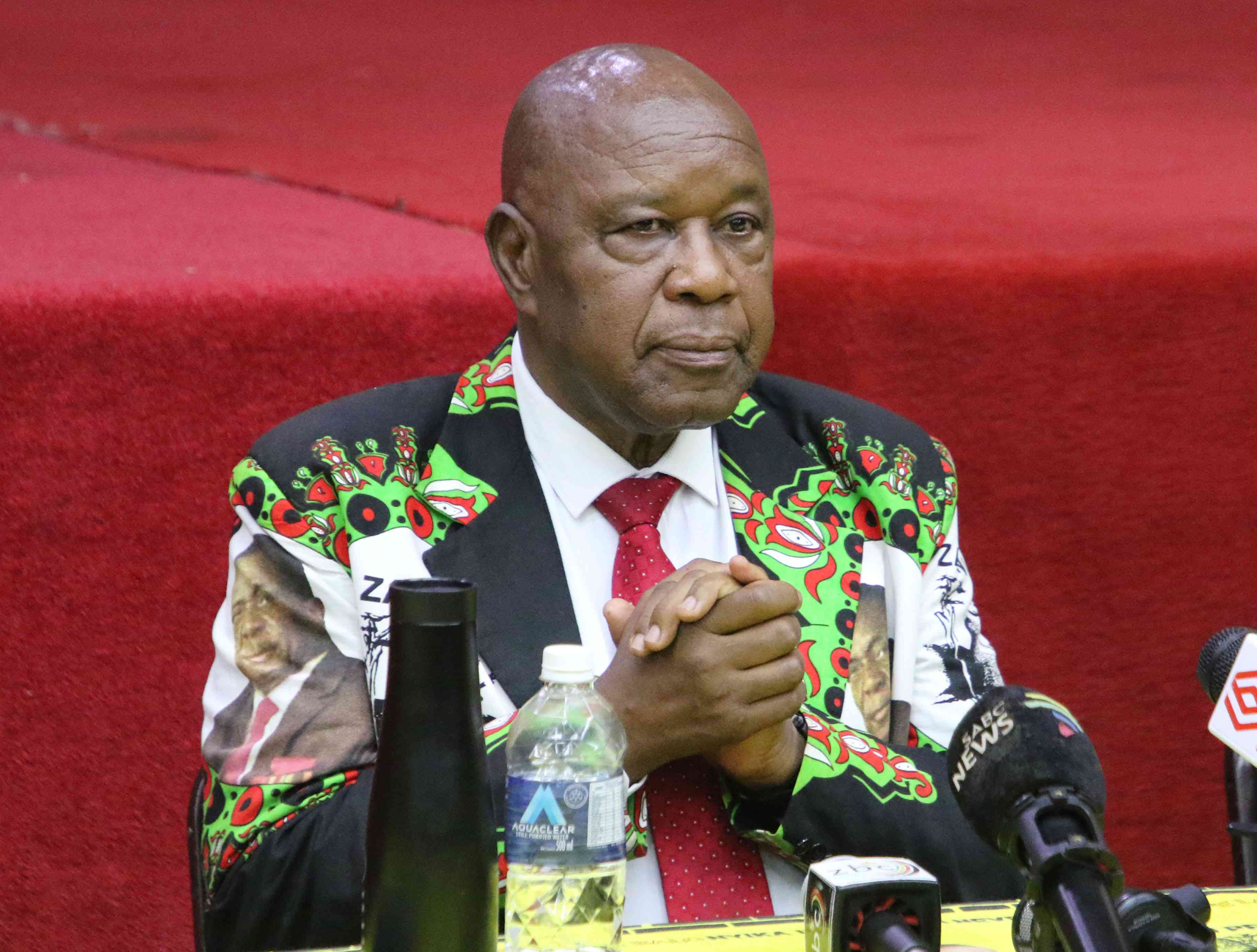

FINANCE minister Mthuli Ncube revealed last week that government is in the process of setting up a diaspora bond to attract increased investment.

A diaspora bond is a bond issued by a country to its expatriates, particularly those in wealthy countries to tap into their accumulated savings.

It is considered an alternative to borrowing from international financial institutions (IFIs), bilateral partners, or capital markets.

The proposed diaspora bond will carry an interest rate of 9% and will be structured such that rather than letting diasporans send money monthly to their relatives back home, the diaspora bond interest yield will be used for that purpose.

The cash-strapped government seeks to tap into the diasporans who have fled the country in droves searching for greener pastures due to the severe tightening of the domestic economy.

According to the latest Zimbabwe National Statistics Agency’s (ZimStat) 2022 census results, about 85% of 908 913 Zimbabwean emigrants are living in South Africa, 47 928 in Botswana, 23 166 in the United Kingdom and the balance scattered across the rest of the world.

Keep Reading

- ‘Israel trying to ignite a religious war in occupied Jerusalem’

- Africa Ahead spruces up 25 healthcare centres in Manicaland

- Africa Ahead spruces up 25 healthcare centres in Manicaland

- US, Israel sign joint anti-Iran nuclear declaration

Independent estimates, however, show that over five million Zimbabweans are living abroad.

Although diaspora bond gives diasporans a chance to contribute to the economic growth and development of their country, it is showing that Zimbabwean authorities are out of touch with lived realities of poor citizens who are being choked by burgeoning public debt.

Official statistics already show public and publicly guaranteed (PPG) debt at US$16,78 billion as of June 2022.

This PPG debt is unsustainable as evidenced by rising external arrears now standing at US$6,41 billion (48,6% of external debt stock).

To show the gravity of debt unsustainability, a granular analysis of the 2021 national budget shows that Treasury had spent more resources on debt servicing than on safety nets.

Ironically, 7,9 million citizens — about half of the total population — were estimated to be wallowing in extreme poverty in 2021 amid chronic inflation and high unemployment.

Now, instead of intensifying domestic resource mobilisation to arrest debt distress, the government is piling more debt which disproportionately benefits the elite who have unlimited access to the corridors of power.

Overreliance on borrowing is perpetrating intergenerational inequities and constraining countercyclical effects of fiscal policies.

More importantly, unsustainable debt has heightened interest, tax, and inflation rates, thereby affecting the competitiveness of domestic manufacturing firms.

As a result, Zimbabwe is now a perennial importer, struggling with high unemployment, particularly among the youth and women, and is experiencing rising income disparities.

Moreso, unsustainable debt has depleted national reserves, thus inhibiting national response to unforeseen contingencies like El-Nino-induced droughts and responding to impacts of climate change and climate variability.

Last but not least, resorting to collateralised borrowing due to limited access to concessionary loans from IFIs is fuelling unsustainable resource extraction in the mining sector, leading to environmental degradation, and pollution of air and water sources, as well as causing forced displacements of locals from their ancestral lands without compensation.

Apart from the negative impacts of public debt on the economy and citizens, there is limited data for the Treasury to have a complete mapping of the diasporans given that most of them have fled political polarisation and are still being denied their constitutional right to vote.

There is also a huge public confidence deficit being depicted through the prevailing toxic political climate, weak institutional capacity, elevated public corruption and impunity, and lack of effective oversight. - Zimcodd

Govt must adequately fund Mat’land infrastructure projects

THE Parliamentary Portfolio Committee on Budget, Finance and economic Development and Expanded Committee on Sustainable Development Goals began consultations for the national budget for 2023 on October 3.

Vendors Initiative for Social and Economic Transformation (Viset) was in attendance for the session held at Maphisa growth point in Matobo district on October 4, 2023.

Major contributions from the participants were focused on education and health infrastructure development, vocational training centre, early child development and science, technology, engineering, and mathematics centre, waste management and climate change.

A participant emphasised on the need to allocate funds towards rehabilitating road infrastructure between Bulawayo and Maphisa, saying it was affecting access to basic services.

This was substantiated by a Tshelanyemba Hospital representative who said patients cannot reach the referral hospital on time and many lives are lost.

It takes more than an hour to travel the 40km distance owing to the bad state of the road.

The budget should support the repair of the dilapidated health infrastructure. The communities that travel more than 40km to access health services are Mkuwa and Manyane. There is need to fix Kezi Clinic whose roof was blown away by wind in 2010.

It was also exposed that Maphisa District Hospital requests patients to pay US$6 fee to the administration to get a stamp prior to being attended to, hence the participants submitted that government should exclude pregnant women, the elderly and children in that “unfair” prerequisite.

Other participants also submitted that the 2023 budget needs to prioritise the construction of bridges, inverts and culverts as most of the bridges in the district need reparation, specifically in ward 11.

People with disabilities said the budget should cater for their special needs like wheelchairs and crutches as well as accessibility of education specialising on them.

They said people with albinism need the budget to allocate funds towards sunscreen lotion facility that will be availed at hospitals and clinics.

Selbourne Hotel was next stop, where informal traders in attendance spoke on the need for market infrastructure, social protection schemes with support for medical aid and pension schemes.

There is need for institutional funding in particular for women informal traders who are the majority but are the least paid economically.

Another contributor spoke on the need to have a central coordinating ministry since there are three ministries that are involved in informal economy activities, a situation that is untenable.

Other contributors spoke on provision of better salaries for health and education personnel.

Social Welfare ministry should also be allocated more resources for safety net provision for the poor and vulnerable.

Chipinge Rural District Council offices was next stop for our team where the development of smart, modern market infrastructure was topical, as the area is a rich horticultural region, but farmers are vulnerable to middlemen who can navigate the bad roads.

The call for more health funding was made by many participants as the local clinics are ill-equipped to handle needs from the communities as there is no ambulance service.

The elderly raised concern with the levels of drug abuse by the youths, saying there was need to allocate resources for the construction of rehabilitation facilities to try and contain the scourge. - Concerned

Decent work must play front, centre roles in restoring economic growth

VENDORS Initiative for Social and Economic Transformation (Viset) yesterday joined the world in celebrating the World Day of Decent Work.

At a time when income inequalities have risen drastically on the back of the COVID-19 pandemic, it is of utmost importance that world governments play a role in ensuring that decent work must play front and centre roles in restoring economic growth.

Article 23 of the Universal Declaration of Human Rights states that everyone has the right to work, to free choice of employment, to just and favourable conditions of work and to protection against unemployment.

However, increasing levels of informality have mitigated against this lofty ideal.

We are heartened that government, through the formalisation strategy it is currently rolling out in partnership with development partners, has seen it fit to try and address the challenges afflicting the informal sector that include lack of access to modern infrastructure, unregulated working conditions, lack of social protection, medical aid, pensions and access to capital.

With the Zimbabwe National Statistics Agency announcing in August that as much as 88% of the population is earning a living through the informal economy, it is incumbent that policymakers make concerted efforts to cater for this majority in resource allocation processes such as budget formulation.

It is, indeed, a travesty that a sector that contributes over 48% of gross domestic product does not have a seat at the table of social dialogue processes such as the Tripartite Negotiation Forum.

Even a cursory look at the country’s economic blueprint — the National Development Strategy 1 — will confirm the poor attention given to the sector.

Sustainable Development Goal 8 emphasises the need to promote sustained, inclusive and sustainable economic growth, full productive employment and decent work for all and this surely cannot be achieved if over 88% of the majority is excluded in resource allocation.

Viset will strive to ensure no stone is left behind in the fight to ensure decent work is availed to all and it is in this vein that we continue engaging on the formalisation process and indeed any other platform that seeks to address the inequalities between the formal and informal sectors and indeed the income inequalities of all classes. - Viset