CLOTHING retailer Edgars Stores Limited says the company will focus on cost-competitiveness by improving the efficiency of its value chain to make its products affordable amid El Niño-induced drought.

Edgars expects consumers to tighten their budgets amid an El Niño-induced drought expected to reduce disposable incomes as consumers prioritise essentials to combat the effects of the drought .

This is because consumers will have to prioritise essentials to combat the effects of the El Niño-induced drought.

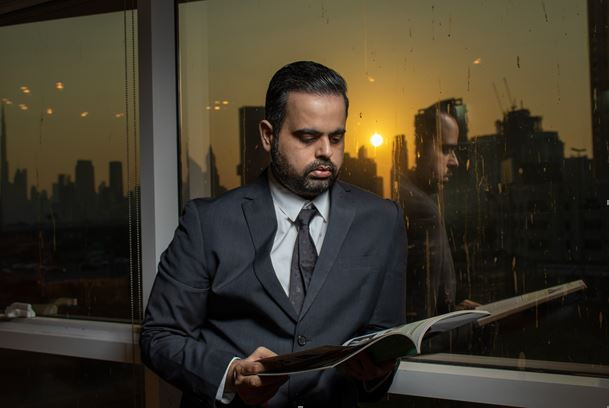

In the latest annual report for the year ended January 7, 2024, Edgars chairperson Thembinkosi Sibanda said the group would also re-launch its Express shops.

“To mitigate against the impact of sales volume declines on profitability, the group will focus on enhancing cost-competitiveness through improving value chain efficiencies. The group will also re-launch its Express shops, targeting the low-income segment of the economy, where it will sell for cash,” Sibanda said.

“In view of the subdued agricultural output in the current year, the country will increase food imports and will be impacted by food inflation. This headwind will bring disposable incomes under additional strain and reduce USD [United States dollar) liquidity in the local financial market.”

Sibanda noted that there was a need for consistent application of regulatory policies around trading in foreign currency to improve cash sales and grow its debtors’ books.

The US dollar retail debtors’ book closed the period at US$12,6 million, representing a 100% growth on the prior year balance of US$6,3 million.

- Edgars Borrowdale relocates to bigger space

- Edgars Borrowdale relocates to bigger space

- Improved performance buoys Edgars

- The plague of informalisation

Keep Reading

Meanwhile, its Zimdollar retail debtors’ book closed the period at ZWL$1,4 billion, a 43,8% decline on the prior year balance of ZWL$2,5 billion.

“Trading in foreign currency since April 2020 has allowed our retail chains to improve stock assortments, which in turn has increased traffic in our stores,” Sibanda said.

“While a sizeable portion of our cash sales is in foreign currency, we believe that this proportion can be increased through favourable and consistent application of regulatory policies around trading in foreign currency.”

He said gearing increased to 137,7% in the current year from a prior year of 103,5%.

“Funding raised was channelled towards growing the debtors’ book as well as store expansion initiatives,” Sibanda added.

The Victoria Falls Stock Exchange-listed entity is in the process of remodelling its business to capitalise on opportunities, after recording a 3 405% rise in profit after tax to ZWL$32,74 billion in the period under review, from the comparative.

The huge increase in profit after tax was owing to a net monetary gain of ZWL$142,81 billion in the reviewed period.

Edgars recorded a profit after tax from ZWL$934,39 million in the comparative 2023 period.

“In addition, cost containment efforts will be an area of key focus to underpin the long-term viability of the business,” Sibanda said.

“The group seeks to expand its geographic footprint through the opening of new stores in strategic locations. In fulfilment of our strategic thrust, we opened a new store at Ascot Shopping Centre in Bulawayo in March this year.”

He said smart merchandise procurement and optimal inventory planning remained the key focus areas to ensure targeted margins were achieved without compromising the merchandise quality.

The clothing retailer would leverage the country’s dollarisation to make returns, it said.