ZIMBABWE'S power utility, Zesa Holdings, owes a staggering US$430 million to Hwange Electricity Supply Company (Hesco), which operates units 7 and 8 at the country's largest thermal energy plant, the Zimbabwe Independent can exclusively reveal.

According to investigations by the Independent, the debt, accumulated from unpaid power supplied between May and November this year, threatens the continued operation of units 7 and 8 at the Hwange Thermal Power Station.

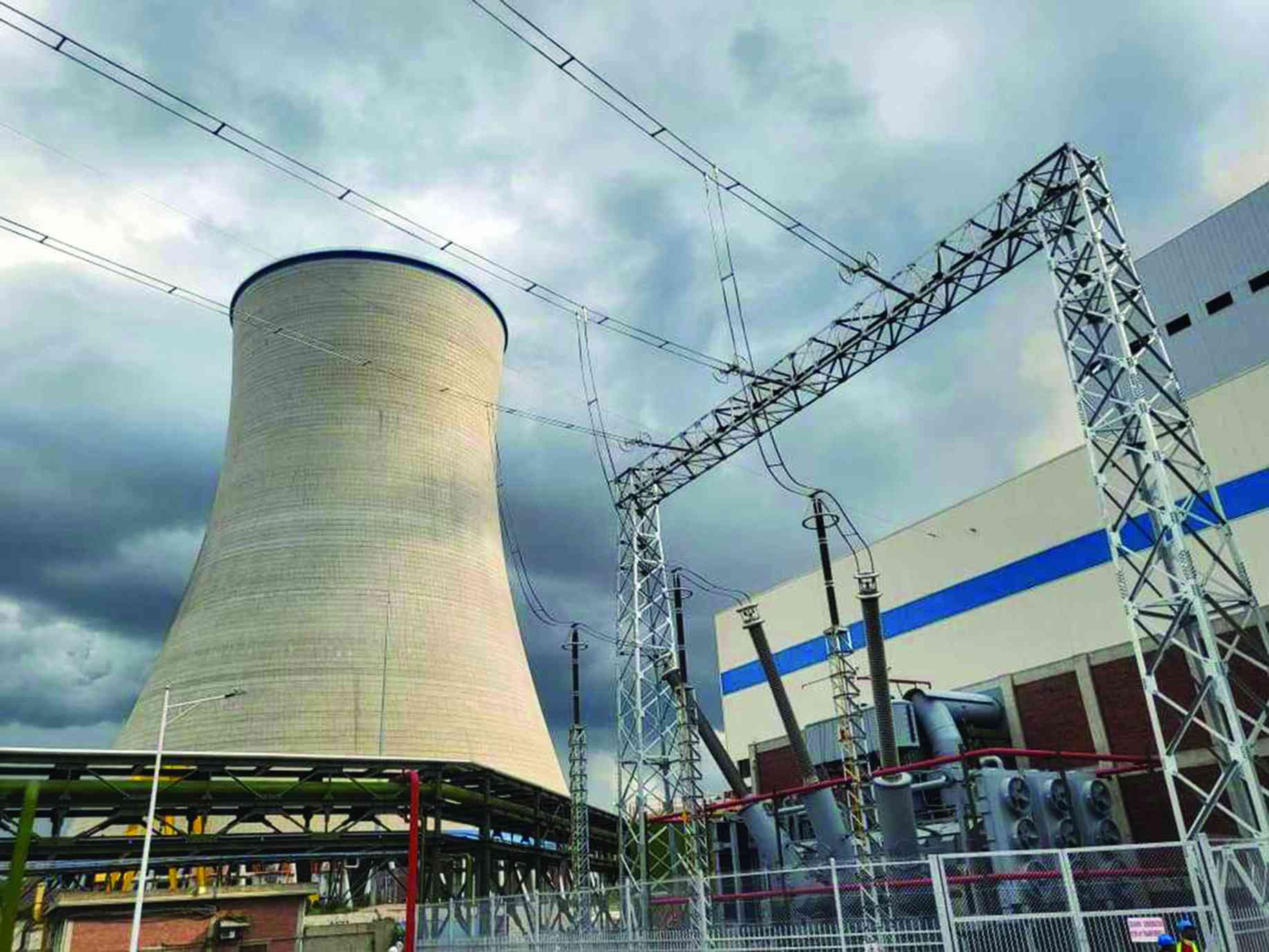

Hesco, jointly owned by Zimbabwe Power Company (ZPC) with 64% shareholding and Sinohydro Corporation of China holding the remaining 36%, operates these units commissioned in 2023 at a cost of US$1,4 billion.

The units, which contribute a significant 600 megawatts (MW) to Zimbabwe's power grid, were funded by a loan secured from the China Export and Import Bank in 2018.

Hesco has warned that if the debt is unpaid, it could plunge Zimbabwe into its worst power crisis, given that the country is already experiencing daily power outages for up to 16 hours.

Zimbabwe relies heavily on the hydro power station in Kariba, and the low water levels have exacerbated the power problem.

Keep Reading

- Low tariffs weigh down ZETDC

- Severe power outages loom: Zesa

- Bodies rot at mortuaries as power cuts worsen

- Gweru debtors’ bill soars to $3bn

The 16-hour load shedding has severely disrupted the economy, according to industrialists and miners.

An official at Sinohydro, who asked not to be named, warned of potential operational halts due to the mounting debt.

“ZETDC owes Hesco around US$430 million. Hesco has no money to pay for operations and maintenance. It also has no money to pay for coal supplies and shareholders,” he said.

The official said the debt, which would accumulate interest if it is not serviced, cast uncertainty on operations at the two units.

“Maybe it will be shut down in the future due to lack of money to fund operations. So far, we have invested hundreds of millions of dollars but the return is zero.”

Investigations show that the debt emanated from an estimated seven billion kWh of power generated from the units and fed into the national grid.

From that US$430 million debt by Zetdc, the official said, Hesco owed US$330 million to Sinohydro Corporation.

“As a contractor, Hesco owes us around US$300 million for maintenance and operation. Hesco owes us another US$30 million,” he said.

Energy and Power Development minister Edgar Moyo told the Independent that the Zetdc debt was being handled by the Mutapa Investment Fund (MIF), which was formed in 2023.

Last month, the cabinet resolved that entities under Zesa would either be unbundled or merged to ease the country’s persisting power problems.

This was a recommendation by a consultant engaged by the government to look into

To Page 2

From Page 1

the Zesa operations. Moyo said: “The issue of debt by Zetdc is a Mutapa Investment Fund matter. Units 7 and 8 add 614 MW to the grid, which is quite significant. These are dependable units in our power supply system.

“Hesco is a SPV (special purpose vehicle) meant to manage Hwange 7 and 8 jointly owned with Zimbabwe. There is no impact of debt, if any, on the maintenance programme on those assets.”

Mangudya referred all questions to the Hesco managing director, who could not be reached for comment.

But a well-placed source close to the ongoing debt negotiations told the Independent that the talks have hit a stalemate.

“Representative of Hesco stakeholders have been regularly meeting with officials from Zetdc and the government to come up with a payment plan for settling the US$430 million debt.

“However, these discussions have not produced any tangible results. Zetdc has not given any concrete timelines explaining how they intended to settle the debt. Shareholders at Hesco want to know how the debt will be settled,” a source who spoke on condition of anonymity told the Independent.

Meanwhile, scheduled maintenance at units 7 and 8, cited as a factor in the recent power cuts, is expected to be completed this month, potentially restoring generation capacity.

The broader Hwange complex includes six additional units built between 1973 and 1978, which lack modern pollution controls and suffer from frequent malfunctions.

Zimbabwe's peak electricity demand is 1 800 MW, against an installed generation capacity of 1 500 MW.

The shortfall is typically bridged through imports from neighbouring countries such as Mozambique, South Africa, and Zambia, though these arrangements are often strained by Zimbabwe’s failure to service debts.

In 2020, Zesa had to negotiate a US$70 million loan to clear arrears with South Africa’s Eskom and Mozambique’s Hydro Cahora Bassa. At the time, Zesa committed to make a monthly payment of US$1 million to Eskom.

To address the intractable power crisis, the government this year announced that it had commissioned nine public and private power generation projects with a combined capacity of 2 670MW. These projects are expected to commence generation next year.

Some of the projects include the 300MW greenfield energy projects being rolled out by Chinese firm Dinson Iron and Steel Company, which is setting up an US$1,5 billion steel plant in Mvuma.

Power generation is expected to significantly improve in March at Kariba hydro station based on rainfall forecasts announced by the Meteorological Services Department.