ZIMBABWE'S investment environment presents unique challenges, including policy inconsistencies, currency volatility, exchange rate disparities, and a dominant informal sector.

Navigating these complexities to ensure capital preservation and potential recovery is crucial for investors in 2025.

While individual risk appetites and goals vary, capital preservation and reduced risk remain priorities.

As Warren Buffett famously said: “Risk comes from not knowing what you’re doing”. Without a clear investment framework, investors risk significant losses by investing without a clear roadmap.

Equities: A bullish outlook

In 2024, equities delivered mixed results; some investors saw significant gains, while others faced substantial losses depending on their market timing.

For 2025, I am optimistic about equities.

While companies that struggled in 2024 may not see immediate improvements, the potential for a market re-rating is high as liquidity conditions improve.

- Stop clinging to decaying state firms

- Zim bourse in limbo

- Piggy's Trading Investing Tips: De-risking mining projects

- Chance to buy 'undervalued' counters: FBC

Keep Reading

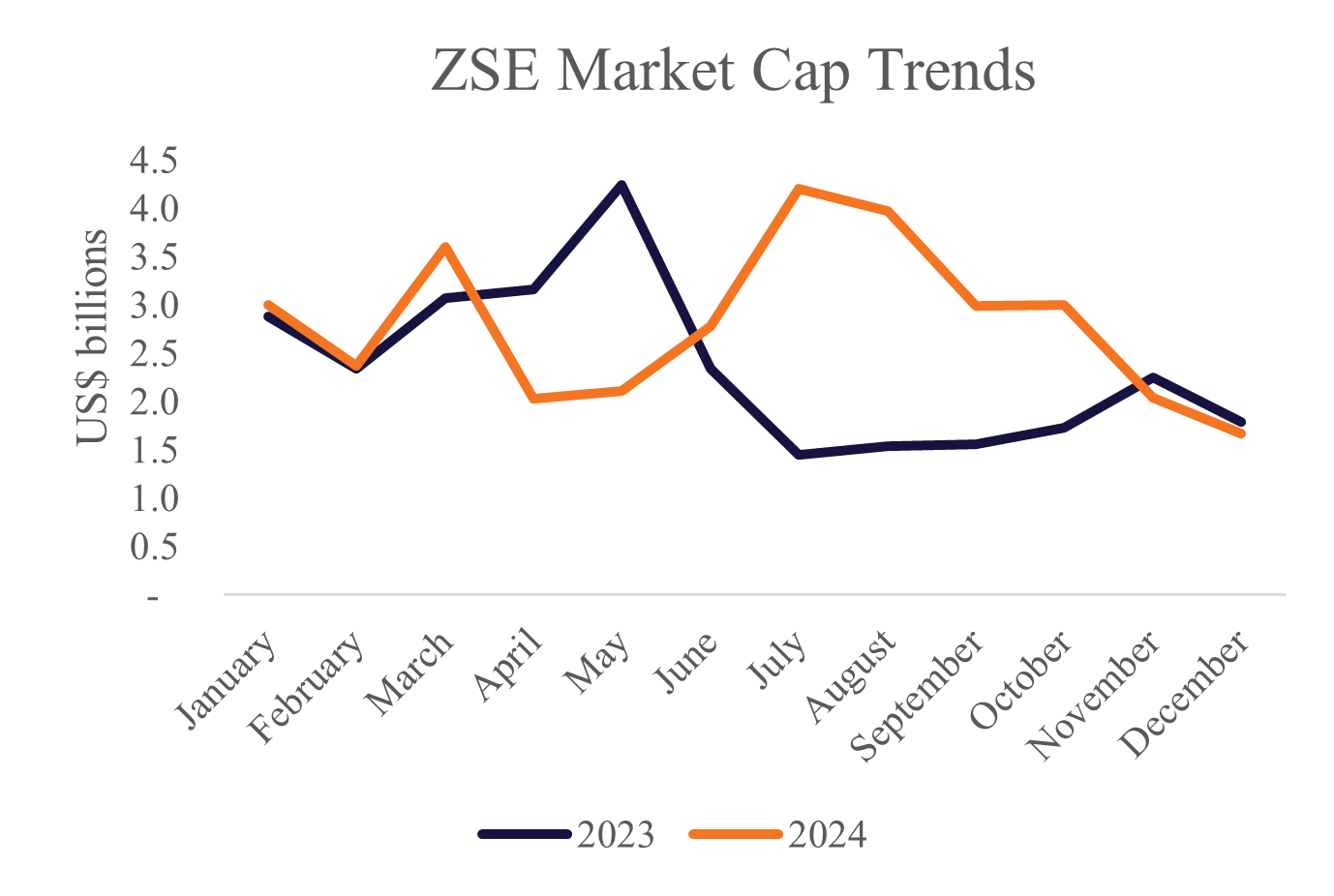

The Zimbabwe Stock Exchange (ZSE), for instance, experienced significant fluctuations in 2024, with its market cap peaking at US$4,2 billion in July and closing the year at US$1,7 billion in a bear market.

Many counters are currently trading at deep discounts compared to historical US dollar averages. Investors, who study market cycles and periodically rebalance portfolios to capitalise on low entry prices, can potentially achieve solid returns. Take a look at how liquidity swings drove its performance over the prior two years.

Real estate: A mixed bag

Real estate has long been favoured for its inflation-hedging capabilities and dollarised nature.

However, the influx of investors has reduced the availability of lucrative deals.

The benchmark annual rental yield of around 10% is increasingly difficult to find. Given the substantial capital required for property purchases or development, yields often fail to justify the initial outlay.

This sector remains viable primarily for those developing properties to sell or for investors adept at identifying exceptional opportunities through thorough due diligence.

Real estate investment trusts

REITs have gained traction in Zimbabwe since the listing of Tigere REITs in November 2022 and Revitus REITs in December 2023.

Tigere REITs, with its high occupancy rates in prime locations, has been a reliable source of periodic US dollar dividends.

Conversely, Revitus REITs, with properties concentrated in the Central Business District, has struggled with occupancy rates below 60% due to the migration of businesses to suburban areas. For REIT investments in 2025, Tigere REITs is my top recommendation for income-generating focused investors.

Exchange-traded funds (ETFs)

The ETF space has faced challenges, with only four ETFs remaining on the ZSE following the delisting of the Old Mutual Top 10 ETF (OMTT ETF) on January 17 2024.

Issues like the migration of blue-chip stocks to the Victoria Falls Exchange (VFEX), thin trading volumes, and tracking errors were the major reasons behind OMTT ETF delisting.

Investors should approach the ETFs space cautiously and conduct thorough due diligence to mitigate some of these risks since they are yet to be addressed.

Fixed income instruments

Fixed-income investments remain risky due to Zimbabwe's volatile currency. While money market funds lending to microfinance institutions offer higher returns, they also carry significant risks.

Treasury bills (TBs) face similar challenges, including the potential for payment delays and currency conversion losses. Investors must fully understand the risks before venturing into this space.

For instance, to convert Nostro USD balances to cash you usually get a haircut, and the government seldom extends its TBs payment dates which further discounts its perceived value in the market.

Holding cash

US dollar cash holdings are popular for hedging against local currency inflation. While suitable for short-term obligations or speculative purposes, holding cash over the long term forfeits potential returns from capital gains, dividends, or interest.

Alternative investments

Alternative investments carry high risks and require specialised expertise. While the potential for high returns exists, they are only suitable for investors with a high tolerance for risk and deep knowledge of these markets.

Outlook for 2025

Zimbabwe's macroeconomic headwinds are unlikely to change drastically in 2025, and companies that faced challenges in 2024 will likely continue to struggle.

However, equities, which were heavily punished in 2024 due to liquidity constraints, offer the most compelling opportunities for re-rating to match historical USD valuations.

A potential market re-rating, similar to 2023 and 2024, could provide attractive entry points for investors. Equities endured heavy punishment at the end of 2023 as well. However, they experienced two re-ratings in 2024, a similar recovery could be on the horizon.

By maintaining a clear investment strategy, periodically rebalancing portfolios, and utilising undervalued opportunities to buy shares of defensive companies, investors can navigate Zimbabwe's complex market landscape to achieve capital preservation and recovery in 2025.

Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He holds a First Class Degree in Finance and Banking from the University of Zimbabwe. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation.