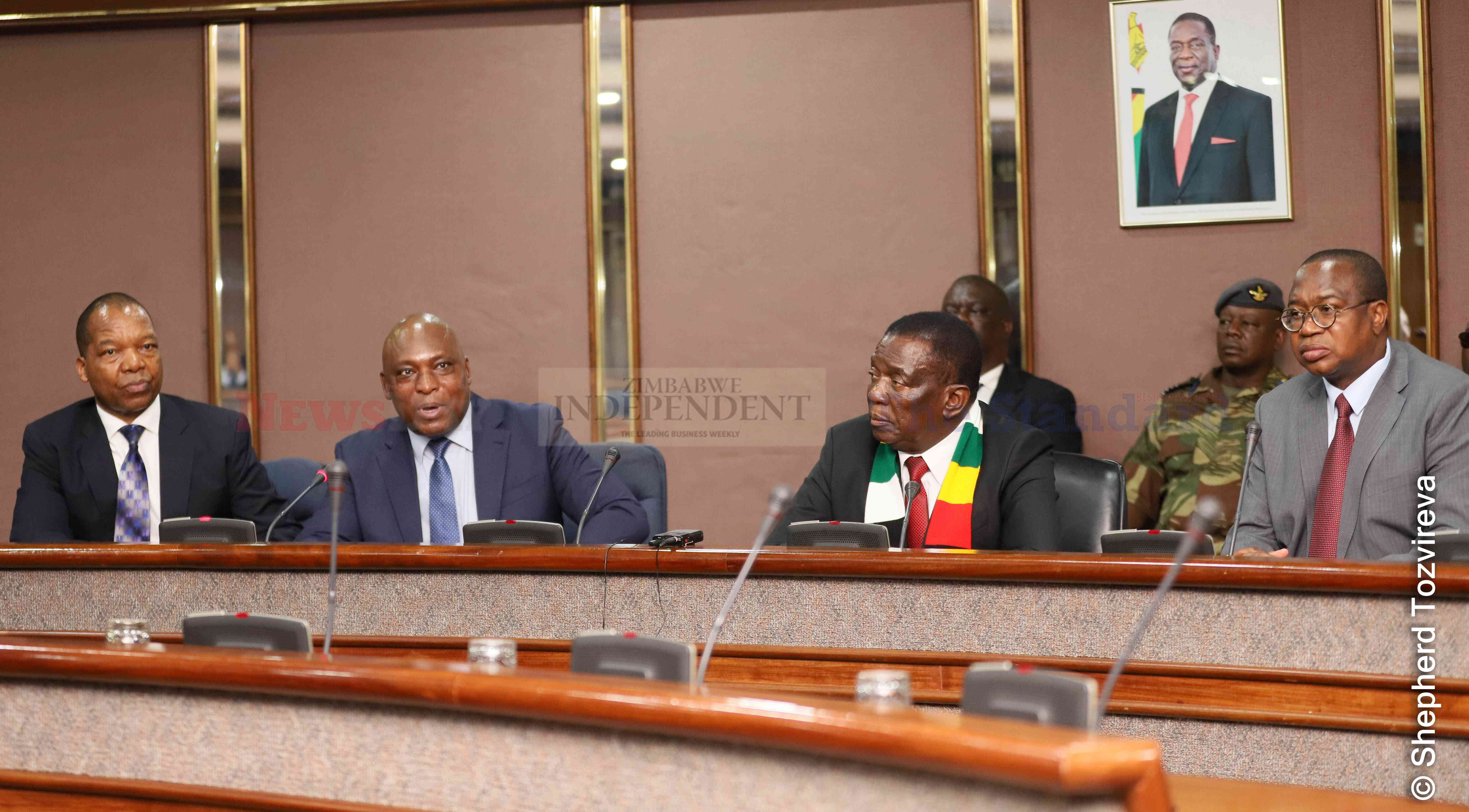

RESERVE Bank of Zimbabwe (RBZ) incoming governor, John Mushayavanhu will mark his arrival at the central bank with the launch of a ‘structured currency’ set for this afternoon, a day after he took President Emmerson Mnangagwa on a tour of the central bank vaults.

He replaces John Mangudya, whose tenure ends on April 30, as he takes charge at the newly established Mutapa Investment Fund.

The currency launch will mark Mushayavanhu’s first move to tackle one of the country’s longest running crises.

“Obviously they will be launching with the monetary policy statement as was hinted by the Minister of Finance (Mthuli Ncube) today (yesterday),” a top government official said last night.

“Denominations of such would be similar to any other fiat currency meaning ZW$1, ZW$2, ZW$5, ZW$10 and others. The RBZ can call them structured currency or ZiG, which name they have already been using.

“A structured currency is a form of a fiat currency that is fully backed by either forex reserves and precious metals, especially gold reserves like what was shown today (yesterday) to the President by the Reserve Bank of Zimbabwe,” he added.

The new currency will replace bond notes, which have been in free fall since 2019, losing 800% of value against the United States dollar in 2023 alone.

The Zimbabwe Independent understands that the highest denomination could be around ZW$200 or somewhere there.

- Rampaging inflation hits Old Mutual . . . giant slips to $9 billion loss after tax

- Monetary measures spur exchange rate stability: RBZ

- Zim deploys IMF windfall to horticulture

- Banker demands $21m from land developer

Keep Reading

Fielding questions from reporters following Mnangagwa’s inspection, Ncube hinted a monetary policy statement expected today would spell out how the currency would be defended.

This was after journalists asked what measures had been put in place to prevent another currency battering.

Data released by the RBZ and Treasury showed gold reserves had reached 2,5 tonnes since stocking began 18 months ago, following Mnangagwa’s directive.

Mushayavanhu estimated the gold reserves value at about US$175 million, adding that the central bank also had US$100 million cash reserves.

George Guvamatanga, permanent secretary in the Ministry of Finance, said in addition to the US$275 million, the government had US$300 million cash reserves in their accounts.

This adds up to about US$575 million, which officials said was enough to cover about one and half month’s imports.

“His Excellency instructed that we could not have a government without reserves,” Guvamatanga told journalists.

“Over and above the instructions that came to the central bank, they also came to the Treasury. The government of Zimbabwe, not in the central bank, but in several private banks is sitting on reserves of US$300 million... over and above this US$275 million.

“There are government reserves and central bank reserves. If we put that together, we have more than adequate capital cover, more than one month of cover, which is between the reserve bank and the government of Zimbabwe.

“So, the total is more than enough for those who are asking to say, do we have adequate reserves?

“If you go to various banks, they will tell you and show that they are holding money on behalf of the government, which is just over US$300 million, which is again a reserve that we were directed by his Excellency that you have to keep a reserve. You can't get your money and spend everything,” he added.

But in an analysis released last night, Gift Mugano, executive director at Africa Economic Development Strategies, said based on projected imports of US$9 billion this year, the country will require US$750

million per month for its import requirements. Import cover refers to the number of months that an economy can sustain its current level of imports using its foreign exchange reserves.

“Around 2,5 tonnes of gold and US$100 million (that is US$291,8 million equivalent) are a drop in the ocean,” Mugano said.

“This year, we are anticipating to import goods worth US$9 billion, that is, US$750 million per month. Our reserves (of) US$291,8 million can only cover 11,7 days of the month if we are not exporting anything.

"In short, our reserves are not enough to give us at least one month import cover. Basic economic theory tells us that we must have at least six months import cover to guarantee currency stability if all things are equal.

“In our case we have approximately 1/3 month cover! This is not enough to support the structured currency even if we are still going to receive forex inflows from exports, diaspora remittances, credit etc,” he said.

An International Monetary Fund report about a decade ago showed the country had less than one week’s cover, and much less during hyperinflation.

Mnangagwa said reserves would be progressively built up in the coming years.

“The handover-takeover of the stewardship of the Reserve Bank of Zimbabwe, we would just normally do it by one walking out and another walking in, taking over the papers,” Mnangagwa said after the inspection.

“This time around, we have decided we want to physically see these assets because in the past, we did not have any reserves or commodities.

“We sold all our gold, all precious minerals. Then I gave instructions to my governor, about three years ago, that I need 10% of our minerals kept in a solid commodity.

“If it is platinum, you convert 10% to gold. Other minerals again, which you cannot keep, physically, you will again convert to gold. We have been doing this for the last 18 months.

“The governor gave me the figures of what he had stocked in the year. So, I felt that I must physically inspect what he told me as he handed over to the new governor so that when I inspect the new governor, it would not be difficult.

“So, I am satisfied. For the first time, Zimbabwe has solid gold in its vaults," the President said.

He added: "We have solid gold, also year by year, we will have one or two tonnes of gold, solid gold kept here. As well as outside, a few months ago, I went outside, I was there where I inspected the gold. I went there and inspected the reserves there, I am satisfied that my officers carried out my instructions quite well."

Zimbabwe has been plagued by currency problems for over two decades, a crisis which has its genesis in the Black Friday of November 17, 1997. On that day, the Zimbabwe dollar crashed, losing 72% of its value against the greenback after the government awarded unbudgeted compensation packages of ZW$50 000 each to veterans of the 1970s liberation war.

The crash kicked off economic collapse and a depression that Zimbabwe is yet to recover from. In June 2019, the Zimbabwe dollar was officially reintroduced as the main legal tender for domestic transactions in the country amid scepticism from the general public concerning its sustainability.

The intention was good but everything has been downhill since then. The local unit was abandoned in 2009 in favour of a multi-currency system following a devastating hyperinflation which topped 500 billion percent, wiping away pensions and rendering the local currency useless.

When the government reintroduced the Zimdollar and briefly outlawed the use of foreign currency, authorities insisted that much of the transactions should be carried out in the local currency. However, the Zimdollar has suffered from a lack of trust from both business and the public, a development that has cast doubt on the local currency’s sustainability going forward.