THE Victoria Falls Stock Exchange (VFEX) experienced a 52,2% increase in market turnover in the second quarter of 2024 compared to the same period last year, indicating a highly active quarter.

Turnover stood at US$10,07 million, from US$6,61 million recorded in the comparable quarter, according to the VFEX’s latest update.

The number of trades increased by 35,78%, suggesting a rise in trading activity accompanied by a successful settlement of trades. Volumes grew 133,94% to 50,8 million.

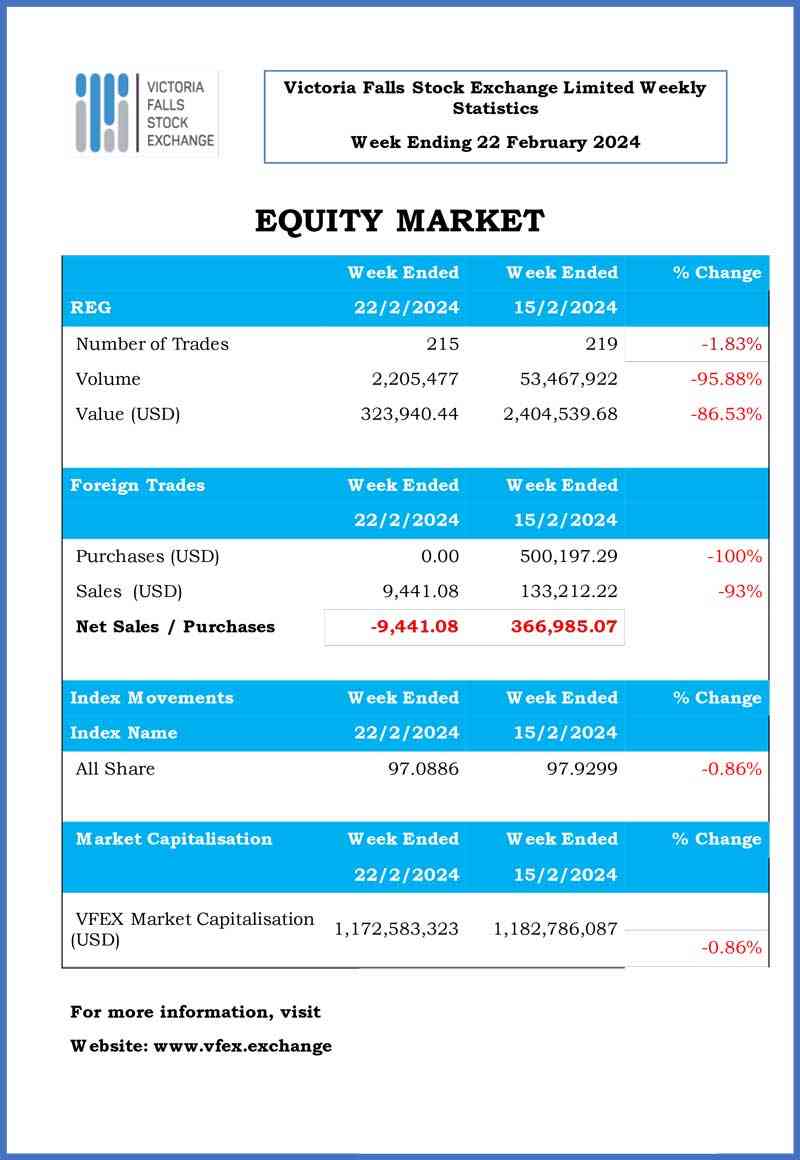

The waterfall bourse, however, suffered a 3,10% decline in market capitalisation to US$1,25 billion.

The VFEX All Share Index closed at 102,69 points, showing an increase of 2,69% since its re-basement in January 2024.

The quarter under review recorded 6,39% in the number of trades compared to the first quarter, indicating a sustainable increase in trading activity.

There are 15 companies trading on the VFEX.

Meanwhile, the Zimbabwe Stock Exchange (ZSE) All Share Index recorded a 28,64% increase in the second quarter, to 128,64 points as local investors dominated the bourse.

- Stop clinging to decaying state firms

- Piggy's Trading Investing Tips: De-risking mining projects

- Chance to buy 'undervalued' counters: FBC

- Zimbabwe's capital markets collapse

Keep Reading

Foreign investor participation accounted for 21% in the period under review.

The ZSE recorded a total market turnover of ZiG184 million (US$13,4 million) with five firms contributing 90% of the total revenue.

The total market capitalisation ended the quarter at ZiG38,7 billion (US$2,8 billion).

The top five biggest equity contributors to market cap were Delta, which contributed 33,18%, Econet (19,88%), CBZ (9,91%), FBC (3,82%) and First Mutual Limited chipped in with 3,65%.

According to Fincent Securities, the market's steady adherence to fundamentals and improved liquidity on the ZSE is attracting growing interest from foreign investors.

“We anticipate this positive trend to persist, particularly post the repeal of SI (Statutory Instrument) 96 of 2022,” Fincent said in its June report.

After enduring a period of inflationary pressures and exchange rate distortions, Fincent said the introduction of the new Zimbabwe Gold on April 5, 2024, brought stability that allowed equities listed to reflect their true fundamental values.

“Following the stabilisation brought by the new currency, there has been a push from market participants to the authorities to lift capital gains taxes and withholding taxes to stimulate activity and liquidity on the ZSE,” the report noted.

The ZSE Top 10 Index, the blue-chip index on the ZSE, gained 36% in the quarter under review, closing at 135,92 points.

The Modified Consumer Staples index recorded the highest gains, registering a 41% boost to close at 141,01 points.

The ZSE ETF Index gained 19,41% to close at 119,41 points, while the market capitalisation of EFTs ended at ZiG86,8 million (US$6,3 million) for the period under review.

The total value traded on the REIT board was ZiG69,9 million (US$5,1 million) and the total number of REIT units that exchanged hands stood at 38 million.