BCC apologises over refuse collection chaos

Local

By Nizbert Moyo | 23h ago

“The city is facing a shortage of refuse compactors,” Coltart said.

Gwanda anti-stocktheft group recovers 21 donkeys stolen from Botswana

He also hailed the Zimbabwe Republic Police (ZRP) for their excellent co-operation in tackling crime in Matabeleland South province.

By Silas Nkala

23h ago

Nkulumane: Opposition's Christmas gift to Zanu PF

By Silas Nkala

Dec. 10, 2025

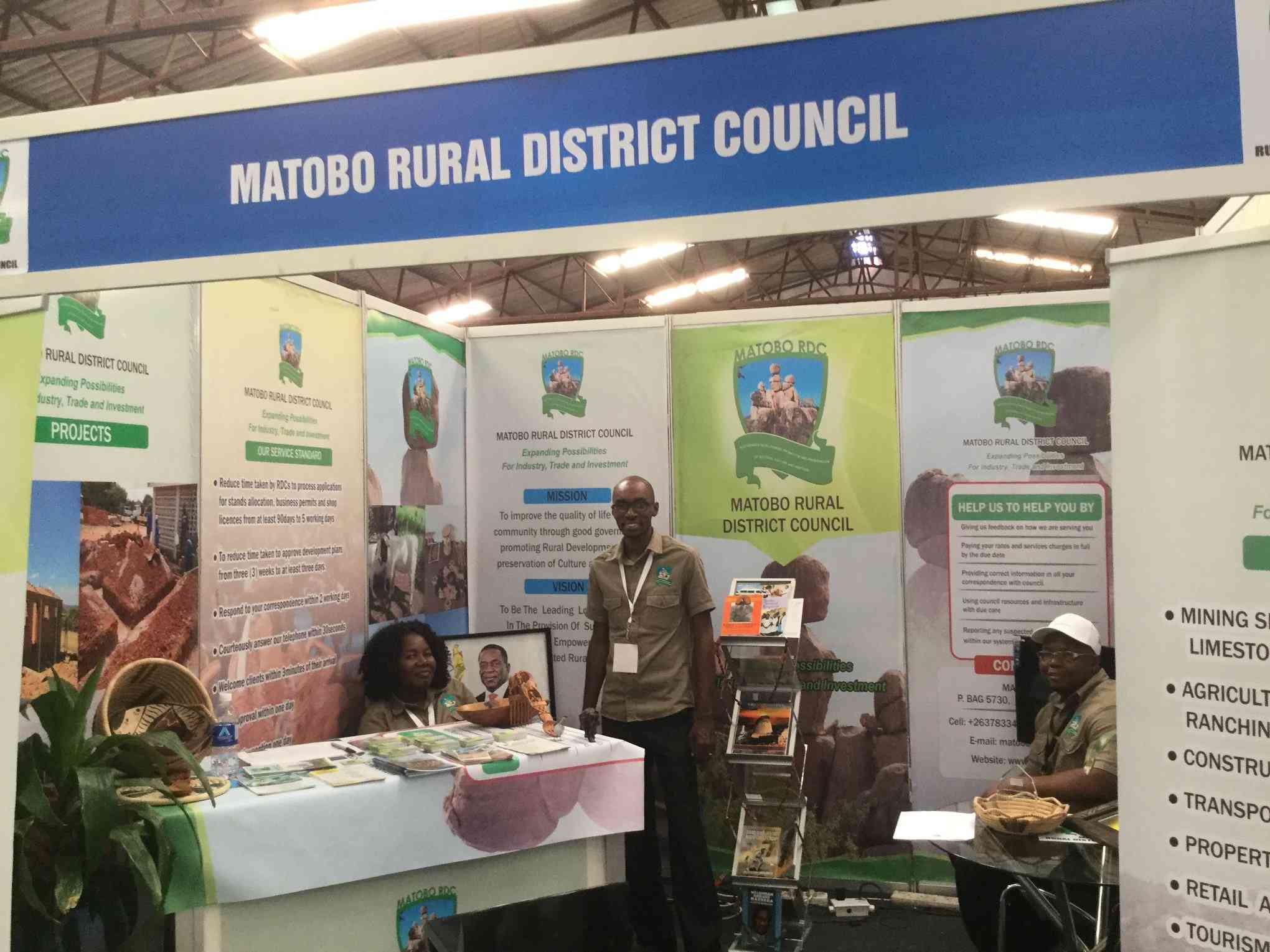

Matobo drops service charges to lure investors

By Nizbert Moyo

Dec. 10, 2025

Why demand for houses is rising in Bulawayo

Local

By Silas Nkala | Dec. 10, 2025

High Court Brings Finality to Long-Running Balwearie Name Dispute

The court ordered the applicants to pay costs on a stringent solicitor-and-client scale, describing their latest application as an abuse of process given the settled nature of the issues.

By Staff Reporter

21h ago

Zanu PF Nkulumane vote buying spree an indictment

By Southern Eye

Dec. 10, 2025

The forgotten river people of Binga

By Obert Siamilandu

Dec. 10, 2025

Will Litecoin Grow in the Future?

By The Standard

May. 4, 2021

Why is Golix the best exchange in Zimbabwe?

By The Standard

May. 4, 2021

What are the best ways to store cryptocurrency?

By The Standard

May. 4, 2021

5 Best Altcoins to Make High Profits.

By The Standard

May. 4, 2021

Kenya’s ivory burning raises questions

By The Standard

May. 3, 2016

Grace, a virtual law unto herself

By The Standard

Mar. 29, 2016

Salute to MPs for stopping minister’s abuse of power

By Southern Eye

Dec. 4, 2025

Save Bulawayo’s iconic library

By Southern Eye

Nov. 13, 2025

Illegal mining scarring Shurugwi’s land and future

By Southern Eye

Oct. 23, 2025

Bulawayo deserves leadership renewal

By Southern Eye

Oct. 15, 2025

Gweru cannot survive on colonial relics

By Southern Eye

Oct. 1, 2025

Makokoba redevelopment: Another empty promise

By Southern Eye

Sep. 24, 2025

How Billy Markus invented Dogecoin

If you know anything at all about cryptocurrencies, you can’t have failed to notice their dramatic increase in value of late. Of course, the original of these cryptos is Bitcoin and this is still the one that steals the headlines and sets the standards. Wherever Bitcoin may go, the anticipation is that this is where […]

By The Standard

Jan. 19, 2022

Liquid joins forces with Google for Congolese adventure

By The Standard

Sep. 22, 2021

Musariri’s vision to transform PSL

Musariri’s blend of practical club management experience and ambitious commercial vision positions him as a compelling contender for the top job.

By Munyaradzi Madzokere

Jul. 17, 2025

Festive lights, political fights: A week in the city

By Ink Whispers

Dec. 4, 2025

Alan Redfern Primary School revels in its success

By Margaret Lubinda

Dec. 4, 2025

AMH journo publishes award-winning IsiNdebele novel

By Margaret Lubinda

Dec. 4, 2025

Inside Lungile Bonga’s powerful debut Umakhelwane

The Kwaito Boy mentioned that he was inspired by artists such as Skhu and Pozeey, Mandoza, Brown Dash, and Arthur Mafokate.

By Nokuxola Mbangeni

Nov. 27, 2025

Discipline of delay

By Mthulisi 'khulugatsheni' Ndlovu

Nov. 27, 2025

No favourites: Insist female poets

By Mpumelelo Moyo and Langelihle Nyathi

Nov. 27, 2025

Mzansi Magic’s Inimba tackles taboo of male infertility

By Mpumelelo Moyo

Nov. 20, 2025

Esther Zitha throws her hat in

By Ink Whispers

Nov. 20, 2025

Youth group promotes heritage tourism

By Nokuxola Mbangeni

Nov. 13, 2025

.

Videos

Thebe Ikalafeng, Founder and Chairman of Brand Africa In Conversation With Trevor

By The NewsDay

Dec. 9, 2025

Thelma Chimbganda,Co- Founder& Chief Logistics Officer of Beyond Borders In Conversation With Trevor

By The NewsDay

Nov. 12, 2025

Shingai Mutasa, CEO of Masawara Plc In Conversation With Trevor

By The NewsDay

Nov. 12, 2025

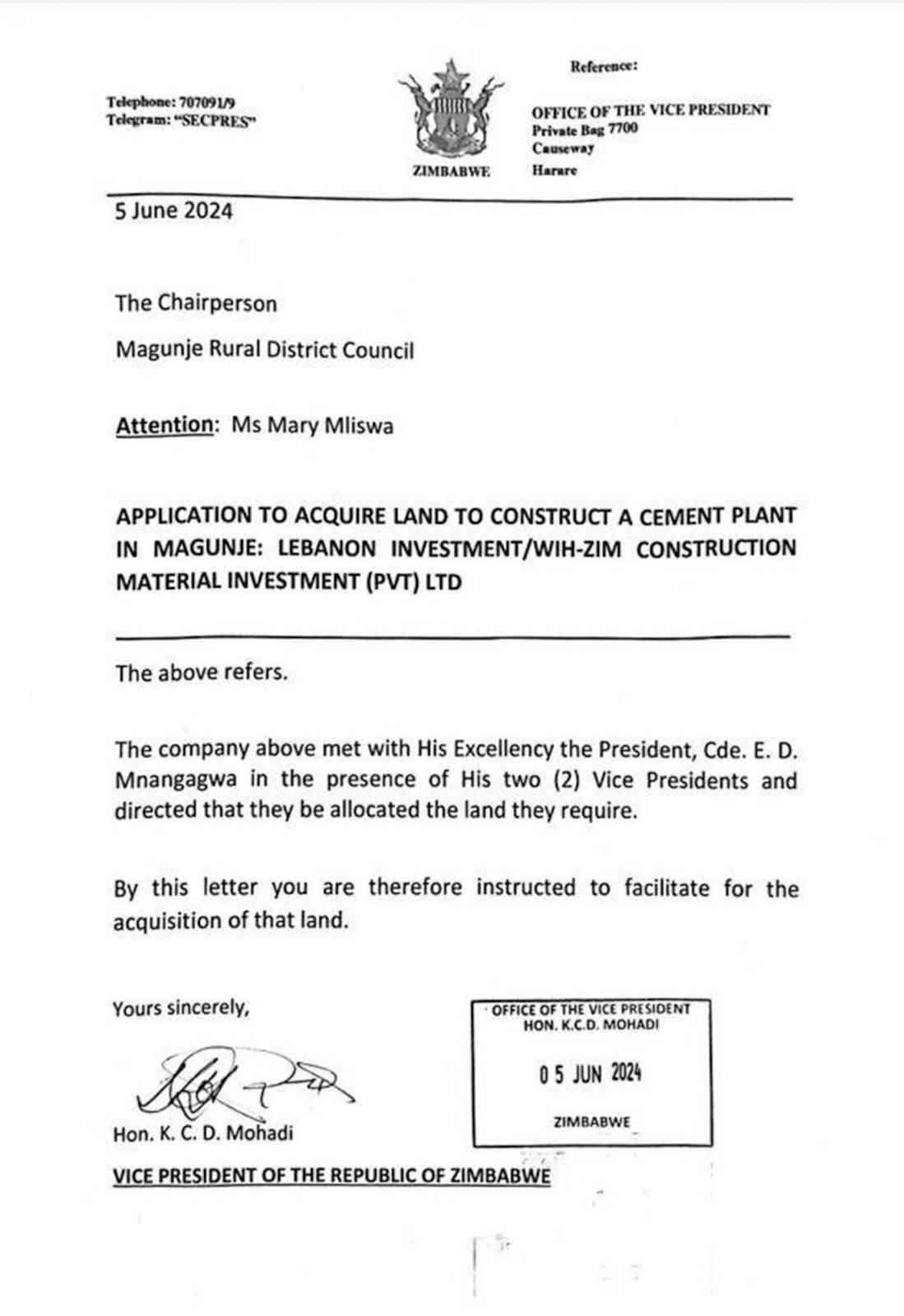

Chinese chase away Hurungwe Villagers from homes

By The NewsDay

Sep. 26, 2025

Dr Simba Makoni, Ex-Finance Minister and Farmer In Conversation with Trevor

By The NewsDay

Jul. 30, 2025

Edinah Masiyiwa, Executive Director At Women's Action Group In Conversation With Trevor

By The NewsDay

Jul. 30, 2025

Fadzayi Mahere, Zimbabwean lawyer and politician In Conversation With Trevor

By The NewsDay

Jul. 30, 2025

Awareness drive urges early pancreatic cancer detection

Cruciferous vegetables such as broccoli and cauliflower are associated with a reduced risk due to their fibre, antioxidants and phytochemical content.

By Cimas

Dec. 12, 2025

New EU envoy hails artistic depth of partnership in launch of 2026 calendar

It was produced in collaboration with the travelling Bepa Gallery, curated by Joanna Powell and Josefina Pierucci.

By Khumbulani Muleya

Dec. 12, 2025

Is Zim really middle-income economy?

By Trust Chikohora

Dec. 12, 2025

Ncube must wake up, face reality

By Harry Wilson

Dec. 12, 2025

Future of digital transformation on procurement performance

By Charles Nyika

Dec. 12, 2025

Premium

Lake Chivero housing project takes shape

The initiative aims to integrate the families into the company's planned mixed housing scheme.

By Tinashe Kairiza

4h ago

Premium

Violence: Why British envoy’s Shona plea has gone viral

The clip is now being broadcast on local radio stations, circulated on social media platforms and screened in community centres across Zimbabwe.

By Austin Karonga

4h ago

Sabi Star mine caught in a clash between culture, custom and modern ideals

Sabi Star mine caught in a clash between culture, custom and modern ideals

By Alfonce Mbizwo

22h ago