TWO of the country’s 19 banking institutions have been placed under “ongoing” central bank monitoring after failing to comply with regulator prescribed liquidity ratios, official papers showed Friday.

A liquidity ratio refers to the amount of cash and cash assets that a bank has on hand for conversion.

Not all bank assets are classed as cash assets, but for purposes of calculating a liquidity ratio, banks would consider only those assets that could be sold off to increase cash on hand within a specified period.

While there are some parts of the world where that window for conversion is longer, many countries use 30 days as the standard.

The ratio itself measures the amount of liquid assets against all financial obligations that a bank must meet within that defined period.

If every obligation to depositors, along with creditors, were called due immediately, a bank should have enough assets to honour them and remain open.

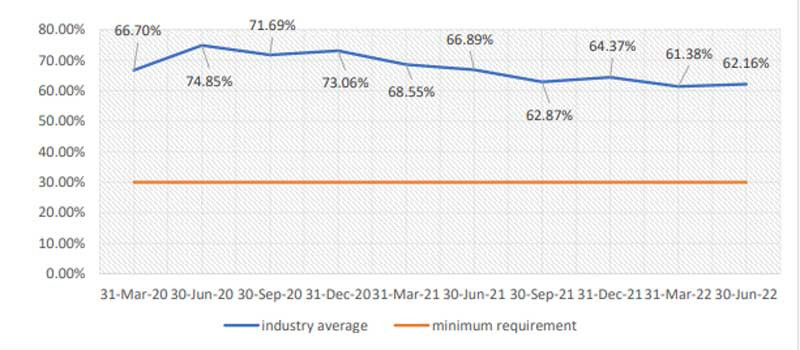

Under Reserve Bank of Zimbabwe (RBZ) regulations, banking sector liquidity ratios are currently 30%, although banks can sit on much higher thresholds.

In a banking sector report for the half year ended June 30, 2022, the RBZ did not disclose the identity of the banks.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

- Letters: How solar power is transforming African farms

Keep Reading

The central bank appeared to emphasise its resolve to forestall potentially devastating bank failures — which would be a repeat of the 2004/2008 financial system meltdown.

“Of the 19 operating banking institutions, 17 were compliant with the minimum prudential liquidity ratio of 30%,” the RBZ said.

“The two institutions which were non-compliant with the minimum requirement are being closely monitored on an on-going basis to ensure compliance.

“The average liquidity ratio has remained high reflecting high stock of liquid assets in the sector.

“Albeit the ratio remaining high, it is noted that the ratio has been on a declining trend from a high of 74,85% in June 2020 as banking institutions are increasing their lending, as evidenced by the gradual increase in the loans to deposits ratio from 44,16% in March 2021 to 53,63% in June 2022.”

For regulators, the good news was that average prudential liquidity ratios were 62,16% during the period, a figure that double what authorities have prescribed.

The central bank has also been tougher on its determination for banks to meet regulator prescribed minimum capital requirements.

Commercial banks were expected to increase their minimum capital to at least US$30 million by the end of last year.

Following a string of interventions by shareholders including approving mergers, the sector has generally been compliant.

Since tougher benchmarks were imposed during the tail end of the banking crisis, the rate of bank failures has plummeted, possibly giving impetus to regulators to tap the accelerator paddle and consolidate the fine health.

The RBZ said bank deposits breached the $1 trillion mark during the period, advancing 261% from $311,5 billion during the comparable period in 2021.

Zimbabweans have been shying away from banking their cash in the banks after they lost all their bank savings in 2008 when Zimbabwe adopted a multicurrency system.

Monetary authorities have been working around the clock to regain market confidence.

The report said the sector had an overall liability sensitive book during the period, with negative cumulative repricing gaps in all time bands implying that a number of banks may lose if market interest rates remain on an upward trajectory.

The report noted that total banking sector assets increased by 100,22% from $969,24 billion as at March 31, 2022 to $1,94 trillion as at 30 June 2022.

The dominant assets on the bank balance sheets were loans and advances at 28,15%, balances with foreign institutions (15,57%) and balances with the central bank at (12,83%).

The larger proportion of loans and advances in the aggregate banking sector balance sheet is consistent with banking institutions’ core business of lending.