Econet released a third quarter trading update that featured positive volume growth in voice and data of 31.2% and 26.1%, respectively. Other material information, such as the uptick in US dollar sales, garnered our attention but we focus on that later. For now, we unpack the trends in the usage of voice and data in the context of “the new normal” that was preached during Covid-19.

Ever since the Covid-19 pandemic grounded the world to a halt, many analysts declared that the ensuing period marked a new normal for business and life in general.

Meetings became virtual, payments became digital, work became remote, demand for office space waned, and the work commute became optional. We recognize the permanent effect of the pandemic in some sectors and in some countries but, more specifically, we focus on the persistence of the pandemic on Zimbabwe’s telecoms sector.

According to Potraz reports, the telecoms sector experienced stronger demand in data compared to voice at the height of the pandemic between 2019 and 2020. During this period, voice services shrunk by 2% while data service increased by 7%. This was underpinned by the shift from physical meetings to virtual meetings as offices operated with skeleton staff because of social distancing. After the worst of the pandemic, several companies in developed and developing countries opted to maintain the new status quo of flexible work arrangements, and this supported the “new normal” remarks.

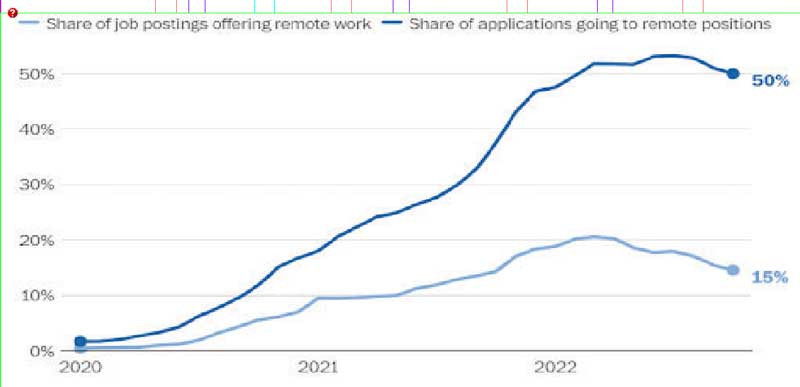

However, trends on LinkedIn show evidence of a decline in flexible work arrangements in other parts of the globe in 2022, albeit higher than pre-pandemic levels.

We opine that Zimbabwe is one such economy that is experiencing a “back to normal” more than a “new normal” phenomenon. Occupancy levels for real estate companies has been on the rise since 2019. Mashonaland Holdings overall occupancy levels improved from 77% in 2019 to 83% in 2022, while FMP’s occupancies marginally gained 2 percentage points from 86% to 87% over the same period. The discussion on occupancies is relevant because of a perceived negative relationship between occupancies and the relative strong demand for data services vs voice services during the pandemic.

The uptick in occupancies coincides with the changing dynamics in the telecoms sector.

Between 2021 and 2022, growth in voice services of 13% was stronger than growth in data services of 8% and differs from trends observed between 2019 and 2020.

- Tarakinyu, Mhandu triumph at Victoria Falls marathon

- Young entrepreneur dreams big

- BCC, HCC adopt results-based ambulance services

- Chibuku NeShamwari holds onto ethos of culture

Keep Reading

We opine that these trends reveal a slow reversion to a pre-pandemic modus operandi in Zimbabwe that is characterised by a decline in remote meetings in favour of the traditional physical meetings.

In addition, more offices have reverted to the traditional model of physical presence in the office for its employees and this has subsequently softened demand for data services.

We also add that, unlike other developed nations, Zimbabwe’s data price remains too high and power supply too inconsistent to make flexible work arrangements feasible for many employers. An analysis incorporating data from cable.co.uk and Morgan & Co Research shows that, at US$1.51, Zimbabwe ranks 110th out of 233 countries on the list of the average cost of 1GB of data. In comparison, the cheapest 1GB of data on the continent can be purchased in Ghana for an average of US$0.61. That said, we maintain that the local telecoms environment still offers potential for growth in the long-term for industry players such as ZSE-listed Econet Wireless Limited despite current headwinds.

The sector has been bogged down by power outages, sub-inflationary tariffs, and low US dollars sales. The chronic power shortages in the country have led to extended downtime in mobile network operators’ base infrastructure, and this has affected the quality of their services.

In addition, the industry was one of the last sectors to receive the greenlight to price their services in multiple currencies and this has seen US dollars sales, a proportion of total sales slowly creeping up in comparison to other sectors with comparative ratios of over 80%. The sub-inflationary tariffs are another headwind, but we opine that this be temporaneous in nature.

In spite of these risks, we identify some points that place Econet at a strategic advantage relative to its peers, that is, its strong market share, growing US dollars sales, and continued investment in new technologies.

Econet remains a market leader in the telecoms sector with a 75% market share in voice services and 77% in data services as per Potraz’s latest sector report.

Econet’s chokehold is underpinned by its expansive base infrastructure compared to its competitors, which it continuously invests in despite limited capex funding since 2019.

In addition, the business launched 5G services in 2022 and this adds to the long-term growth of the business.

We believe that Econet will be established by the time 5G services and 5G-enabled devices become widespread and affordable. We add that Econet’s increasing US dollar sales — which now exceed 25% of total sales — provides the business with required US$ for capital expenditure in existing infrastructure in 5G equipment.

We value the business at a US dollars equivalent of US$0,33, which points to a loss in real value from the historical price levels of around US$0,42 because of the prevailing risks.

However, Econet currently trades at a US dollars equivalent of US$0,20, and offers upside potential to the tune of 65% to investors over the course of the year.

- Mtutu is a research analyst at Morgan & Co. — tafara@morganzim.com or +263 774 795 854.