PLATINUM group metals miner (PGMs), Zimplats Holdings Limited, has recorded a 96% drop in profit after tax to US$8,22 million for the year ended June 30, 2024, owing to lower revenues during the period.

The drop is from a comparative of US$205,46 million earned last year.

During the period under review, global commodity prices declined owing to geopolitics and a slowdown in China’s economy.

China is the world’s largest consumer of raw materials and is estimated to import up to 40% of the world’s industrial metals annually.

Any economic slowdown by the world’s second largest economy affects global demand for precious metals.

“...profit before tax declined to US$37,6 million (FY2023: US$286,8 million). Income tax expense at US$29,4 million was mainly driven by an increase in deferred tax expense of US$17,2 million following the change in corporate income tax rate from 24,72% to 25,75%. Profit after tax fell to US$8,2 million (FY2023: US$205,5 million),” Zimplats said.

The PGMs miner said revenue decreased by 20% to US$767,1 million during the period under review, down from the US$962,3 million recorded in the comparative 2023 timeframe as average US dollar metal prices softened during the period.

“Gross revenue per 6E ounce sold [including the revaluation of pipeline debtors) declined by 20% to US$1 196 (FY2023: US$1 595]. Sales volumes increased by 6% to 641 000 6E ounces, benefiting from higher production in the period (FY2023: 603 000 6E ounces),” Zimplats said.

- Zimplats raises expenditure on environment rehab

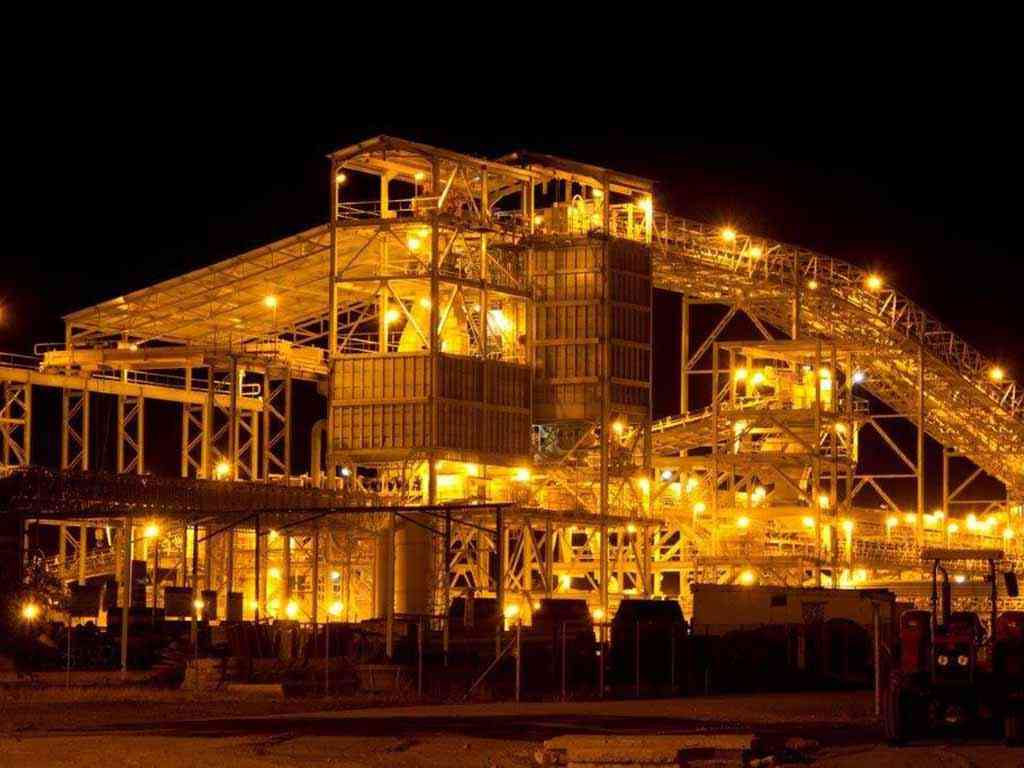

- Zimplats sinks US$373,6 million into projects

- Zimplats revenue down 23%

- Zimplats invests US$516m on capital projects

Keep Reading

“Cost of sales increased by 5% to US$684,7 million [FY2023: US$651,9 million] primarily due to increased production and sales volumes and a higher depreciation charge, moderated by several cost containment initiatives implemented in the period.”

Zimplats added that operating unit cash costs decreased by 1% to US$829 per 6E ounce during the period compared to last year, benefiting from cost containment initiatives.

Despite the drop in profits, the miner had US$2,31 to every dollar of short term debt showing the firm ended the period under review being highly liquid.

The drop in revenue comes despite mined volumes having increased by 5% to 7,9 million tonnes, from the 2023 comparative of 7,6 million tonnes, owing to increased production volumes from the replacement mines.

However, the mined grade was negatively impacted by an increase in lower-grade development tonnages from Mupani Mine and dilution caused by traversing geological structures at the other mines.

This resulted in a 1% decline in the achieved 6E head grade to 3,32g/t (grammes per tonne) compared to the 3,33g/t recorded last year.

Zimplats said that ore milled for the year was 7,9 million tonnes, up 6% from the comparative 2023 period owing to additional tonnage from its third concentrator plant which ran for a full year compared to nine months in prior year. This was in addition to higher milling rates.

Zimplats said 6E production increased by 6% to 646 000 ounces from 611 000 ounces in the prior year.