ALL indices on the Zimbabwe Stock Exchange (ZSE) were rebased to the Zimbabwe Gold (ZiG). This marked the beginning of a new era.

The first quarter of the year was marked by hyperinflation, while the second quarter saw a more stable exchange rate and gradually improving liquidity. During the second quarter, both penny stocks and blue chips experienced a bull run, largely due to the policy change that reduced the capital gains withholding tax to 2%.

All thanks to capital market participants, who advocated for the reduction of the capital gains withholding tax at a conference, which was held in Nyanga around that same period.

The uptrend, which then ensued, underscores the significant influence of the policy framework on share price movements in our local capital markets. At the same time, it is important to recognise that share price movements also varied in response to fundamentals.

Some stocks, such as Meikles, swiftly adjusted their prices based on fundamental developments whilst others adjusted gradually. The ZSE All Share Index, which provides a comprehensive representation of the performance of the entire exchange was on a bullish trend, heavily skewed on blue chip counters such as Delta, Econet and Hippo.

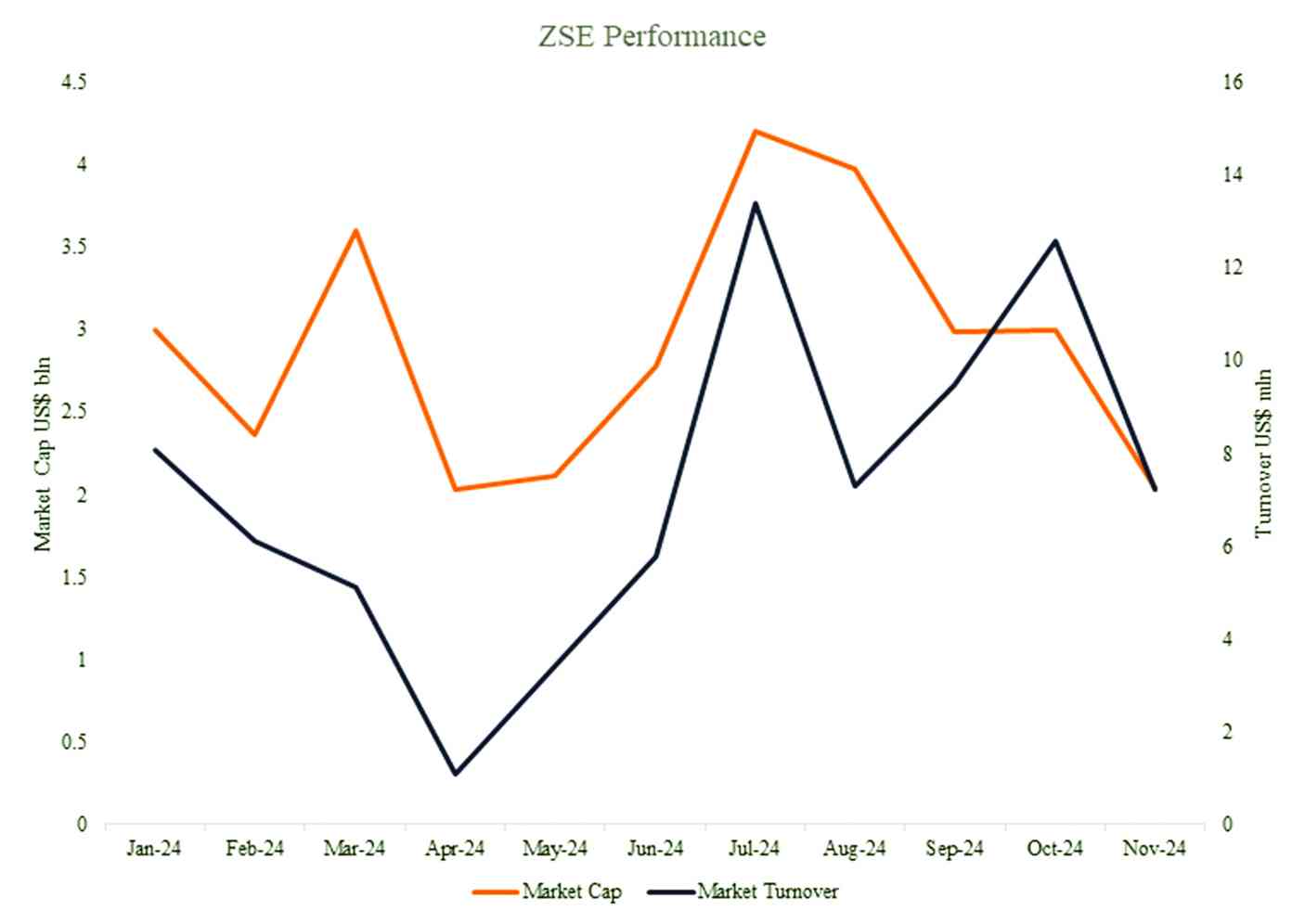

By the end of June, the All-Share Index had already gained 28%, which was quite significant, especially after considering the monthly inflation rates, which were below 1% for that period. As July came to an end, the index stood at 198, reflecting a 98% increase from April, with a peak of 204 recorded in July, marking an approximate 104% rise from April.

The third quarter recorded the best performance for the year, particularly in July. This was largely due to an increase in liquidity, reduction in capital gains withholding tax and a reasonable parallel premium of below 50% compared to the premium of over 100%, which was experienced in September.

On September 27, the Reserve Bank of Zimbabwe devalued the ZiG by 43% and introduced tight liquidity measures, which resulted in the bourse plummeting in both its activity and overall market capitalisation. Surprisingly, the bourse did not adjust to ZiG devaluation, in contrast prices continued on a free fall.

- Tarakinyu, Mhandu triumph at Victoria Falls marathon

- BCC, HCC adopt results-based ambulance services

- Water rationing looms in Bulawayo

- Building narratives: Chindiya empowers girls through sports

Keep Reading

Increased turnover experienced in October simply reflects both retail and institutional investors purchasing blue chips, such as Delta and Econet, which are currently trading at a steep discount.

Comparing this year to the previous one, trading volumes on the ZSE have increased astronomically. At the end of 2023, both the Zimbabwe Stock Exchange experienced poor performance, the worst since the challenging year of 2019.

The bourse saw a notable drop in annual traded values, with the ZSE declining by 51,45% compared to 2022. The ZSE's market capitalisation fell by 29% in real terms but rose by 18% compared to the significant US$1,294 billion recorded in 2019.

By year-end in 2023, market capitalisation stood at US$1,526 billion, based on a market rate of US$1-ZW$10 500. In that same period, the ZSE saw a turnover of 4,66 billion shares valued at US$52,13 million across 43 060 trades.

Although we are yet to wrap up the year, market turnover on the ZSE from January to end of November already exceeds US$80 million, with a volume of over 338 billion shares exchanging hands.

This heightened activity was also spurred by corporate transactions, which were recorded throughout the year, such as the recent TSL and Nampak deal, Meikles assets disposal amongst other notable events and the aforementioned factors.

Currently, the bourse has a market cap of around US$1,8 billion compared to US$1,5 billion recorded in 2023. It is disturbing to think that in July the overall bourse had a market cap of over US$4 billion.

That is how volatile the ZSE is, and how swift it is to be influenced by policy changes and liquidity dynamics.

Finance, Economic Development and Investment Promotion minister Mthuli Ncube in his 2025 budget statement, indicated intentions to further reduce the capital gains withholding tax to 1%, as a positive step towards increasing investor appetite on the market.

In my view, investors can choose to look at the current state of the bourse as an opportune moment to accumulate value stocks that are trading at a heavy discount, to offload them as the market swings back to reasonable levels.

For instance, Delta Shares traded at around 37 US cents per share in December 2023, a heavy discount to its intrinsic value. Investors, who initially developed an investment thesis, set out a clear exit strategy, and planned to hold their portfolios for at least until July 2024, had more than a 200% return in real terms through capital gains alone.

In summary, the ZSE's prospects are positively influenced by policies and local macroeconomic conditions taking place.

I highly encourage investors to study the cycles of our market and periodically rebalance their portfolios because the factors aforementioned in this article, present both opportunities and risks, depending on how investors choose to respond to systemic issues.

Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He holds degree in Finance and Banking from the University of Zimbabwe. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the chartered financial analyst charter designation.