Micro, Small and Medium Enterprises (MSMEs) have been identified as foundational for inclusive economic growth and an important catalyst for the turnaround of the Zimbabwean economy.

Despite bearing such a critical role, MSMEs are being deprived the chance of performing to their full potential as they continue to be denied access to credit facilities from lending institutions, the main reason being perceived high risk and the lack of requisite collateral.

It is against this background that in 2018, Export Credit Guarantee Corporation of Zimbabwe (Pvt) Ltd (ECGCZ), in collaboration with the Reserve Bank of Zimbabwe (RBZ), established the MSME Credit Guarantee Scheme.

The main objective of the guarantee is to facilitate access to finance for MSMEs and individuals with bankable projects without the lack of collateral being a hindrance.

Before the launch of the MSME Credit Guarantee Scheme, ECGC consulted various key stakeholders which included banks, microfinance institutions, World Bank, RBZ, Insurance and Pensions Commission and CGC of Malaysia for their input.

The idea was to come up with a well customised solution which addressed the financial needs of MSMEs operating in Zimbabwe. The guarantee is provided to the lending institution as an alternative form of security which may be called upon by the lending institution if the borrower fails to meet their repayment obligations.

The scheme is designed to ensure that MSMEs are granted credit facilities based on their financial capabilities without the value of pledged collateral security being a limiting factor.

As a basic requirement, the MSME must have a commercially viable project approved by the bank for them to qualify under this credit guarantee scheme. The bank will have a responsibility of exercising due diligence when assessing credit worthiness of the borrower and viability of the business to ensure only credit worthy projects are considered.

- Special role of ECGC as an export credit agency

- Enhancing growth through MSMEs Credit Guarantee Scheme

Keep Reading

Currently 12 banks, have subscribed to this credit guarantee scheme plus 29 microfinance institutions.

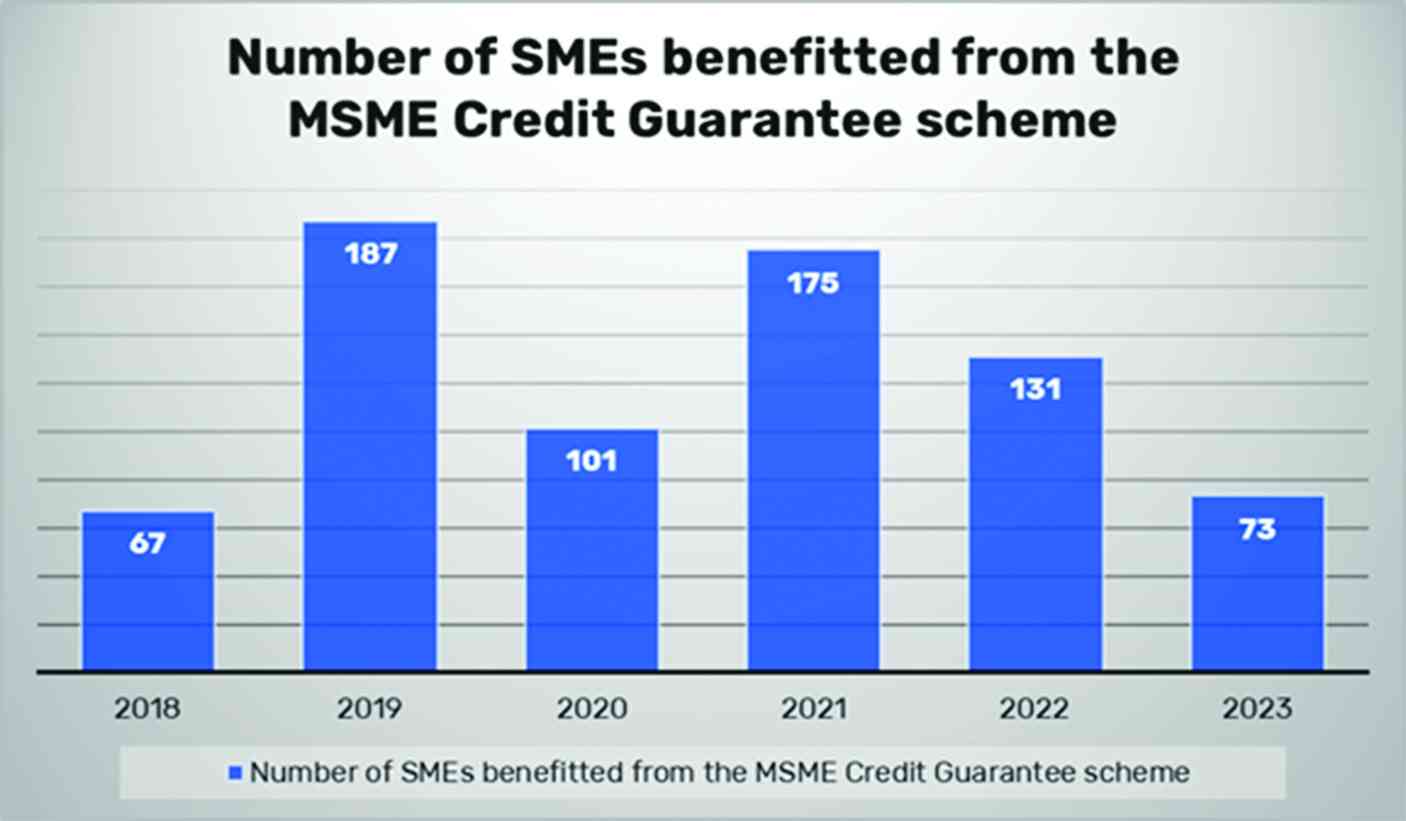

Since inception, more than 739 SMEs have benefitted from this initiative and business supported is worth more than US$145 million. This therefore means that in the absence of this MSME Credit Guarantee Scheme, all the above SMEs would have probably been denied access to finance because of lack collateral.

One can therefore appreciate the role which is being played by ECGC in bridging the finance gap in Zimbabwe through the provision of credit guarantees.

Besides alleviating the constraints facing SMEs in accessing finance, credit guarantee schemes are, in many countries around the world, regarded as a policy instrument to promote the economy by boosting MSMEs, creating more jobs, stabilising the market as well as supporting financial inclusion.

Despite adequate liquidity, commercial banks are often reluctant to extend credit facilities to MSMEs without collateral, which is a serious constraint to business operations and broader economic development.

The scheme therefore seeks to support the financial inclusion initiative being spearheaded by the RBZ, so that we bridge the finance the gap between MSMEs and lending institutions.

Taru is a guarantees expert with experience spanning to over 11 years. He is a former banker and a holder of MBA Finance attained from the University of Zimbabwe. He was actively involved in the setting up of the MSME Credit Guarantee Scheme in 2018.