IN yesterday’s edition, we ran a story titled MPs roast Ziyambi over ZiG devaluation, wherein some legislators queried why government decided to devalue the local currency at a time the price of gold is rising on the world market.

For honesty sake, it does not make sense that government decided to devalue the local currency, which authorities told us is backed by gold, other precious minerals and forex reserves.

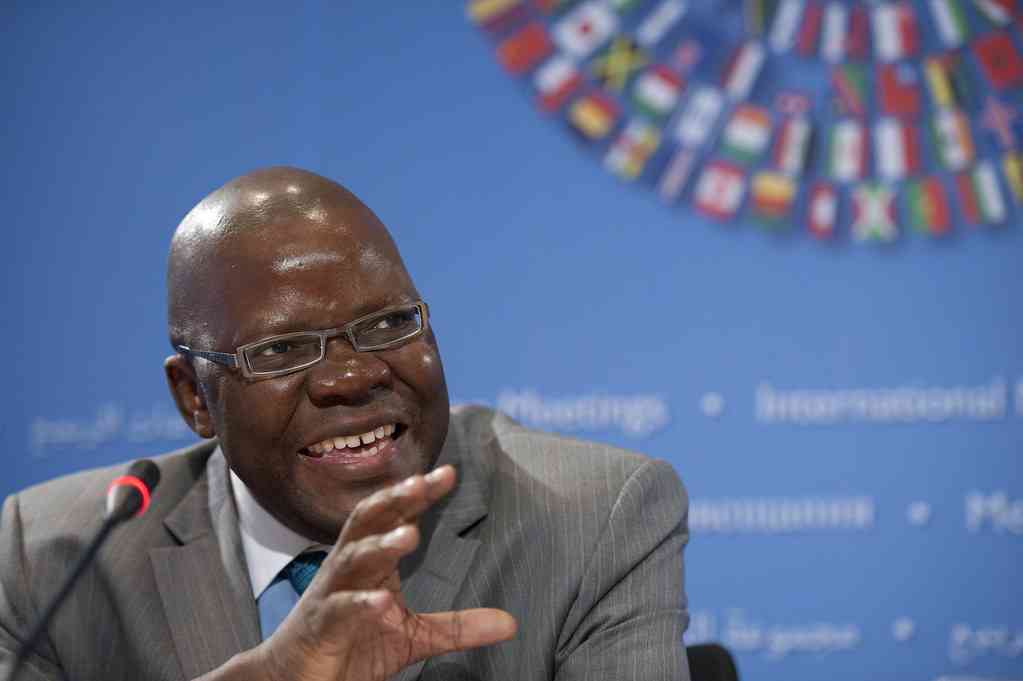

“The whole idea (was) bringing in ZiG and having it backed in our reserves, be it of gold or forex. The currency that is in circulation in terms of ZiG at the moment is around ZiG10,6 billion and our reserves that are backing up this currency are around US$400 million,” Justice, Legal and Parliamentary Affairs minister Ziyambi Ziyambi responded to a question in Parliament.

“If you do the mathematics and if government wakes up today and say we want to dispose of our reserves and buy back the ZiG, the rate at which that will wipe up all the ZiG will not be more than ZiG23,5 per US$.”

But the legislators maintained: Explain the disequilibrium of having a gold-backed currency devalued by 44% when the price of gold per ounce has phenomenally risen.

It makes sad reading to note that those in charge, be it at the central bank or the Executive, do not use the ZiG.

Their pockets are brimming with US dollars.

“It was a once-off,” Reserve Bank of Zimbabwe governor John Mushayavanhu told the State media.

- Awards target married couples

- Awards target married couples

- Sibanda living his writing dream

- Pomona deal under spotlight as experts meet

Keep Reading

“We expect things to stabilise going forward and should start to see prices fall.”

Mushayavanhu should know better about the local currency.

Before him was John Mangudya, who in 2016 declared that he would quit his position if the bond note failed.

Indeed, the bond note failed, just as critics had predicted, yet Mangudya stayed on a further eight years on until March this year.

Maybe talk of behind-the-scene Damascene moment.

We will not discuss the Gideon Gono era as one could possibly sum it up: Catastrophic.

We must learn to stick to the basics.

Excessive printing of money, especially with disputed reserves, will only create high demand for the US dollars, further weakening the local currency.

That message has been hammered over and over again over the years, but it would seem there is a clique that seems to make a killing from currency crisis in the country.

All that government simply needs to do is exercise fiscal discipline and manage the monetary supply responsibly.

Beyond fiscal responsibility is the need to create demand for the local currency.

Government has taken a bold step of trying to create demand for the ZiG by announcing that starting next years, most taxes and fees will be paid expressly in the ZiG.

What is left is walking the talk: Accepting payments for passports in ZiG, buying fuel using the local currency as well as payments for government services.

Government should lead by example in that regard.

A currency cannot function if it cannot be accepted as a means of payment for critical services like fuel, passports and government taxes.

“If this fails, it ceases to be a currency,” one local publication wrote.

For all intents and purposes, good money does not need jingles so that it can be accepted and widely used.

It does not need to be defended on TV or in Parliament and neither does it need to make the headlines on a daily basis.

Ceteris paribus, good money defends itself.