THE Zimbabwe Power Company (ZPC) owes Makomo Resources US$6,8 million for unpaid coal supplies, a debt that weighed heavily on the coal miner before it slipped into curatorship in 2021.

Corporate rescuer Grant Thornton released Makomo from external administration last month.

However, the lingering debt, equivalent to ZiG181 billion at the interbank exchange rate, was one of several unresolved financial obligations.

A report issued in January revealed that Makomo supplied ZPC with 40 000 tonnes of coal monthly.

According to the 12-page report by Grant Thornton, obtained by the Zimbabwe Independent, the power utility has been settling the debt in local currency.

“As at the date of this report, Zimbabwe Power Company owed Makomo Resources an outstanding balance of US$6,8 million, which translates to approximately ZiG$181 billion using the interbank rate of the day,” Grant Thornton said.

“ZPC pays for thermal power coal in ZiG currency at the interbank rate.”

Economist Stevenson Dhlamini said the unresolved debt could pose long-term risks to ZPC’s viability.

- Ex-ZBC staffer, MP appeal dismissed

- Our hands are clean, says Zinara board

- Power crisis exposes bureaucrats’ incompetency

- Editorial Comment: Power crisis could have been avoided

Keep Reading

“It limits the company’s ability to secure more funding for increasing electricity generation capacity,” he said.

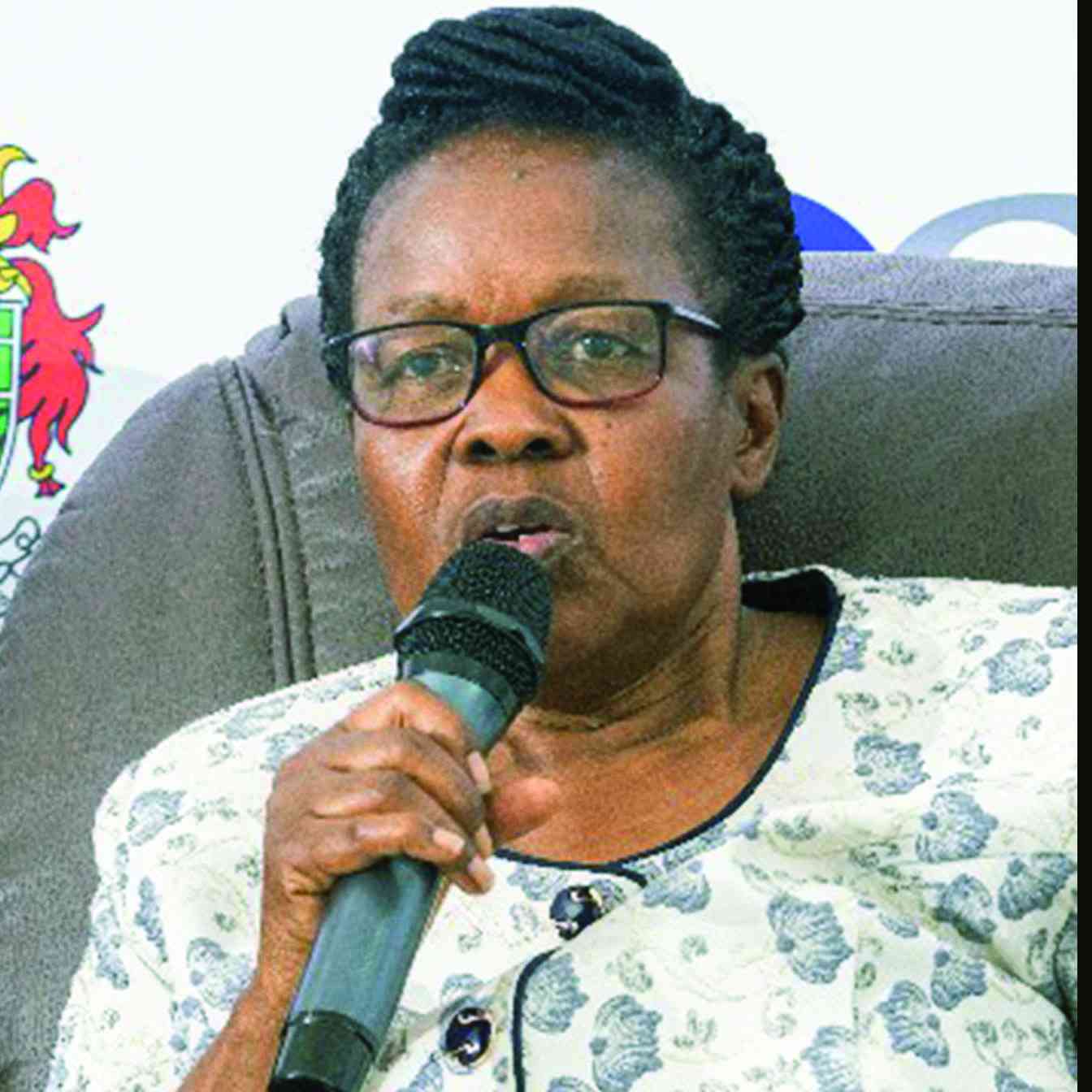

Chenayi Mutambasere, an economist at the Africa Centre for Economic Justice, said the debt reflected broader financial challenges plaguing Zimbabwe’s energy sector.

“This debt is part of a series of financial obligations that ZPC and its parent company, Zesa Holdings, have accumulated, impacting their operational efficiency and capacity to meet the nation’s electricity demand,” she said.

“Zesa is owed more than US$1 billion in total debt. In addition to the liquidity risk, there is also a risk of parcelling out energy sector infrastructure as a means to settle debts owed.”

Mutambasere also cautioned that the liquidity crunch could trigger dire consequences, including the potential sale of energy infrastructure to settle outstanding debts.

She said such disruptions could result in reduced power generation capacity and more frequent load shedding.

Mutambasere said high debts could deter potential investors, including independent power producers, from entering the market.

“The unattractive investment climate stalls projects that could enhance capacity and diversify energy sources,” she said.

“This is a damning reality for Zimbabwe’s energy sector, which points to an accumulation of misgovernance over the years.”