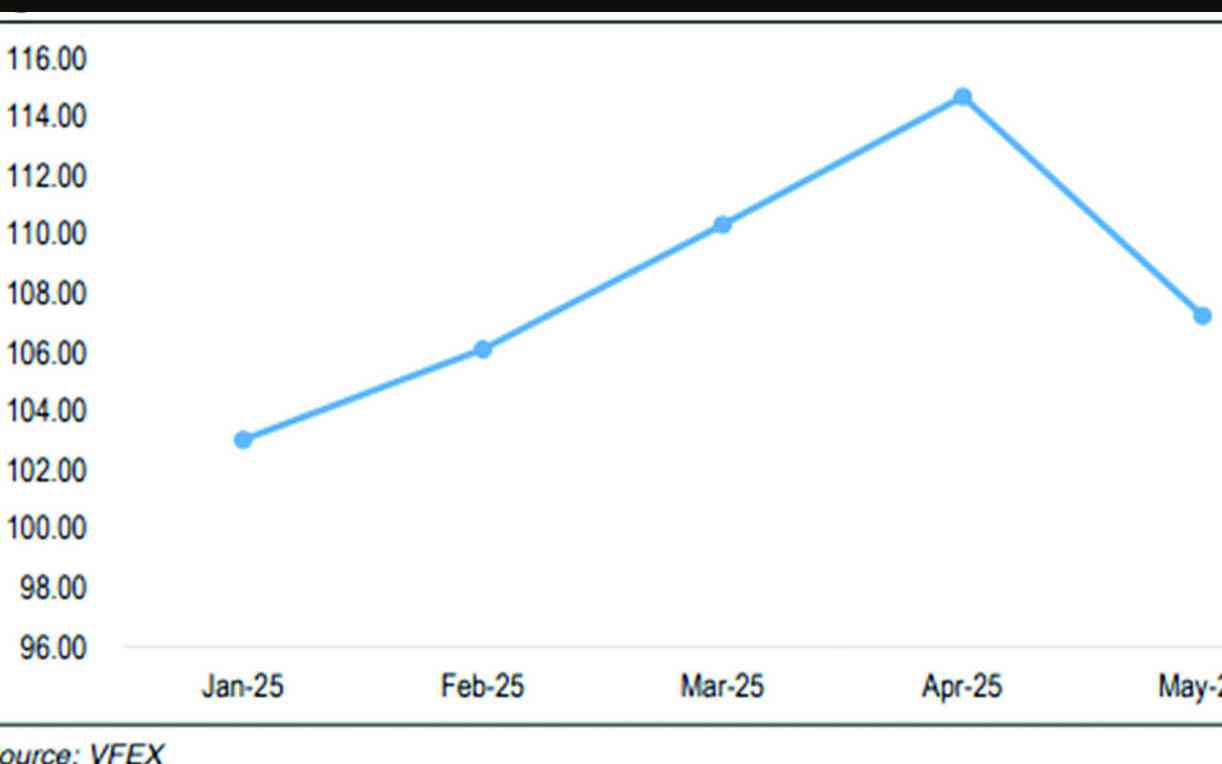

From hitting a record low last week, the total value of forex traded on the auction market marginally increased to US$11,05 million, driving the five week moving average to a lowest of $12,37 million. The value traded last week, at US$10,4 million is the lowest since June 2020.

In the first session which succeeded a revamp in June 2020, the auction market recorded US$10,3 million in total trades before a gradual increase which peaked at US$40 million in 2021.

The current year weekly average has since decreased to US$30 million weighed by the 2nd half performance. In May government announced a cocktail of fiscal and monetary policy measures meant to cushion the Zimdollar depreciation.

Part of the measures entailed further liberalisation of the auction market.

The scenarios

By allowing higher volumes to trade through the interbank over the last three months, RBZ has improved price discovery in the market, thus allowing for a more modest premium between the formal and informal markets.

Keep Reading

- Lupane man survives axe attack

- Teachers, other civil servants face off

- Veld fire management strategies for 2022

- Magistrate in court for abuse of power

The parallel market premium sits at 20% its lowest in over a year. The decline in the parallel market premium is largely due to the convergence of the exchange rates and a more stable parallel market performance since May.

At a run rate of US$3,3 billion in cumulative foreign receipts, over the six months period to June 2022, the deduction is that the economy is generating at least US$0,5 billion per month, largely through exports.

This further deduces to about US$137 million a week. When juxtaposed against the implied average weekly inflows, the current auction market run rate is only 7% of the total, which means of the total receipts earned very little is now being channelled towards the auction market. that is not to say there is no commensurate demand (imports. but clearly it demonstrates that the auction market’s role as the prime dispenser of forex liquidity in the economy has diminished.

Further, the increased liberalisation of the exchange rate through allowing the interbank to play a discovery role has also increased market confidence contributing to relative stability of the currency.

Over the latest four weekly sessions the auction rate has however eased at a much more diminished rate of 1,4% per week, down from averages of about 4% per week, a sign of near stability.

There however cannot be a precise prediction of a point of stability over the near term, given that a lot of moving variables that could influence the rate are highly volatile and at the discretion of government.

These include money supply, which has to date been largely stable as government tightens spend and issuance of new money coupled with open market operations.

If the current stance is maintained, it may result in a near term stability which would clearly rattle growth and drive the economy back again into recession by 2023 it being an election year.

This policy position is not likely to be pursued in earnest as it has the impact of swerving voters.

History has shown that government has failed to resist the temptation of overblown expenditure in election periods.

However, the current government has attempted to navigate cautiously on the fiscal and monetary front and therefore has an equal chance of maintaining discipline at the cost of growth.

- Gwenzi is a financial analyst and MD of Equity Axis, a financial media firm offering business intelligence, economic and equity research. — respect@equityaxis.net