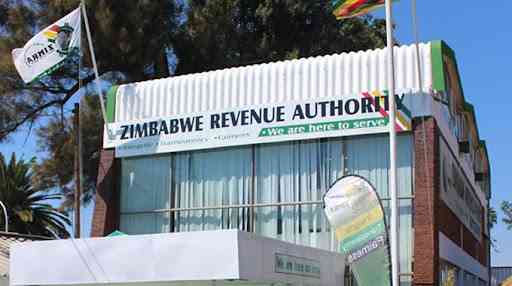

THE Zimbabwe Revenue Authority (Zimra) says it has stepped up its campaign to combat the rampant smuggling of goods into the country.

The tax authority highlighted the continued prevalence of smuggling activities despite ongoing enforcement measures.

“Yes, people still resort to smuggling as noted from encounters in enforcement activities conducted by Zimra and other law enforcement agents,” Zimra head of corporate communications Francis Chimanda told NewsDay Weekender.

“The motives for smuggling vary from person to person, but in general, people smuggle goods to evade controls and payment of duty at entry points as well as to avoid paying inland taxes when they sell smuggled commercial goods.”

The tax authority said smuggling was rampant despite the presence of a traveller’s rebate of duty, allowing individuals to import goods up to a value of US$200 per month without paying duty.

Chimanda said: “A duty-free allowance for travellers is technically referred to as a traveller’s rebate of duty.

“This rebate is allowed and not charged, enabling the traveller to import the allowed goods free of duty, currently, a traveller is allowed to import non-commercial goods up to a value not exceeding US$200 once a month.”

In June this year, the Department of Customs and Excise used drones in an attempt to lessen instances of smuggling along the nation’s borders.

- Zimra seizes CCC campaign vehicle

- Firearms smuggling suspect weeps in court

- Eyebrows raised over Zimra tender

- Zimra clearing agent in US$437K fraud

Keep Reading

Zimra collects revenue like customs duty at the country’s border posts, which are crucial to the country’s economy.

The duties include excise duty and import value-added tax.

While non-commercial goods imported by private individuals are subject to relatively lower rates, ranging from 5% for books to 110% for certain alcoholic beverages, the illegal importation of goods still poses a significant threat to the country’s revenue base.

“Non-commercial goods imported by private importers are charged duty at flat rates of assessments on their value or quantities, in the case of alcoholic beverages, cigarettes and clothing, including footwear,” Chimanda said.

“The rates range from 5% for books to 110% for some alcoholic beverages. Some rates are a flat monetary amount per quantity of goods, while others are a combination, that is a percentage of the value plus a flat monetary amount.”