ZIMPLATS Holdings has recorded a 4% decrease in total operating cash costs in the quarter ended June 30, thanks to cost-containment measures, the company has said.

In March, the platinum group metals (PGM) miner announced a voluntary layoff exercise for all employees to keep the company afloat following a dip in prices on the metals market.

For the period under review, total operating cash costs totalled US$127 339 000, down from US$133 134 000 recorded in the comparable quarter last year.

“Cost containment initiatives implemented during the quarter resulted in a 4% reduction in total operating cash costs on a year -on-year and quarter-on quarter basis,” the company said.

“Operating cash cost per 6E ounce of US$823 was 1% lower year-on-year and quarter-on-quarter mainly due to cost saving initiatives being implemented.”

PGMs contain 6E which are platinum, palladium, rhodium, iridium, ruthenium and osmium.

Zimplats said expansion projects are underway.

“The Bimha and Mupani mine development and upgrade projects will replace production from Rukodzi and Ngwarati mines [which were depleted in FY2022 and June 2024, respectively] and Mupfuti Mine [which will be depleted in FY2028],” Zimplats said.

- Zimplats raises expenditure on environment rehab

- Zimplats sinks US$373,6 million into projects

- Zimplats revenue down 23%

- Zimplats invests US$516m on capital projects

Keep Reading

“Cumulatively, US$407 million has been spent on these projects as of June 30, against a total project budget of US$468 million.”

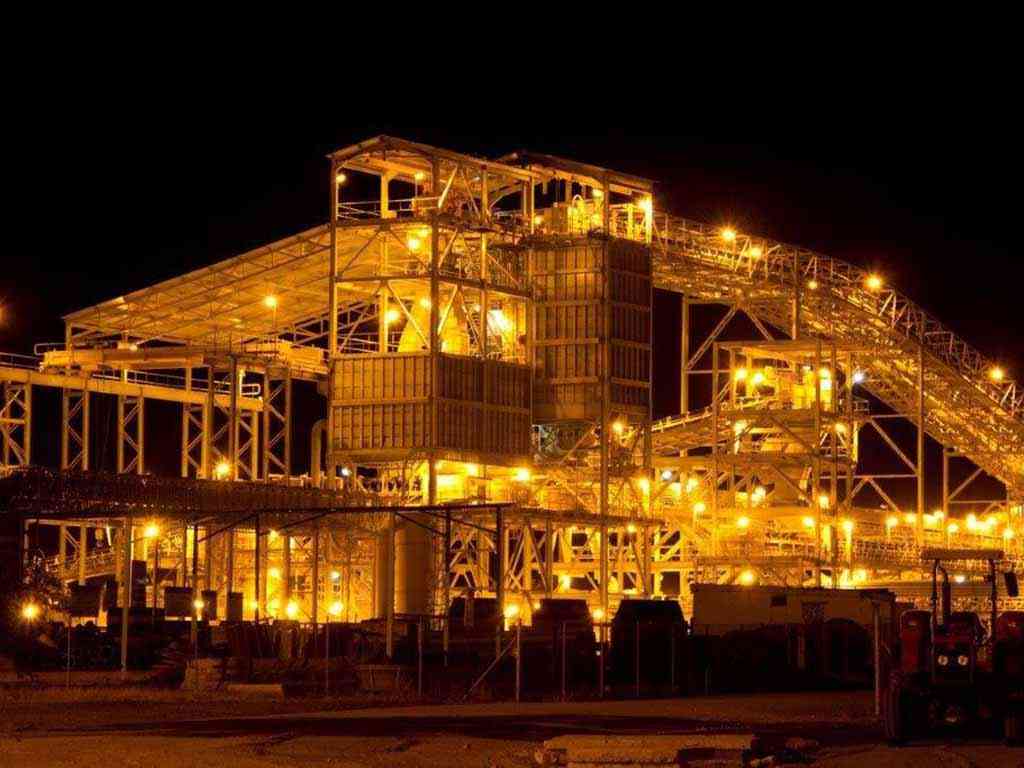

Zimplats said a total of US$387 million had been spent on the smelter expansion and its SO2 abatement plant project against a total project budget of US$544 million.

“US$36 million has been spent on the implementation of the 35MW (megawatt) solar plant project against a budget of US$37 million. The solar plant will be commissioned in the first quarter of FY2025,” Zimplats said.

“A total of US$28 million has been spent on the base metal refinery refurbishment project, against a total budget of US$190 million.”

It said exploration activities remained curtailed during the quarter in response to depressed metal prices.

“The focus was on interpretation of previously drilled core and updating the group’s geological and mineral resource models,” Zimplats said.

During the quarter under review, Zimplats mining volumes increased by 2%, year-on-year, benefitting from pillar reclamation activities at Rukodzi Mine and the continued production ramp-up at Mupani Mine, which is under development.

“However, mining volumes declined 1% from the prior quarter due to higher productivity and Ngwarati Mine primary operations ramping down,” Zimplats continued.

The period under review saw Zimplats record ore mined and milled at 1 973 000 and 1 995 000 tonnes, respectively, from a previous quarter’s 2 002 000 and 2 007 000 tonnes.

This was also up from 2023’ second quarter comparative of 1 940 000 tonnes of ore mined and 1 943 000 tonnes of ore milled.

“6E head grade declined by 1% year-on-year and quarter-on-quarter due to an increased contribution of lower-grade Mupani Mine development ore and dilution from mining across geological structures,” Zimplats said.

Zimplats said year-on-year milled volumes improved by 3% due to the higher milling rates achieved, in line with improved mining volumes.

“Milled volumes decreased by 1% from the prior quarter, however, due to a planned mill reline shutdown at the Selous Metallurgical Complex concentrator. Concentrator recoveries were 1% lower year-on-year and quarter-on-quarter due to lower mill feed grades achieved,” Zimplats said.