CHINA has written off “substantial” interest free loans borrowed by Zimbabwe during the late former president Robert Mugabe’s final years in power, giving relief to a country that the International Monetary Fund (IMF) says is in ‘debt distress’.

Zimbabwe currently owes a combined US$17,5 billion to foreign and local creditors.

Of this amount, about US$14 billion is owed to foreign creditors.

As a result of the debts, Zimbabwe has been shut out of international financial markets.

Multilateral creditors, including the World Bank and the African Development Bank (AfDB), suspended extending loans to Zimbabwe in 2001 when the country started defaulting.

Mugabe left Zimbabwe saddled with a massive debt when he was toppled through a “military-assisted transition” that propelled President Emmerson Mnangagwa to the helm in 2017.

Keep Reading

- The brains behind Matavire’s immortalisation

- Red Cross work remembered

- All set for inaugural job fair

- Community trailblazers: Dr Guramatunhu: A hard-driving achiever yearning for better Zim

Between 2000 and 2020, Zimbabwe

With Zimbabwe’s external debt standing at about US$14 billion, debts owed to China translate to about US$2,1 billion.

The bulk of the cancelled loans were availed by China’s Export and Import Bank (Eximbank).

Former Finance minister Patrick Chinamasa, who presided over the Treasury when the loans matured, did not respond to the Independent’s questions.

This publication sought to understand the exact value of loans and how Zimbabwe benefited from China’s gesture of goodwill.

In 2015, when the cancellations were made, Chinamasa presented a US$4,1 billion budget.

Out of this, US$3,32 billion was gobbled by the public service wage bill, while US$798 million was channelled towards operations, debt servicing and development projects.

A severe drought and acute liquidity crisis forced Chinamasa at the time to trim economic growth projections from 3,2% to 1,5% in 2015.

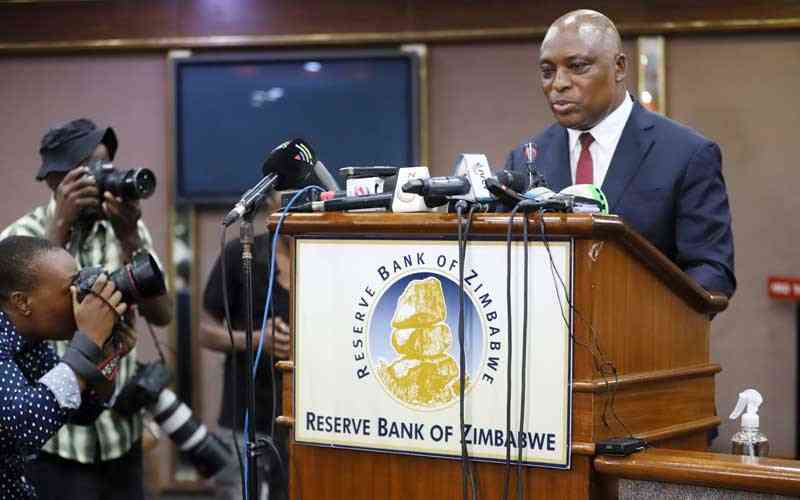

On August 24, 2022, Finance minister Mthuli Ncube told Parliament that Zimbabwe had borrowed US$2,7 billion from China since Independence in 1980.

Some of the loans were settled.

The Treasury boss said at the time: “Since 1980, Zimbabwe has contracted loans from China amounting to approximately US$2,7 billion.

“Out of the loans that I have mentioned, US$152 million worth of loans have since matured and are fully paid up. The outstanding debt to China as at August 2022 amounts to US$1,768 billion.”

During that same address, Ncube disclosed that Zimbabwe had collateralised 26 million ounces of platinum in exchange for a US$200 million loan to finance the agriculture mechanisation programme in 2006.

Zhou added that Beijing was willing to assist Zimbabwe address its odious debt question after the US pulled out of the AfDB-led initiative to resolve Harare’s debt crisis this year.

Subsequently, the US replaced its Executive Orders embargo imposed against Zimbabwe in 2003 with the Global Magnitsky sanctions framework.

Under the fresh sanctions, Mnangagwa and 11 other individuals consisting of his wife Auxilia and top lieutenants were designated.

The sanctions include asset freezes and travel bans.

“China would like to enhance communication with the Zimbabwe government to work out proper settlements through friendly consultation,” Zhou added.

“China will continue to support Zimbabwe’s economic and social development based on its needs.

“China will continue to communicate with the Zimbabwean government on financial assistance of infrastructure and livelihood projects to enhance Zimbabwe’s capacity for self-generated and sustainable development and deliver tangible benefits to its people.”

Sources close to debt settlement negotiations between Harare and Beijing told this publication that Ncube travelled to China in October.

In China, he met officials from Eximbank.

The sources in multiple briefings, added that deliberations focused on Harare’s plea for debt rescheduling. Debt rescheduling refers to restructuring loans through reducing payment amounts by extending payment periods.

It can also be done by increasing the number of payments.

“Finance minister Ncube travelled to China in October where he met with top officials from China’s Eximbank and other top officials from China’s ministry of Finance,” a top government source said.

“Discussions among parties centred on exploring flexible ways that can be pursued for Zimbabwe to settle its debt obligations. China is confident that Zimbabwe will honour its obligations.”

Questions posed to Ncube seeking understanding on how his discussions with Eximbank unfolded were not addressed.

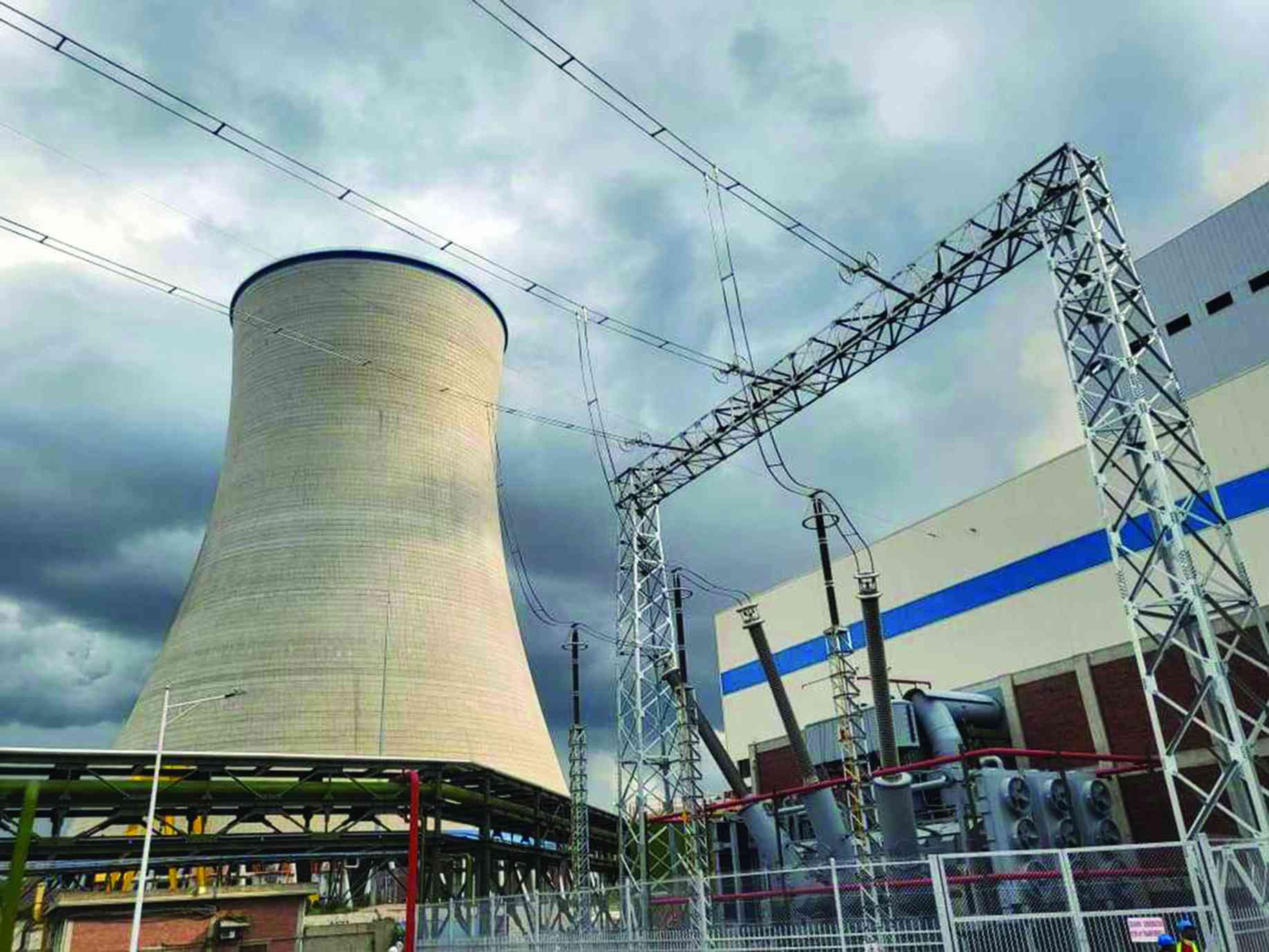

Some of the loans that Zimbabwe has borrowed from China in recent times include US$152,8 million for upgrading the Robert Gabriel Mugabe International Airport, US$997,7 million for expanding the Hwange 7 and 8 units, US$98,7 million for the construction of National Defence College and a US$149,9 million facility for Victoria Falls International Airport expansion.

In a 2006 paper titled: “China Eximbank and Africa: New Lending, New Challenges,” the Center for Global Development headquartered in Washington contended that the bank had become an alternative source of credit for nations isolated by the West.

“The rise of the China Exim is a potentially important trend for African development by providing a new source of capital, especially for much-needed infrastructure investment,” the paper reads.

“For pariah regimes like Sudan or Zimbabwe, these credits can be a lifeline.”