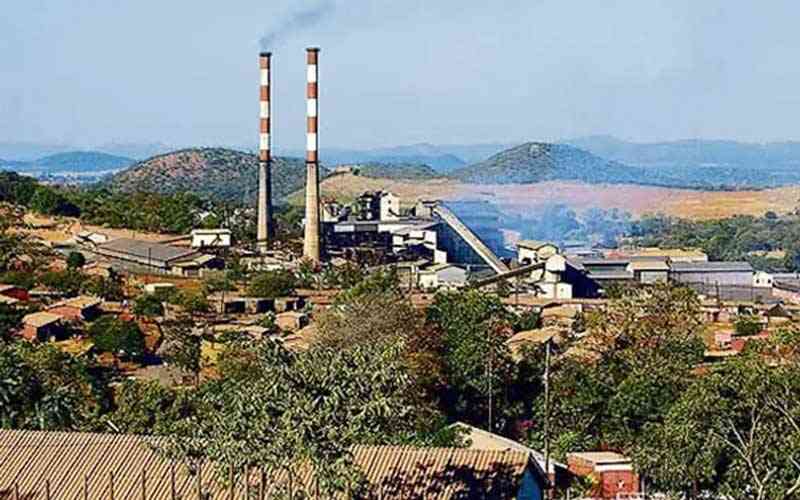

BNC has nickel resources across Zimbabwe under mining, processing, and exploration assets.

These are Trojan Mine, Shangani Mine, the BSR facility, Hunters Road Project, Damba-Silwane as well as the Trojan Hill and Kingstone Hill projects.

Collectively, these resources amount to a total of 72,5 million tonnes of ore, at an average grade of 0,60%, containing approximately 434,8 kilo-tonnes of nickel.

The mining company revealed that it has spent US$3,5 million to replace obsolete underground mining equipment