THE sparks of confidence from a seasoned banker gleamed around the new central bank chief, John Mushayavanhu, this week as he pledged to dismantle a foreign currency black market that has plagued Zimbabwe for 24 years

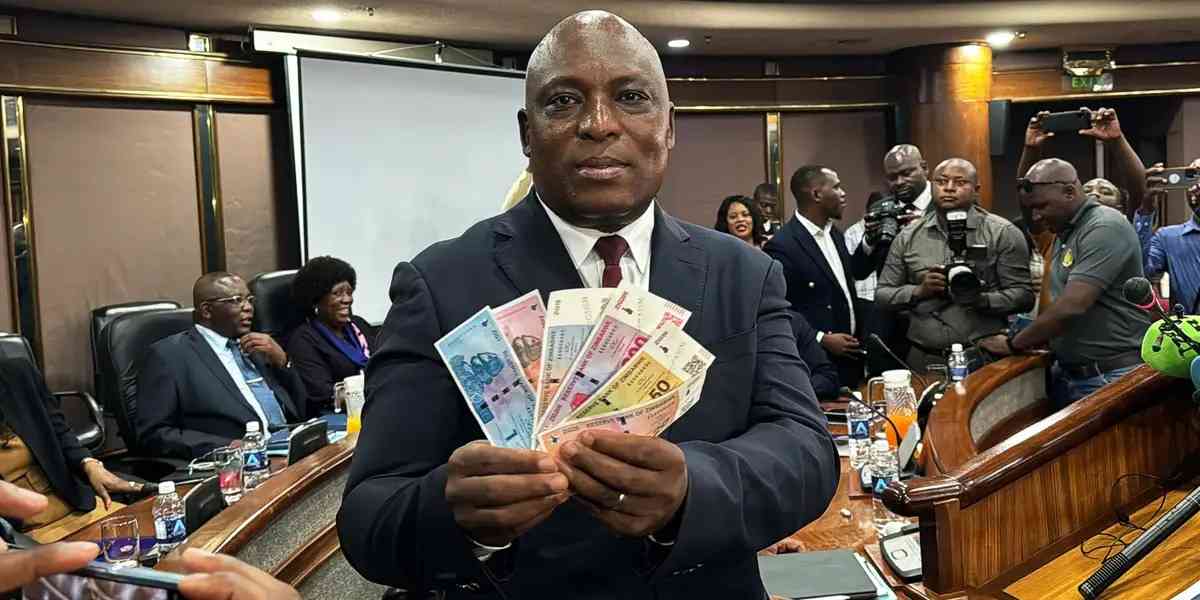

In an exclusive interview after rolling out a bold monetary policy ‘recalibration’, which ushered in a gold-backed currency called ZiG, Mushayavanhu said he had in place concrete measures to push armies of black market kingpins out of dark corners and bring stability to the local currency.

But he will be fighting to restrain an informal market that the RBZ estimates to be controlling over US$500 million, according to its October 2021 report. It holds sway.

Zimbabwe’s black market has so much power and influence to determine the exchange rate, which formal businesses have been whipped into accepting.

It allocates forex at the same rate as banks would do in a stable market.

Independent estimates say the informal black market controls over US$2,5 billion, which fuels the parallel market. It spiralled out of control between 2000 and 2008, when banks ran out of forex, with the economy in protracted tailspin.

Authorities reluctantly dollarised in 2009.

Zimbabwe’s gross domestic product (GDP) has rocketed to about US$49 billion since then.

- Zimbabwe’ banks are bleeding

- In Conversation with Trevor: Livingstone Gwata: Why I retired early

- Inside listed companies: Listed companies stand their ground in difficult year

- Awards target married couples

Keep Reading

But even under this growth, markets have continued to queue to street corner dealers for their forex requirements.

Experts say if Mushayavanhu, former CEO at FBC Holdings, prevails, he will enjoy the good will of a country that has bled without solution for over two decades, with a trail of bankruptcies.

His first move came through last Friday, with ZiG’s introduction.

He believes the currency has the power to stand its ground exchange rate fragilities, hyperinflation, rapid money supply growth and tapering output in some industries.

“What I can tell you is that the days of illegal money changers are numbered,” Mushayavanhu told the Independent.

“ZiG is fully convertible. If you have a genuine need for forex. Let us say you have an invoice to pay in forex, you go to your bank and that forex will be available to you and they debit your ZiG account if you have the money in the account.

“The only people who are likely to go to the parallel market are people, who are buying ZiG for illegal purposes, who are buying US dollars for illegal purposes.

“But if you have a legal genuine need, there is absolutely no reason why you should go to the parallel market,” the central bank chief added.

After shutting down the forex auction system, which had struggled to honour allotments, the switch to a market determined exchange rate is expected to help him ride out the storms.

“The exchange rate determination, going forward under ZiG, is going to be market determined, just like we have done since January. But you will find that because there will be a demand for ZiG, ZiG might actually strengthen instead of going the other way.

“I am sure you have seen what we out in the monetary policy statement. Come next QPD (quarterly paid dates) in June, 50% of the QPD dues are going to be paid in ZiG.

"There is only US$80 million worth of ZiG in circulation in this market, 50% of QPDs are way in excess of US$80 million. There is going to be a huge demand for ZiG.

“I have been saying if I were you, I would start accumulating ZiG now. Because you might find that by the time we get to June, it will be so expensive that you will be losing out.

“All I can say to Zimbabweans is that ZiG is the future, ZiG is a stable currency. If you do not get ZiG now, you will be looking for it as early as June this year. Everyone will be hunting for it,” the central bank chief said.

He also defended Zimbabwe’s reserves after analysts said they were too little to back the new currency.

“I do not know where they are getting that from,” Mushayavanhu told the Independent, referring to analysts.

“As at the date of conversion, we had ZW$2,6 trillion worth of reserve money. When you convert that at the closing exchange rates on Friday, it comes to just over US$80 million. And in nostro balances alone, we have US$100 million.

“So basically, if we wanted, we could buy all the ZiG in this market. And then the next day we say, you must pay for everything in ZiG. Let us see where you are going to get it from. So, why would they say that reserves are not adequate?

"Then, over and above that, and here I am just talking about the cash that we have. Then we have two and a half tonnes of gold, which means, if we run out of that cash, but I do not see how we will run out of that cash when in fact we have got more than enough."

He added: “You add the cash, US$100 million, plus the value of the gold that we carry (which is worth about) US$185 million. The total is US$285 million, plus the total money in circulation of US$80 million. We are three times covered, in fact more than three times covered.

“So, I do not understand when people say the reserves are not adequate. What will we be covering beyond what is already there that is supposed to be covered?”

Mushayavanhu also refuted allegations that he owns shares in FBC Holdings, which would have made him ineligible to occupy the post of governor.

“Well, the position is that FBC is a listed company. The share register of FBC is a public document and it is registered in Zimbabwe and any company that is registered in Zimbabwe, the records are at the Company Registry. If you go there and find my name, it's fine. Does that answer you,” he stated.