In an increasingly interconnected world, free trade agreements (FTAs) are not just instruments of economic policy—they serve as blueprints for a nation’s future, shaping growth and creating pathways to opportunity. When the Maldives signed its FTA with China in 2017, there was hope that this small island nation could harness the might of a global economic powerhouse to foster growth, create jobs, and build a more diversified and resilient economy. However, as the Maldivian government now prepares to enforce the FTA by the end of September 2024, it becomes crucial to reconsider whether this agreement genuinely aligns with the nation's aspirations or if it disproportionately favors Chinese interests at the expense of Maldivian growth.

A Deal Tilted Toward China: Limited Benefits for Maldivians

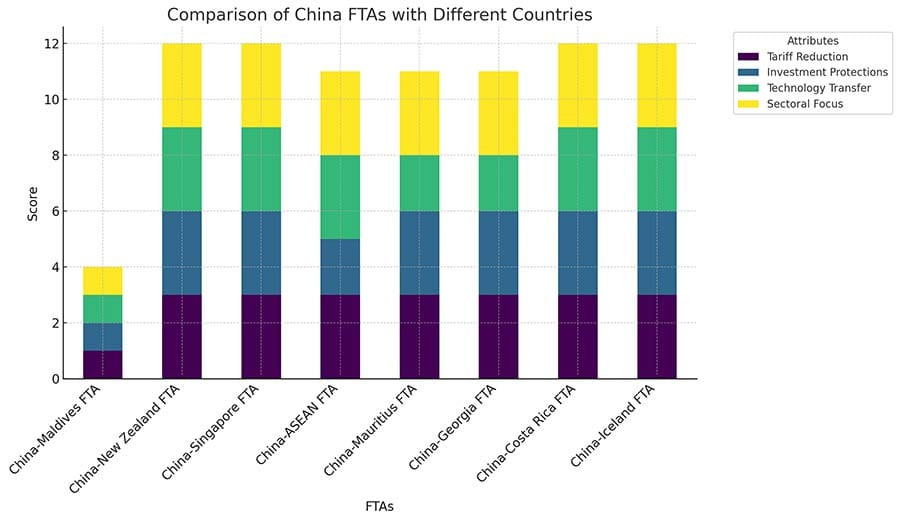

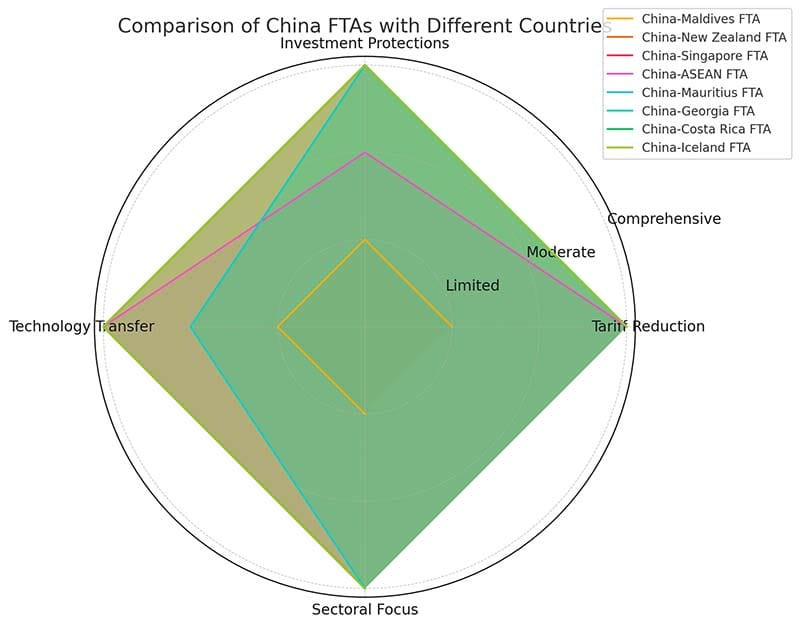

The China-Maldives FTA focuses primarily on reducing tariffs on Chinese goods entering the Maldivian market, which undoubtedly benefits Chinese exporters. However, the Maldives, with its limited export capacity—mainly centered around fish products—receives little in return. The agreement opens Maldivian markets to an influx of Chinese goods while offering minimal reciprocal access to Chinese markets for Maldivian businesses. Given the Maldives' narrow range of exportable products, this lopsided focus on tariff elimination offers little beyond cheaper imports—at the cost of a widening trade deficit.

Contrast this with the China-New Zealand FTA—one of the most comprehensive FTAs China has signed—which eliminates tariffs on 96% of New Zealand's exports, including dairy, meat, and wine. For New Zealand, this agreement is not merely about market access; it empowers its businesses to compete and thrive in the world's second-largest economy. Similarly, the China-Singapore FTA emphasizes high-value sectors such as financial services, technology, and digital trade, ensuring that Singaporean businesses can leverage China's growth to propel their own development.

The Maldives is a young, dynamic nation, with approximately 45% of its population under the age of 35. This demographic presents a significant opportunity to drive innovation and growth. However, the China-Maldives FTA lacks the framework to harness this potential. Unlike the China-Singapore FTA, which emphasizes cooperation in digital services, e-commerce, and fintech—sectors that appeal to younger, tech-savvy entrepreneurs—the China-Maldives FTA does not foster growth in emerging sectors beyond tourism.

The China-ASEAN FTA, for example, promotes cooperation in building ICT infrastructure, digital economies, and regional connectivity. ASEAN countries have leveraged this agreement to strengthen their positions as digital hubs and integrate their young populations into the global economy. The Maldives, aspiring to diversify its economy and reduce dependence on tourism, misses out on similar provisions that could create jobs and build skills in new industries.

Investment and Economic Diversification: The Critical Missing ElementsInvestment is a cornerstone for sustainable economic growth, yet the China-Maldives FTA does little to encourage it in areas beyond tourism. The agreement offers only basic investment protections, with limited mechanisms for dispute resolution or safeguards for Maldivian businesses. This is in stark contrast to other FTAs, such as the China-Mauritius FTA, which includes comprehensive protections for investors, a robust Investor-State Dispute Settlement (ISDS) mechanism, and a forward-looking agenda that promotes investment in high-value sectors like financial services and ICT.

Consider the China-Iceland FTA, which supports investments in renewable energy and technology transfer. Iceland has leveraged its agreement with China to attract investments that align with its strategic interests in sustainable development and innovation. Meanwhile, the Maldives, despite its abundant natural resources like solar and wind, has not secured similar commitments to green energy investment under its FTA with China. This gap is especially glaring given the Maldives' vulnerability to climate change and its need for sustainable development.

While FTAs should ideally offer pathways for wealth creation, the China-Maldives FTA falls short in this regard. It provides limited support for Maldivian small and medium-sized enterprises (SMEs), which are the backbone of the economy and key to future growth. In comparison, the China-ASEAN FTA includes provisions for capacity building, technology transfer, and infrastructure development, all designed to empower local businesses and integrate them into regional and global supply chains.

The Maldives' reliance on tourism—a sector vulnerable to external shocks like pandemics and climate change—highlights the need for a more diversified economic strategy. An FTA that focuses only on tariff reductions for imported goods does little to promote resilience or sustainable growth. By contrast, the China-New Zealand FTA is structured to support New Zealand's broader economic ambitions by enhancing access to China’s markets and encouraging growth in multiple sectors, from agriculture to technology.

A Call for a Balanced Reconsideration Before EnforcementAs the Maldivian government prepares to enforce the FTA with China by the end of September 2024, now is a critical moment to reassess its terms. The agreement could have been a pathway to diversified growth, a tool to engage its youthful population, and a framework to attract investment in new and emerging sectors. Instead, it seems to cement the Maldives' role as a consumer of Chinese goods and a destination for Chinese tourists, with few reciprocal benefits. This raises a critical question: Should the Maldives move forward with enforcing this FTA, or seek to renegotiate it to better reflect its economic priorities and aspirations?

A more balanced agreement would not only include provisions for greater market access for Maldivian goods but also encourage investments in sectors like renewable energy, digital infrastructure, and technology transfer. It should aim to empower Maldivian SMEs, create opportunities for the country’s growing youth, and promote sustainable and inclusive economic growth.

Conclusion: Toward a Fairer Trade FrameworkThe China-Maldives FTA, as it stands, is not only one-sided; it is also a missed opportunity. Compared to other FTAs that China has signed, this agreement provides the least consideration for the partner country's economic development, wealth creation, and long-term growth. As the Maldives approaches the decision to enforce this agreement, it should seek a fairer trade framework that genuinely supports the aspirations of its people, particularly its youth. A renegotiated FTA that reflects these values would be a step toward a more balanced and prosperous future for the Maldives.