Respect Gwenzi

Follow Respect Gwenzi on:

Forex demand continues to fall

These indicators are however inverse to the movement in the exchange rate on the respective market.

By Respect Gwenzi

Sep. 2, 2022

Auction allotments levels remain low

The levels of allotments remained low, cementing a trend that has been true for at least two months now.

By Respect Gwenzi

Sep. 16, 2022

Paltry US$11m traded on auction market

Data shows that for some non-exporting companies over 30% of sales are now in foreign currency.

By Respect Gwenzi

Sep. 30, 2022

Forex traded continues to fall

The total value traded came in at US$10,5 million which is the lowest level since the revamp of the auction market in June 2020.

By Respect Gwenzi

Oct. 7, 2022

Parallel market rate spikes again

The entrenched use of the US dollar in the economy meant that more players had the capacity to finance own forex requirements through direct sales.

By Respect Gwenzi

Oct. 28, 2022

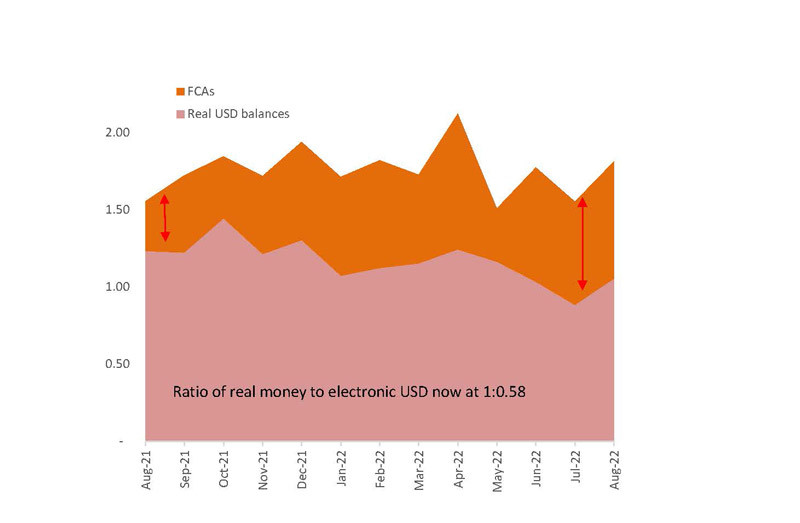

US dollar creation, a ticking time bomb

The results are shocking and point towards yet another pending currency crush brewing from electronic creation of US dollar credit.

By Respect Gwenzi

Nov. 4, 2022

Currency market under pressure

While this is happening, the auction market remains relatively stable weakening in each respective session albeit at fading margins.

By Respect Gwenzi

Nov. 11, 2022

How much oil reserves does Zim have?

Managing director Scott Macmillan says the early results are “an exciting development validating our subsurface model”.

By Respect Gwenzi

Nov. 18, 2022

Is Zim headed towards a technical recession?

When this article was written, The Zimbabwe Stock Exchange's nominal growth for the year-to-date (YTD) period ending 15/11 in 2022 was 28,79%.

By Respect Gwenzi

Nov. 25, 2022

Zim now one of the fastest growing African economies

Corruption persists like a festering wound slowly spreading to all of the state’s institutions.

By Respect Gwenzi

Dec. 2, 2022

Widening premium gap reflects market instability

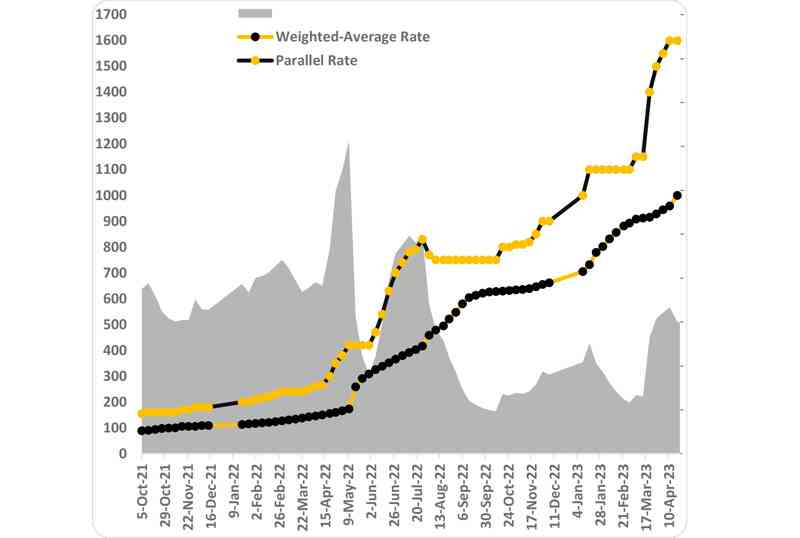

The parallel market gap has widened to 36% in the latest session from a low of 15% in October.

By Respect Gwenzi

Dec. 9, 2022

Burgeoning public debt a threat to development

The Covid-19 pandemic has fuelled debt expansion as countries struggled to service their debts.

By Respect Gwenzi

Jan. 6, 2023

Zimdollar depreciation path unlikely to change in 2023

It also gives a foresight into the interplay between the auction and parallel markets.

By Respect Gwenzi

Jan. 13, 2023

Weak trading data shows RBZ is in control of the exchange rate

The RBZ has made efforts to continuously drive the currency market towards full liberalisation.

By Respect Gwenzi

Jan. 20, 2023

Little movement on parallel market

Authorities earlier warned state contractors against dumping currency on the parallel market and driving the rate southwards.

By Respect Gwenzi

Feb. 24, 2023

Zimdollar will remain weak

THE gap between the parallel market and the auction market rates narrowed for the fifth straight week this week, despite a sustained decline in the value of the latter.

By Respect Gwenzi

Mar. 17, 2023

The season of madness at play

Meanwhile in the interim, rational agents are anticipating a gallop in expenditure as the new salary structures take effect.

By Respect Gwenzi

Mar. 24, 2023

Measures cannot curb inflation

Measures such as gold coins, although wildly popular and rationale from the perspective of investors or those seeking to basically preserve value

By Respect Gwenzi

Mar. 31, 2023

Exchange rate situation to worsen

The current pace of losses on both markets is ahead of all the past four years since the reintroduction of the local currency.

By Respect Gwenzi

Apr. 21, 2023

A comprehensive approach needed to promote economic stability

If the formal market continues to depreciate at its current pace, the gap between the parallel and auction markets may widen in the coming weeks.

By Respect Gwenzi

Apr. 28, 2023

No sign of Zimdollar stability in the short-term outlook

Government issued Treasury Bills (TBs) valued at about US$1,45 billion in fulfilment of obligations due to some creditors and suppliers, prior to shelved.

By Respect Gwenzi

May. 5, 2023

Local currency at its worst against the USD since 2022

On easing this week, the Zimdollar took its year-to-date loss to 58%, which is its quickest pace of decline on a comparative basis since its reintroduction in 2019.

By Respect Gwenzi

May. 12, 2023

Premium

Forex auction market rate under immense pressure

The pressure is reflected in increasing bids, which this week totalled US$30,3 million, the highest since May 2022.

By Respect Gwenzi

May. 19, 2023

Retailers in high stakes game

This week’s jump in demand is even higher than the May 2022 jump, which came in at 88%, just as the rate depreciated by 33% in that respective season.

By Respect Gwenzi

May. 26, 2023

Is Africa ready to join the IoT revolution?

Many still lack the infrastructure and connectivity needed to support IoT applications, and there is a significant digital divide between urban and rural areas.

By Respect Gwenzi

Jun. 23, 2023

Zimdollar gains marginally against United States dollar

Prior to, the central bank engaged in money issuance through bare RTGS balances credit to exporters, for settlement of export surrenders.

By Respect Gwenzi

Jun. 30, 2023

Retailers in high stakes game.

This week, the outcome of the auction market suggested further liberalisation, which some have suggested to be full liberalisation of the market into a pure Dutch Auction System.

By Respect Gwenzi

Jul. 28, 2023

Currency Market Weekly Review

The parallel market activity is driven by formal market liquidity, which is beginning to spike, plus a degree of speculation on money supply.

By Respect Gwenzi

Aug. 4, 2023

Stability, a stretch away: Currency market review

This deduces to an average of US$16,15 million per session.

By Respect Gwenzi

Sep. 29, 2023