THE African Development Bank (AfDB) president Akinwumi Adesina wants Africa’s green environmental assets to be properly priced to allow the continent to turn its massive green assets into wealth.

Proper valuation of Africa’s green wealth is seen as increasing access to international finance, in part, because credit rating agencies will be able to incorporate the true value of an overall asset class thus attracting investors.

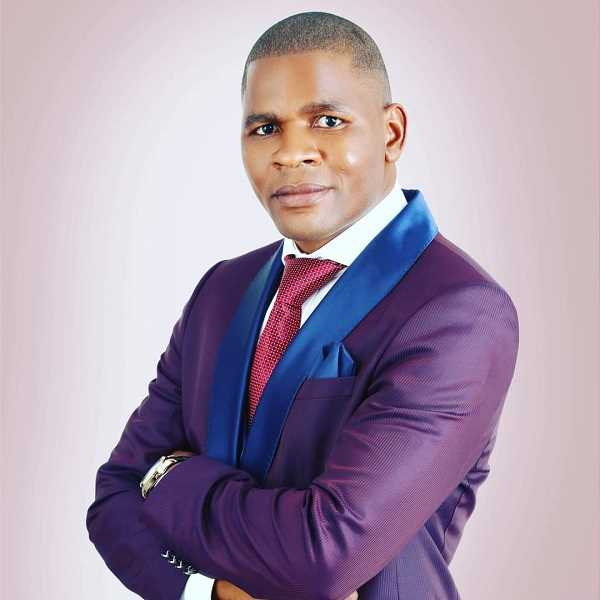

Adesina made the remarks at the COP 29 High-Level Event on ‘Measuring the Green Wealth of Nations: Natural Capital and Economic Productivity in Africa’ last week.

COP 29 or the 2024 United Nations (UN) Climate Change Conference or Conference of the Parties of the UN Framework Convention on Climate Change, is being held in Baku, Azerbaijan, which started on November 11 and ends on the 22nd.

Adesina said proper priced green assets would raise massive financial resources for the continent, spur greater green investments and provide better policies for the greening of African economies for sustainable development.

“Therefore, it is time for Africa’s green environmental assets to be properly priced to allow the continent to turn its massive green assets into wealth, through their inclusion in ‘green GDP (gross domestic product) for Africa’,” he said.

“This will raise massive financial resources for the continent, spur greater green investments and provide better policies for the greening of African economies for sustainable development.

“The significantly higher revenues that Africa will generate from the proper valuation of its carbon sinks and environmental services will also allow it to be able to service its debts, assuring debt sustainability.”

- COP26 a washout? Don’t lose hope – here’s why

- Under fire Mnangagwa resorts to Mugabe tactics

- How will energy crunch transition impact transition to renewables?

- COP26 a washout? Don’t lose hope – here’s why

Keep Reading

AfDB’s preliminary estimates, based on very conservative assumptions, show Africa’s nominal GDP in 2022 could have increased by US$66,1 billion when adjusted for carbon sequestration only.

Adesina said Africa’s natural capital needed to be included in its GDP.

This is because the continent holds considerable non-renewable natural resources.

It accounts for 50% of the world’s reserves of cobalt (used for batteries), 40% of manganese reserves (solar and wind farms) and over 80% of platinum reserves, complemented by rich endowments of nickel, copper, and rare earth minerals.

Adesina said these were crucial for electric vehicles and battery energy storage systems, whose estimated value was expected to rise from US$7,5 trillion to US$59 trillion.

“The greening of the GDP will also have other benefits, including the development of carbon markets in Africa. Unfortunately, today, several African countries are giving away their vast amounts of land to carbon credits. While this may generate some short-term financing, it needs to be understood that Africa is a carbon price taker and therefore is short-changed,” he said.

“While the price of carbon in Europe is high and could be as high as US$200 per tonne because of the strict EU Emission Trading Standards, carbon price in Africa could be as low as US$3 to US$10 per tonne.”