ZIMBABWE’S government recently gave local producers of carbon offsets two months to comply with new regulations as it moves towards curbing greenwashing.

The carbon market has been growing in recent years in response to the rising need to reduce greenhouse gas emissions globally. The introduction of carbon credits and offsets has been one solution to carbon emissions, and Zimbabwe has played a part in it through environmentally friendly projects over the years.

The birth of the carbon markets dates back to 1997 when a treaty was signed and adopted by 41 countries in Kyoto with the goal of reducing the emission of greenhouse gases (GHGs) that contribute to global warming.

The efforts of the Kyoto Protocol of 1997 were further affirmed by the Paris Agreement of 2015 whose goal is to hold the increase in the global average temperature to well below two degrees Celsius above pre-industrial levels.

This resulted in the implementation of cap-and-trade programmes that punish emitters of GHGs and reward companies that reduce emissions by converting carbon dioxide into a tradeable commodity.

The carbon market comprises of carbon credits and carbon offsets. Carbon credits are also known as carbon allowances and, as the name suggests, these work like permission slips for emissions.

These are issued to companies by regulators, and companies that emit less GHGs than they are permitted to end up with excess credits which they sell to other companies.

Carbon credits trade in a regulated market in the carbon marketplace. According to the Refinitiv, the total market size of the global compliance market for carbon credit exceeds US$261 billion.

- Exploring carbon markets

- ABCs of climate investing

- Companies are buying up cheap carbon offsets

- Zimbabwe urged to tie mining taxes to environmental, social performance

Keep Reading

Carbon offsets, on the other hand, are created by companies when they remove a unit of carbon from the atmosphere as part of their normal business activity.

These units are called carbon offsets and, like carbon credits, can be traded. To put this into perspective, one tonne of carbon dioxide is equivalent to 3 300 kilometres with a petrol car, a flight from Frankfurt to New York, or 8 800 cups of coffee.

Carbon offsets are traded in voluntary markets in the carbon marketplace, and the size of the global voluntary carbon offset market is estimated at US$2 billion.

The carbon marketplace offers incredible for African considering that the continent has vast amounts of carbon stored in its ecosystems.

For example, the Congo rainforest is also known as the planet’s most important lung because it absorbs c.1,2 billion tonnes of carbon dioxide each year.

At COP27 held in November 2022, African countries launched the Africa Carbon Markets Initiative to produce 300 million carbon credits annually. The initiative seeks to unlock US$6 billion in revenue and create 30 million jobs by 2030.

The price of these carbon credits and offsets fluctuates in a similar manner as other commodities.

Price volatility is driven by, among other factors, (i) supply and demand, (ii) cost of fuel, and (iii) any policies that affect their availability.

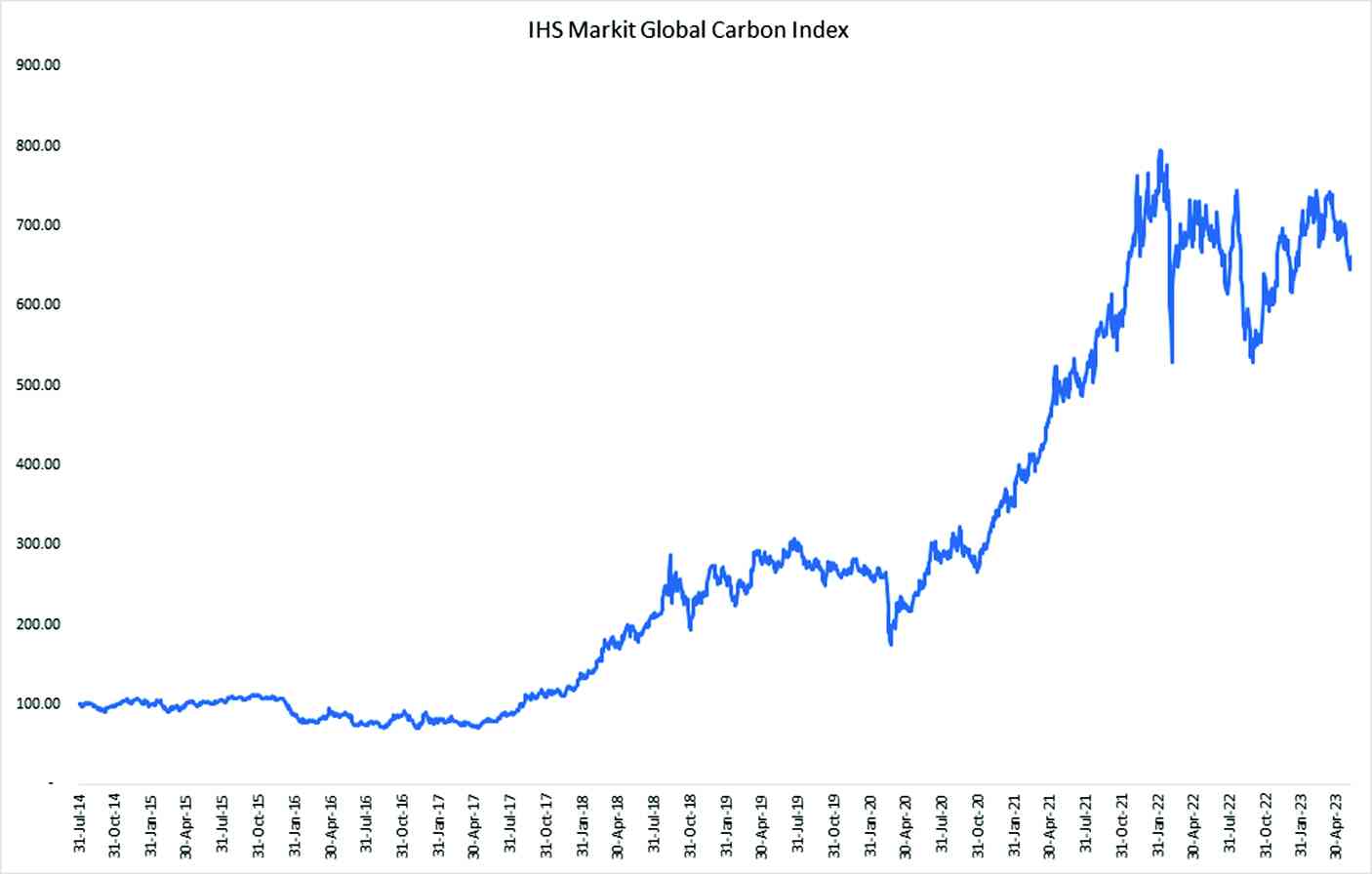

IHS Markit’s Global Carbon Index aptly quantifies the performance of carbon credits in its various markets. The index comprises of carbon credit futures that can be easily accessed by institutional investors for trading purposes.

As a result, futures included trade on the European Union Allowance (EUA), UK Allowance (UKA), California Carbon Allowance (CCA), and Regional Greenhouse Gas Initiative (RGGI) markets. Other criteria, such as liquidity and maturity of the relevant cap-and-trade programs, are also taken into consideration.

The trend in the global carbon index reflects multiple supply-tightening measures, the expansion in the scope of the European Union (EU) Emissions Trading System (ETS), and California’s 20% increase in its emission reduction ambition, and these have underscored the surge in the index.

According to Bloomberg, the IHS Markit Global Carbon Index also surpassed the MSCI World Index, which comprises large and mid-cap equities across 23 developed markets, by 9,2%.

Unfortunately, the development of this market in Zimbabwe remains an elusive dream for local investors because of a myriad of issues. The country’s futures market has been dogged by several factors that mainly include:

Extensive interference in the trading and pricing of commodities,

A volatile currency, and

Inconducive and volatile policies.

Recently, Zimbabwe announced new rules that govern carbon offsets generated in the country. Among these rules was a mandatory requirement to surrender half of the revenues from carbon offsets to the state.

This alone is likely to disincentivise the establishment of green and ESG projects by foreign investors and choke the possibility of a tradeable asset class that has been outperforming global equities.

- Mtutu is a research analyst at Morgan & Co. — tafara@morganzim.com or +263 774 795 854.