ONE of the focus areas for the modern-day economist is to advocate for policies earmarked at alleviating poverty and reducing inequality.

Most economists concur that economic growth should be maintained as a major policy objective. One reason for this being that economic growth is a feasible option to solve the problem of poverty. The argument is that with economic growth, a lot of the poor can be improved without taking anything away from the better-off.

The most famous economist of the 20th century, J.M. Keynes, contended that the very essential economic problem — scarcity — can be abolished through economic growth. However, new studies are showing that poverty is not just one problem but instead an accretion or series of different problems which feed on each other. As such, there is no one silver bullet for poverty alleviation. In addition, the arithmetic of economic growth does not necessarily imply any reduction in economic inequality. If the incomes of the rich and the poor grow at the same rates, the proportionate difference between them stays the same, and the absolute difference — in dollars per year — increases.

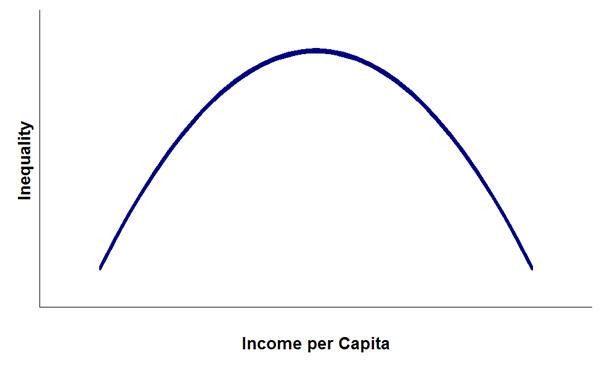

As demonstrated by the original Kuznets curve hypothesis, when growth or industrialisation increases, income inequality first increases and then decreases at a later stage.

Inequality is only expected to decrease when a certain level of average income is reached and the processes of industrialisation — democratisation and the rise of the welfare state — allow for the benefits from rapid growth and increase the per-capita income.

That said, concerns are that while recent numbers show improvements on poverty levels, more than 700 million people remain in extreme poverty, in certain parts of the world, particularly in Sub-Saharan Africa (SSA). In the case of Zimbabwe, poverty levels have been increasing.

The Zimbabwean economy has faced several headwinds triggered by (i) adverse weather conditions (droughts and cyclones) that weigh on agricultural output and energy production and (ii) currency and a liquidity crisis that hamper economic activity across the country.

Piggy contends that current policies are not adequately addressing the issues of poverty alleviation.

- IDBZ in tax miscalculation gaffe

- Groundswell of caution over ‘punitive’ IMTT...Captains of industry want 2% tax scrapped

- Piggy’s Trading & Investing Tips: Investing as a poverty alleviation tool

- Currency risk unsettles insurance sector

Keep Reading

Policy-makers should review the following areas to solve the problem of poverty in the country;

Firstly, salaries and wages of most workers within the private and public sectors are in Zimbabwean dollars (ZWL). The deteriorating exchange rate implies that the real values of incomes is declining on a monthly, if not daily. This situation also presents serious risks for companies given the pressure to continuously review salaries. Certain sectors of the economy such as real estate (rentals and property purchases) are pricing strictly in USD and this presents further pressures on disposable incomes. Informal sector transactions are also in USD and ZWL pricing is pegged against the parallel market exchange rate. Wages and salaries of those that are formally employed have therefore not moved in line with inflation. Most households are living below the poverty datum line;

Secondly, the limited avenues for companies to generate forex implies that production levels have dwindled. The low productivity has led to downsizing thereby contributing to unemployment. Labour unions and other independent bodies have pegged the unemployment rate in Zimbabwe at between 80% and 90%. While this is clear evidence that the economy is largely informal, it gives a good indication of low household incomes;

Thirdly, taxes in Zimbabwe remain high. It is worth noting that Zimbabwe has one of the highest personal income tax rates in the world. This is because the Government of Zimbabwe is cash-strapped and revenues from the Personal Income Tax Rate are an important source of income. The Intermediated Money Transfer Tax (IMTT) has also negatively impacted household incomes and constrained consumer demand. IMTT has made the general populace worse off given the contraction in consumer purchasing power and the inability of households to build personal assets; and

Finally, access to capital for small and medium sized businesses (SMEs) remains limited. The current interest rate regime is not accommodative to micro-enterprises and start-ups. Piggy has consistently insisted that policy makers need to boost employment and aggregate demand by providing financing solutions for micro-enterprises.

In conclusion, there is an urgent need to encourage saving and investing even within a weak economy.

Government, regulators, pension funds and other related institutions need to both encourage and support savings at all levels of the economy. There is also a need to create new assets and investment vehicles while also driving the financial inclusion agenda. Investing and saving is also critical for a developing economy like Zimbabwe given that it (i) promotes capital formation, (ii) creates employment opportunities and (iii) controls excess liquidity. It is against such a background that there is a need to create effective mechanisms for saving and investing.

Learn more about investing and trading by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the managing partner at Mark & Associates Consulting Group and founder of piggybankadvisor.com. — +263 78 358 4745 or batanai@markassociatescg.com / batanai@piggybankadvisor.com.