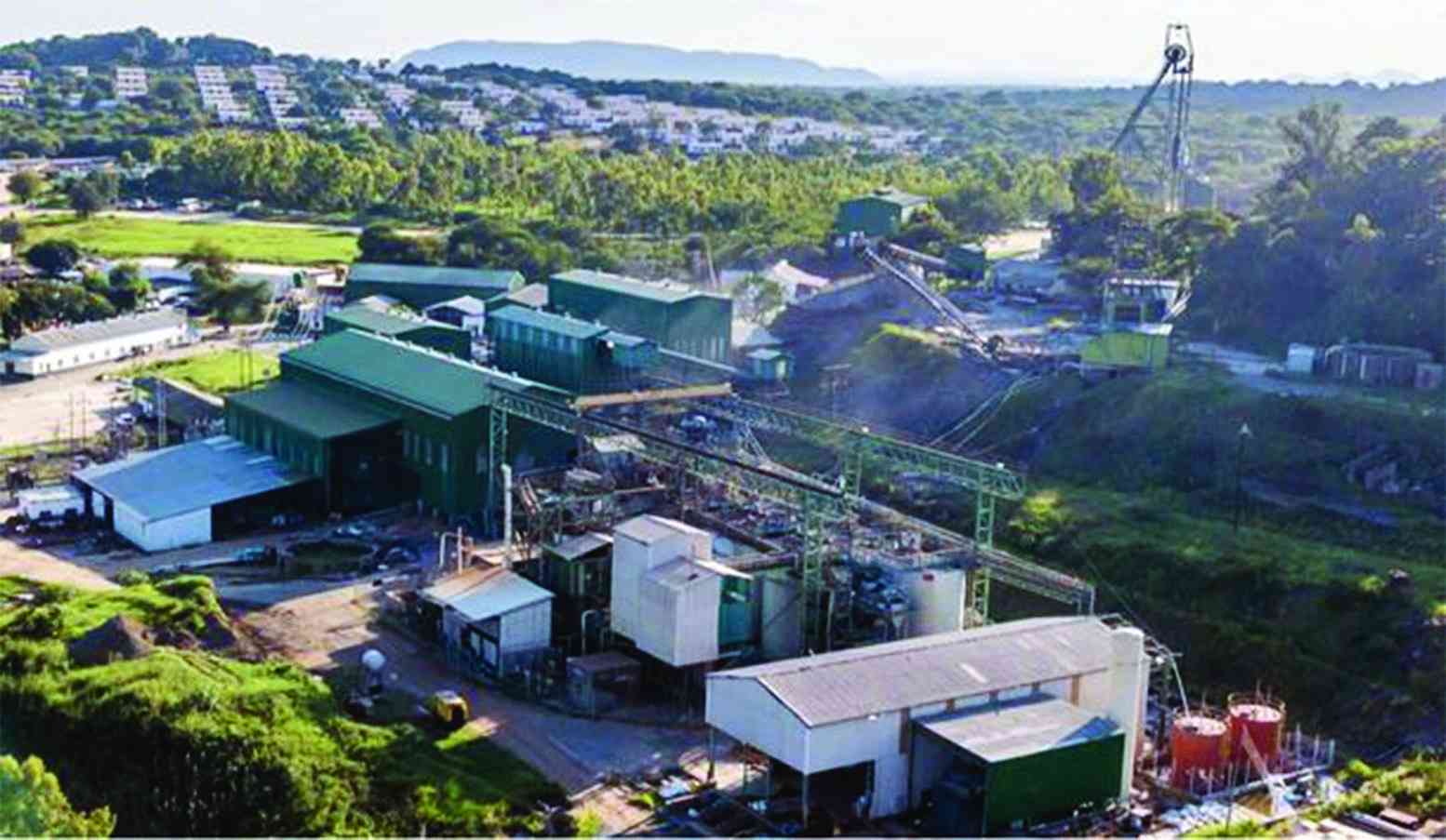

CALEDONIA Mining Corporation is expected to invest US$22 million in capital expenditure at its Zimbabwe-based Blanket Mine (pictured) by the end of the second half of this year, according to sources.

The miner had initially halted capex spending after disappointing production results in late 2023 and the first six weeks of 2024.

However, after turning around a loss of US$4,01 million in the first half of 2023 to a profit after tax of US$13,16 million by June 2024, Caledonia’s improved cash flow has allowed it to resume capex activities.

The rebound in profitability was driven by a 33,35% increase in revenue to US$88,63 million in the first half of the year, compared to the same period in 2023.

The revenue boost was largely due to a 14% increase in gold production over the previous year.

Caledonia Mining holds a 64% stake in Blanket Mine, as well as 100% ownership of the Bilboes oxide mine, Bilboes sulphide project and the Motapa and Maligreen gold claims in Zimbabwe.

Currently, Blanket Mine remains the company’s most profitable operation.

“We will spend US$32 million at Blanket in the whole of 2024,” Caledonia chief executive officer Mark Learmonth told businesssdigest in responses to questions sent to him on WhatsApp. “We spent US$9,5 million in the first six months, therefore, US$22 million to spend in the second half. We don’t give guidance for the 2025 capex.”

- Cricket hero Raza draws inspiration from fighter-pilot background

- Record breaker Mpofu revisits difficult upbringing

- Trafigura seeks control of Zim metals over debts

- Cricket hero Raza draws inspiration from fighter-pilot background

Keep Reading

The company is also conducting a preliminary economic assessment (PEA) for the Bilboes sulphide project.

The Bilboes gold project is anticipated to produce approximately 1,5 million ounces of gold over a 10-year mine life, with an all-in sustaining cost of US$968 per ounce.

The project is estimated to have a payback period of 1,9 years at a gold price of US$1 884 per ounce.

IH Securities, a local financial services firm, noted that despite ongoing global economic challenges, gold prices have continued to rally, surpassing the US$2 500 per ounce mark earlier this month.

“Bloomberg consensus estimates have put prices at US$2 768/oz by 2027, giving resilience to top line growth for gold producers,” IH Securities said, in an analysis of Caledonia’s half-year performance released on Monday.

“Under Blanket Mine, annual production is forecast between 74 000 and 78 000 ounces.”

IH added that electricity costs were notably expected to remain high in the short term and then decrease as older less efficient infrastructure gets decommissioned.