AfDB, ESAAMLG launch new project to combat money laundering, financing of terrorism in Africa

PVOs Bill: The mask has fallen off

Don’t drag Zim into darkness

'Zim correspondent banking relationships under threat'

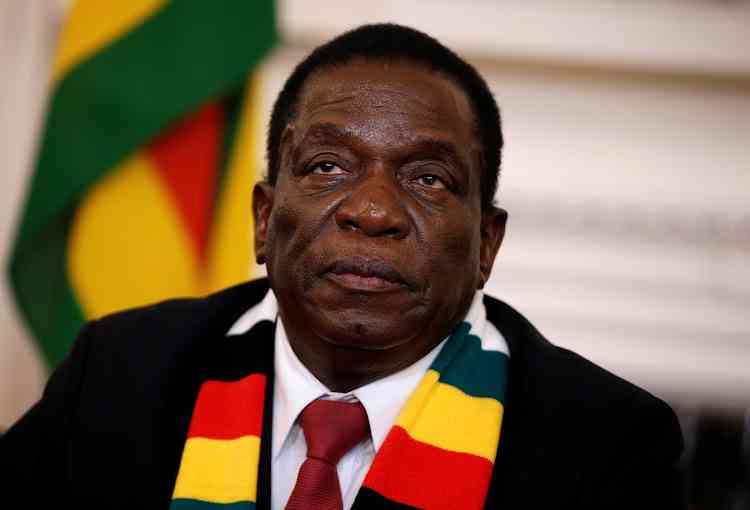

New perspectives: Still celebrating Zim's removal from greylist

Celebrating Zim's removal from grey list

New perspectives: Money laundering red flags in insurance sector

Some of the life insurance products and features that can make them vulnerable to money laundering risks include unit-linked or with-profit single premium contracts, single premium life insurance policies that sore cash value, second-hand endowment policies, and fixed and variable annuities.

New perspectives: Money laundering red flags in insurance sector

Some of the life insurance products and features that can make them vulnerable to money laundering risks include unit-linked or with-profit single premium contracts, single premium life insurance policies that sore cash value, second-hand endowment policies, and fixed and variable annuities.

New perspectives: Combating money laundering in real estate

The threats of money laundering and the financing of terrorism and the proliferation of weapons of mass destruction have led financial sector regulators and financial institutions to strengthen their vigilance in support of the efforts of governments to counter these threats and to minimise the possibility that their jurisdictions or institutions becoming involved.