Cryptocurrency has been one of the most talked-about financial innovations of the 21st century. What started with Bitcoin as an obscure experiment in digital currency has grown into a trillion-dollar market with thousands of different cryptocurrencies. This explosive growth has sparked a global conversation: could cryptocurrency one day replace traditional money? Let’s explore the possibilities and challenges of a world where digital currency might take over our financial system.

The Rise of CryptocurrencyCryptocurrency began with a simple idea: to create a decentralized form of money that doesn’t rely on governments or banks. Bitcoin, introduced in 2009 by the mysterious figure Satoshi Nakamoto, was the first to bring this concept to life. Over the years, the idea caught on, and now there are thousands of cryptocurrencies, each with unique features and use cases.

One of the main reasons for cryptocurrency's growing popularity is its potential to solve some of the issues plaguing traditional financial systems. These include high transaction fees, slow processing times, and the lack of privacy. Cryptocurrencies offer an alternative, with faster, cheaper, and more secure transactions, all while giving users more control over their own money.

Could Cryptocurrency Replace Traditional Money?The idea of cryptocurrency replacing traditional money might seem far-fetched to some, but it’s not as improbable as it once was. Here’s a closer look at the factors that could influence this potential shift:

1. Adoption by Businesses and ConsumersFor cryptocurrency to replace traditional money, widespread adoption by businesses and consumers is crucial. We’ve already seen significant progress in this area. Major companies like Tesla, PayPal, and Microsoft have started accepting Bitcoin and other cryptocurrencies for payments. Additionally, many small businesses are also joining the trend, particularly in the tech-savvy sectors.

Consumers, especially younger generations, are becoming more comfortable with the idea of digital currency. The convenience of using crypto for online transactions and the appeal of decentralized finance are driving this trend. Even in niche markets, such as the growing online gaming industry, players are increasingly turning to cryptocurrencies for a smoother, more secure experience at the best online crypto casino sites. This trend in the online casino space highlights how cryptocurrencies are already finding practical use cases in our everyday lives.

2. Government Regulations and SupportGovernment regulation is a double-edged sword for cryptocurrency. On one hand, clear and supportive regulations could pave the way for wider adoption by providing a legal framework for businesses and consumers to operate within. On the other hand, overly restrictive regulations could stifle innovation and limit the potential for cryptocurrencies to replace traditional money.

Some governments have already started exploring the idea of central bank digital currencies (CBDCs), which are government-backed digital currencies that could coexist with or even replace physical cash. While CBDCs are different from decentralized cryptocurrencies like Bitcoin, their development indicates that governments are taking digital currency seriously, which could accelerate the shift away from traditional money.

- What is an excellent crypto wallet made of?

- New perspectives: Combating money laundering in real estate

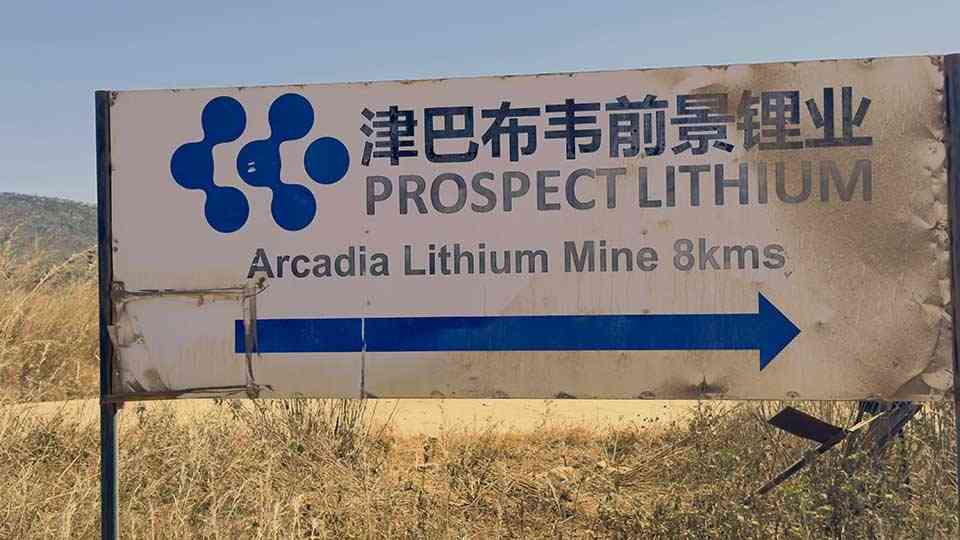

- New perspectives: How Zimbabwe can effectively fight money laundering

- New perspectives: Combating money laundering and terrorist financing

Keep Reading

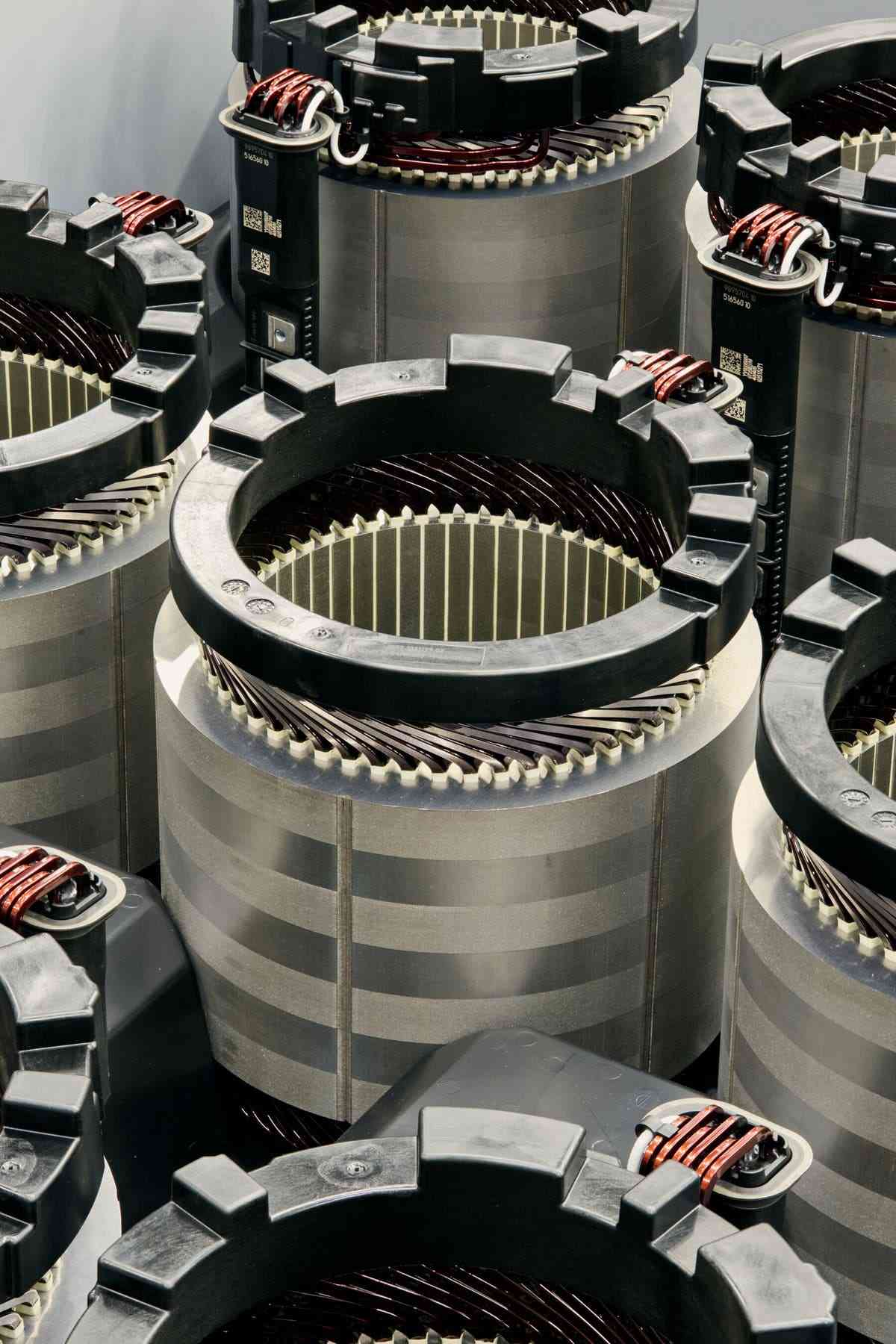

For cryptocurrency to truly replace traditional money, it must overcome certain technological challenges. Scalability, for example, is a significant issue. Bitcoin’s network can only handle a limited number of transactions per second, far fewer than traditional payment systems like Visa or Mastercard. However, ongoing developments, such as the Lightning Network for Bitcoin and Ethereum’s shift to a more efficient proof-of-stake model, are addressing these issues.

Another technological factor is user experience. While crypto wallets and exchanges have become more user-friendly over the years, there’s still a learning curve involved in using cryptocurrency. Simplifying this process will be key to driving widespread adoption.

4. Stability and TrustTraditional money benefits from the stability and trust that comes with government backing. Cryptocurrencies, on the other hand, are known for their volatility. The price of Bitcoin, for example, has experienced dramatic swings in value over short periods. For a cryptocurrency to replace traditional money, it must achieve a level of stability that makes it a reliable store of value.

Stablecoins—cryptocurrencies pegged to stable assets like the US dollar—offer a potential solution to this problem. They combine the benefits of cryptocurrency with the stability of traditional currencies, making them more suitable for everyday transactions.

The Road AheadWhile the idea of cryptocurrency replacing traditional money is intriguing, it’s unlikely to happen overnight. The road ahead is filled with challenges, from regulatory hurdles to technological advancements. However, the progress made so far suggests that cryptocurrency will continue to play an increasingly important role in our financial system.

Whether it completely replaces traditional money or simply coexists alongside it remains to be seen. What’s clear, though, is that cryptocurrencies are here to stay, and their influence on the global economy will only grow in the years to come.

As we move forward, staying informed about these developments is crucial. Whether you’re an investor, a business owner, or simply curious about the future of money, understanding the potential and limitations of cryptocurrency will help you navigate this evolving landscape.

So, will cryptocurrency ever replace traditional money? Only time will tell. But one thing is certain: the future of money is digital, and it’s unfolding before our eyes.