THE Reserve Bank of Zimbabwe (RBZ) last week released its quarterly snapshot for the period ended December 31, 2025, painting a largely positive picture on currency, price and financial sector developments.

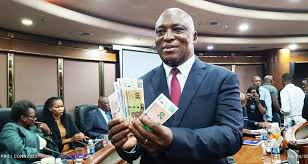

According to RBZ governor John Mushayavanhu, monetary policy in 2025 demonstrated clear effectiveness, restored discipline and delivered measurable macroeconomic gains, particularly in taming inflation and stabilising the exchange rate.

Sustaining the momentum in 2026 will require “continuing to walk the talk in prudent money supply management, foreign currency reserve accumulation and strong fiscal and monetary policy complementarity”.

In the snapshot, the central bank highlighted a sharp decline in annual ZiG inflation to 15% in December, well below the 30% target. Foreign currency reserves rose to US$1,2 billion, equivalent to 1,5 months of import cover as at December 31, 2025, from just US$276 million in April 2024.

The steady accumulation of reserves is significant, as it is one of the key preconditions for a sustainable mono-currency regime. RBZ has set a target of reserves covering three to six months of imports to anchor such a framework.

Reserve money cover for the ZiG also strengthened markedly, rising to ZiG31,4 billion in December 2025, equivalent to six times cover, from ZiG2,2 billion or two times cover, in April 2024.

Exchange rate developments have reinforced the narrative of stabilisation. The willing-buyer willing-seller rate, after peaking at ZiG26,9457, eased to ZiG25,9807 in December, pointing to a more stable and predictable currency environment.

Against this backdrop, the case for easing the tight monetary policy thrust has become more compelling. The current bank policy rate of 35%, while effective as a shock absorber during the period of acute currency stress in 2024, now appears increasingly misaligned with the disinflationary trend, improved reserve buffers and anchored exchange rate expectations.

- To or not to deduct Aids Levy from VAT in Zim

- Charging school fees in forex unreasonable

- Stop meddling in PSMAS affairs

- Village Rhapsody: Zimbabwe’s currency merry-go – round continues

Keep Reading

The tight stance has also weakened the monetary transmission mechanism. A high policy rate has flattened credit appetite across the economy, limiting the pass-through of improved macroeconomic stability to households and firms.

As a result, gains in price and exchange rate stability have not fully translated to increased production, capacity utilisation or job creation, raising the risk of a low-growth equilibrium despite macro stability.

Persistently high interest rates risk crowding out the private sector. With the government maintaining fiscal restraint, an opportunity exists for the monetary policy to complement fiscal consolidation by supporting growth through affordable credit, rather than reinforcing contractionary pressures on both fronts. This policy complementarity is essential if stability gains are to be consolidated into durable economic expansion.

Excessively high ZiG interest rates have discouraged local currency borrowing, inadvertently entrenching dollarisation at a time when authorities are pursuing a de-dollarisation thrust, with the ZiG as the sole currency after 2030.

Moderating the policy rate would help to normalise ZiG financial intermediation.

Conditions that previously amplified easing risks are now substantially mitigated. Reserve accumulation has improved, money supply growth is contained.

A data-driven and incremental loosening, supported by continued reserve build-up and strict liquidity management would, therefore, represent a transition from emergency stabilisation to consolidation and growth support.

In this context, easing monetary policy would not undermine credibility, but rather reinforce it by demonstrating responsiveness to improving fundamentals and a commitment to broad-based economic recovery.

Mushayavanhu is alive to that. In his foreword to RBZ’s 5-year strategic plan (2026-30), the central bank chief said a tight monetary policy stance adopted at the onset of the “Back-to-Basics” strategy served the country well in taming inflation and setting the economy on a course to sustained price stability.

He said the monetary policy thrust in the next five years would focus more towards prudent and disciplined money supply management, with policy decisions calibrated to reflect emerging inflationary pressures and crystallisation of any inflation risks.

Zimbabwe has paid dearly for macroeconomic discipline, authorities equated to the pains of adjustment.

The tight monetary policy thrust did its job; now it’s time to ease.