THE 2024 Monetary Policy Statement (MPS), which is being announced today, is a highly anticipated event eagerly awaited by economists, investors, and individuals interested in the Zimbabwean economy.

Therefore, the aim of this write-up is to provide a concise overview of the general market expectations from the upcoming MPS, with a particular focus on the launch of a new “structured currency”.

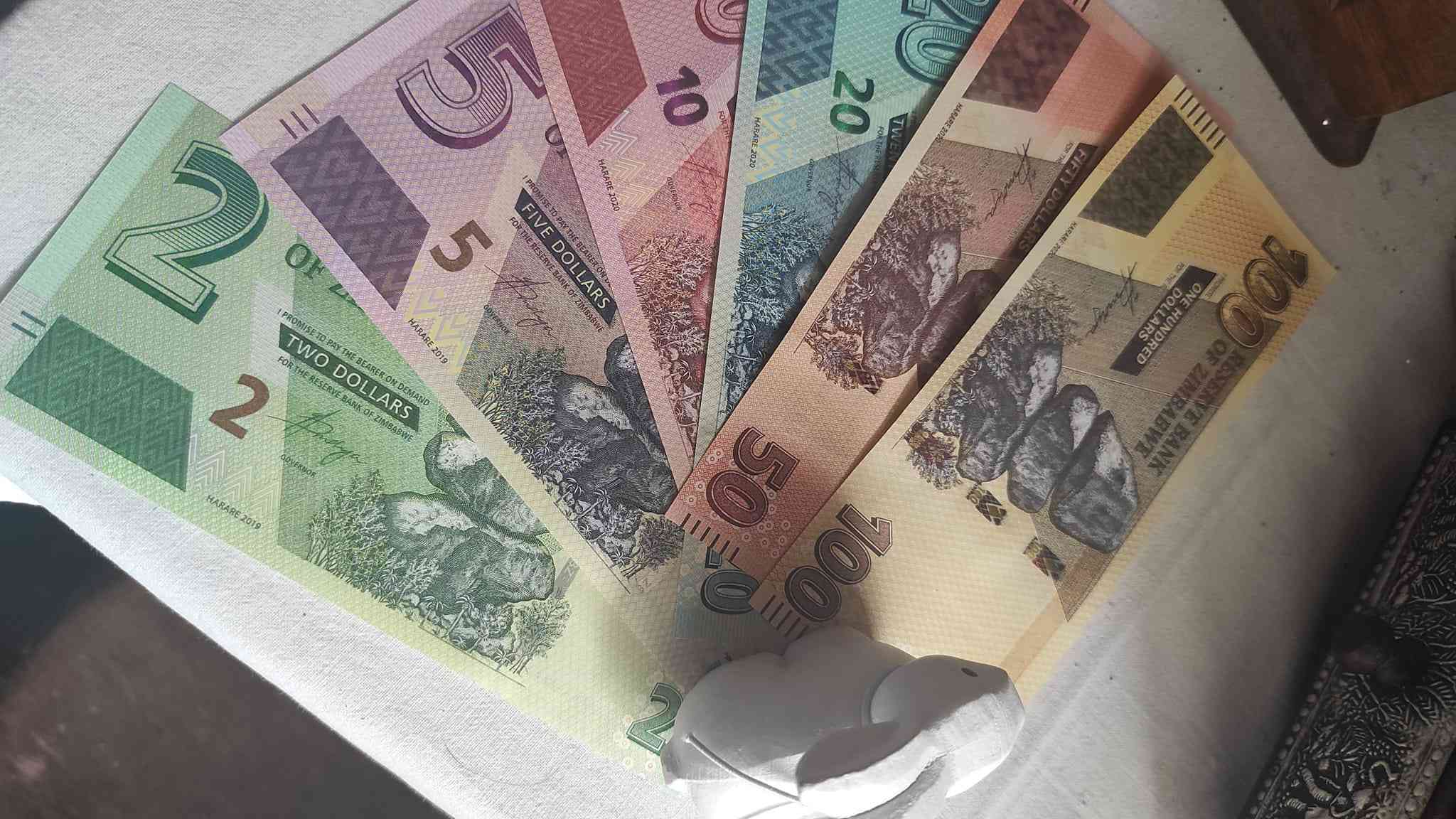

With its unique design and features, authorities expect this new currency to bring significant changes to the Zimbabwean economy, making it a topic of great interest and curiosity.

Current context

The currency reforms that started in October 2018 led to the separation of nostro-foreign accounts (FCA) and the local RTGS dollar.

The first official interbank market trade in early February 2019 set the rate at ZW$1:US$2,50 before losing a staggering 62% of its value in only four months to close June 2019 at ZW$1:US$6,60 (ZW$1:US$ 8,50 in alternative markets).

By the end of December 2019, the Zimbabwe dollar (ZWL) officially traded at ZW$1:US$16,77, down 61% from June 2019.

In the successive years 2020, 2021, 2022, and 2023, the ZWL lost 80%, 25%, 84%, and 89% of its value against the United States dollar (USD) in the formal market, respectively.

- Zimpraise to release album Number 13

- Hyperinflation headache for accountants

- Zimpraise to release album Number 13

- Hyperinflation headache for accountants

Keep Reading

Fast forward to 2024, the local unit (ZWL) has erased a staggering 72% and 70% of its value in the official and alternative (parallel) markets, respectively, in only three months.

For the same period in 2023, the ZWL erased 24% and 44% in the official and parallel markets, respectively.

This massive ZWL decline is likely attributable to low foreign currency generation as global mineral commodity prices remain subdued and rising fiscal pressures emanating from the assumption of the Reserve Bank of Zimbabwe (RBZ) liabilities by the Treasury.

This is in addition to the payment of public infrastructure projects and agricultural subsidies in the summer cropping season.

The preceding perspective is corroborated by RBZ statistics showing that in 2023 alone, the ZWL component of total money supply/broad money (M3) (isolating the USD component of M3 subdues the impact of exchange rate movements) grew at an alarming pace, averaging 16,4% per month.

In annual terms, ZWL broad money component grew by a staggering 446% from ZW$1,01 trillion in December 2022 to ZW$5,5 trillion in December 2023. In addition, the monetary policy environment's unpredictability, rampant corruption, and multiple exchange rates are sustaining excessive rent-seeking behaviours like speculation and arbitrage.

Without concerted efforts to decimate the currency conundrum, perpetual ZWL decline in a high and regressive tax environment will continue to fuel business costs, subdue savings and investment, erode the real value of incomes, and widen inequalities.

For instance, elevated ZWL depreciation in foreign exchange markets during the January-March 2024 period significantly reduced the real value of the 2024 national budget by at least 50%, threatening effective and efficient service delivery in areas like public health, education, and sanitation.

The massive ZWL decline experienced in the first quarter of 2024 (1Q24), coupled with route-to-market reforms and tax increases like Value-added tax (VAT) implemented through the 2024 national budget, has fuelled general prices of essential goods and services in USD and ZWL terms.

The blended official inflation figures from ZimStat show mounting inflation pressure, forcing annual inflation outturn, which closed December 2023 at 26,5%, to spike to 55,3% in March 2024.

Consumers have witnessed a 55,3% jump in shelf prices in March 2024 compared to their March 2023 level. On an MoM basis, blended inflation (weighted average of ZWL and USD price indices) spiked by 4,9% in March 2024, slightly down from the February 2024 outturn, to give an unsustainable 1Q24 average of 5,4%.

Structured currency

To tame rampant depreciation of the ZWL and chronic inflation prevailing in the markets, authorities have elected to launch a “structured currency.”

According to the sketchy details provided by the Treasury and RBZ, the structured currency (SC) will be the existing ZWL but is now linked to hard currencies like the USD and hard assets like gold.

As such, this SC likely incorporates the characteristics of fiat money, which relies on government regulations and RBZ monetary policies, and commodity-backed money, whose value is derived from the value of an underlying asset.

From the preceding, one can speculate that the pending SC will be just an economy-wide adoption and use of gold-backed digital tokens dubbed Zimbabwe Gold (ZiG), which were introduced in the system by RBZ in May 2023.

Tokenisation operates on the premise that technology enables the conversion of real-life tangible assets, such as gold, into digital tokens representing them.

The physical gold held by RBZ in its vaults fully backs the tokens.

These digital gold tokens can be used for investment purposes and are also tradable and capable of facilitating business transactions and settlements.

Zimbabwe has been building gold reserves since it changed payment modalities of royalties, where 50% is now settled in the physical form of the minerals.

Apart from the accumulation of gold reserves, the ZiG will also likely be backed by foreign currency (USD) reserves accumulated through RBZ’s voluntary export surrender requirements.

Exporting companies will continue to cede some of their export proceeds in exchange for ZiG tokens, which they can later liquidate into ZWL to settle local transactions. The Treasury can also demand that significant corporate taxes and other import duties be settled using ZiG to create maximum value.

Chances of success

While we await more details about the “structured currency,” it is worth noting that backing a currency with gold could bring relative stability.

Generally, gold is considered a safe haven investment during downturns and financial crises because of its long history of use as a store of value.

Its properties are helping it achieve this status: malleability, portability, aesthetic appeal, virtual indestructibility, universal acceptance, liquidity, and rarity.

So, hypothetically, the ZiG could slow ongoing rapid local currency substitution (dollarisation) and strengthen the ZWL by limiting the ability of authorities to print ZWLs willy-nilly.

There is also a chance for gold tokenisation (ZiG) to succeed if the RBZ and banks adopt advanced technologies, such as distributed ledger technology, which guarantees transparency and efficiency of transactions and is even difficult to disrupt.

This ensures that all market transactions are safely recorded, as no documents can be falsified since all data is immutable – anyone cannot modify it.

This will circumvent the dangers of reliance on centralised, traditional database systems, which are highly prone to manipulation, may be hacked, and are susceptible to genuine human errors.

In addition, advanced technologies are vital in ensuring gold production tracking and monitoring to minimise chances of gold leakages and illicit trading.

Traceability measures help curb criminality as information such as the exact source of gold, holder of gold buying license, and amount of taxes paid on gold exports can be collected and analysed.

The current rampant illicit gold trading, as reported in Al Jazeera’s Gold Mafia documentary, if not curtailed, will militate against the accumulation of gold reserves, which are crucial in supporting the value of the “structured currency.”

The ZiG concept requires frequent auditing of physical gold reserves backing the digital tokens by reputable and independent audit institutions.

Suppose there are no trusted audits of the quantum of gold reserves in RBZ vaults versus issued digital tokens (ZiG).

In that case, the tokens risk suffering the same fate as bond coins and notes, which RBZ introduced under a US$200 million facility provided by Afreximbank.

There is also a need to provide strong guard rails against gold leakages from the RBZ vaults, which can be caused by theft and fraud. Last but not least, there is a need to set up public trust and investor confidence-building measures.

These include, among others, massively reducing leakages of public resources by curbing public corruption and illicit financial flows (IFFs), maintaining policy consistency and adopting a participatory approach to economic governance (multistakeholder consultations).

This is in addition to improving public service delivery, and adequate political will to swiftly implement a robust reform (economic,governance, land tenure systems, etc) agenda.

This robust reform agenda is critical to improving efficiency in government, strengthening institutional and regulatory frameworks, improving social fairness and inclusion, and eliminating prevailing excessive pricing distortions inhibiting market competition and innovation.

Parting shot

The RBZ is expected to present the 2024 MPS today at a time when the local currency is facing massive depreciation pressures and the economy is under threat of unsustainable price growth across all markets.

This calls for bold monetary policy measures to tame recurring instability, which continues to impoverish citizens and widen societal inequalities.

Will the “structured currency” to be launched through 2024 MPS, among other measures, bring a lasting solution to Zimbabwe’s currency conundrum?

The column will provide a granular analysis of this policy in due course. Please watch out for it!!!

- Sibanda is an economist. He is a research associate with Zimcodd. He is a staunch advocate for inclusive and sustainable development. He writes in his personal capacity.