GOVERNMENT has made some progress and will next month begin the process of compensating former farm owners as Harare seeks to resolve the impass, seen as key in the country’s quest to belong to the community of nations.

Swiss ambassador to Zimbabwe, Zambia and Malawi, Stéphane Rey last week applauded government’s efforts to compensate Swiss and other European farmers affected by the land reform programme.

“I want to express my appreciation for the bold steps taken, particularly the effective compensation of farmers.

“This historic development is not just about financial settlement; it’s about reconciliation and moving forward.

“The initial disbursements will start being effective next month. Twenty-seven Swiss farms are directly impacted. Seventeen of them have been validated and approved for compensation this week and the remaining 10 will be examined by the end of this week,” Rey said.

The farms were seized during the fast-track land reform exercise at the turn of the millennium a move which harare defended saying it was meant to redress colonial injustices and give landless blacks access to one of the means of production — the land.

Some of the farms seized were meant to be protected under the Bilateral Investment Promotion and Protection Agreement (BIPPAs) notwithstanding.

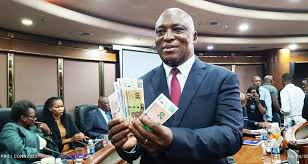

In 2020, the country agreed to pay US$3,5 billion compensation for farm improvements to former farm owners.

The compensation of former farm owners, including those that were under BIPPAs, is at the centre of the country’s arrears clearance and debt resolution process championed by African Development Bank (AfDB) president Akinwumi Adesina, who has put his head on the block for Harare to normalise relations with Western capitals.

The energetic Adesina has shuttled between Western capitals, engaging the country’s creditors as he believes Zimbabwe “cannot run up a steep hill of economic recovery carrying a heavy backpack of debt on its back”.

He is being supported in the drive by high level facilitator and former Mozambican President Joaquim Chissano to open political doors.

The compensation of former farm owners must also be accompanied by housekeeping issues — reforms.

The country agreed to undertake economic and governance reforms.

There are signs of movement on the economic front after government ended central bank’s quasi-fiscal operations and transferred that function to Treasury.

While the central bank has been pumping money into the market, there are concerns that the exchange rate is not market-determined due to the gulf between the formal and parallel market exchange rates.

However, the wheels have been slow on governance reforms. Zimbabwe and its creditors had agreed on seven sub-indicators on the Mo Ibrahim Governance Index — democratic elections, absence of violence against civilians, impartiality of the judicial system, judicial processes, civil society space, institutional checks and balances and public procurement procedures.

Zimbabwe promised to fight corruption.

Graft is an area that has blighted this administration especially after a tenderpreneur implicated in alleged corrupt practices declared “Hapana zvamunondiita, ndakachibata kuti dzvii [I am untouchable]”.

Time is running out for Zimbabwe and it must accelerate the process.

The midwife of the process Adesina’s tenure at AfDB is coming to an end next year. Once Adesina leaves office, he won’t have the clout that he currently wields.

Time Bank has proposed to arrange syndicate loans to help the country resolve the debt crisis.

It is a proposal that must be interrogated with the bigger picture of resolving the debt crisis, which will open a window to new cheap lines of patient capital needed to drive the Vision 2030 agenda of attaining an upper-middle-income economy status.