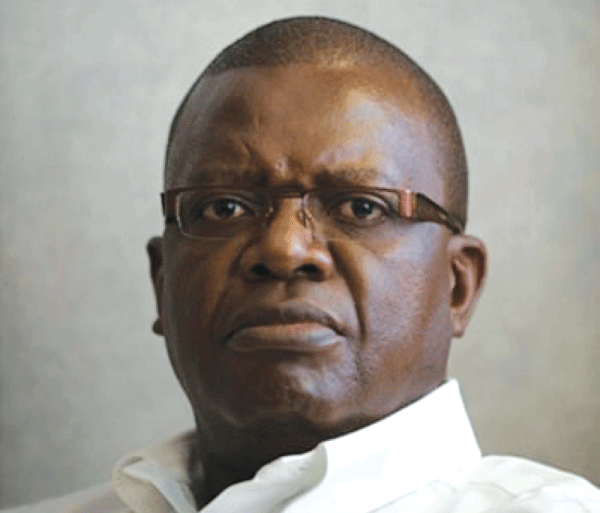

MEDIA mogul Trevor Ncube has assumed 100% ownership of Alpha Media Holdings (AMH) after his former partners Media Development Investment Fund (MDIF) disposed of their equity interest from Zimbabwe’s largest independent media house.

BY STAFF REPORTER

The move came after Ncube also divested from South African weekly, Mail&Guardian (M&G), where he was a major shareholder since 2002.

Ncube confirmed the development in a statement yesterday, saying both parties had mutually agreed to part ways after 14 years working together as a team. Before this latest deal, Ncube’s trading vehicle controlled 61% while MDIF had 39% stake in AMH.

“My partner of 14 years, the Media Development Investment Fund (MDIF), under the leadership of Harlan Mandel have put forward a compelling plan that will ensure the survival of the M&G well into the future. As part of this deal, MDIF will be exiting from my media interests in Zimbabwe namely Alpha Media Holdings (AMH),” he said.

AMH are the publishers of NewsDay, The Standard and Zimbabwe Independent.

The Zimbabwean entrepreneur described his stay at M&G as an eye-opener, saying: “Ownership of the M&G is equivalent to carrying a baton that gets passed on from generation to generation with just this underlying principle: Editorial independence is sacrosanct. I have often said my role over the past 15 years has been more of a custodian of a great South African asset, than an owner.”

He, however, lamented the global turmoil which has shrunk the media industry, hitting advertising revenue and circulation figures, forcing most media investors to migrate to the digital platforms.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“Change is what keeps us media people awake at night. I am glad that the end of my stewardship of the M&G coincides with changing fortunes in my beloved homeland of Zimbabwe. You couldn’t script this kind of scenario. Thank you to everyone who has been part of this incredible journey,” Ncube said.

The restructured ownership would result in M&G CEO, Hoosain Karjieker, acquiring a minority stake in the business as part of a Black Economic Empowerment transaction.

MDIF CEO Harlan Mandel said: “Trevor Ncube has played a vital role in the history of M&G, demonstrating an unwavering commitment to its editorial independence and high standards of journalism. He deserves enormous credit for successfully turning around a failing paper and charting a new strategy with new relevance for post-apartheid South Africa.”

MDIF is a New York-based not-for-profit investment fund for independent media in emerging markets. It has a 22-year history of helping to build print, digital and broadcast media companies in emerging markets. Since 1996, it has invested in more than 100 media companies in 39 countries on five continents.

Ncube added: “When I took over the M&G its circulation was around 38 000 copies a week. The readership of the M&G was to peak at an all-time record of over 58 000 copies a week. In the time that I owned this important institution, I have had the pleasure of hiring and working with some of the most outstanding editors. In many ways, the M&G has prepared them for leadership in media.

“Looking back on the decade and a half that I was at the helm of the M&G, I can say without a doubt that this august newspaper broke many of the stories that at the time seemed against the spirit of the Rainbow Nation. But as we now know with the State Capture series of stories, the M&G was brave enough to report on the stories that should have warned all of us not to assume that a pretty constitution was enough of a safeguard against greed and corruption.”

Trevor Ncube full statement

Farewell to M&G Staff

In September 2001, I was approached by the late Govin Reddy, at a function in Cape Town, who told me that the Mail & Guardian was for sale. I had known Govin from the time he spent in Zimbabwe in exile.

I had recently acquired full control of Zimind Publishers who owned two titles in Zimbabwe namely the Zimbabwe Independent business weekly and the Sundaynewspaper The Standard.

This approach by Govin was an opportunity to spread my wings and diversify my risk. Within Zimbabwe, the economic and political situation was deteriorating and an investment in South Africa made sense.

In August 2002, after months of negotiations, I concluded a deal with the Guardian Newspapers UK, to acquire majority control of the Mail & Guardian.

In March 2002, shortly before my acquisition the company reported a loss of R15m, and as I commenced my time at this institution, I came face to face with the reality of the fractious environment that prevailed internally, which had led to the Guardian divesting. The company was in dire need of a recapitalisation strategy, and together with Hoosain Karjieker, we set a plan in motion.

My motto then and now was: The Editorial Independence of the Mail & Guardian could only be guaranteed by the organisation’s ability to operate as a commercially viable entity. In short, this meant that I would never interfere with the duties of our journalists and editors.

We enjoyed many good years together with the MDIF, and when the initial facility was paid up, we received further funding to re-acquire our shareholding in M&G Online from the Naspers group. It could be argued that perhaps we overpaid Naspers to regain control of this important asset – the asset had been disposed of hastily before my time, and we negotiated with our backs against the wall.

The turmoil in the global media industry would however soon affect us too.

From 2009 onwards, we noticed a softening in print advertising revenues, and dwindling circulation. The world was going digital. And so we plotted a new path forward.

Armed with our full shareholding in M&G Online, unlocked from the shackles of the onerous shareholders agreement with Naspers, we embarked on an ambitious digital strategy – perhaps too ambitious in retrospect – that resulted in further losses to our bottom line.

I take full responsibility for the mistakes we made. And I know too that we were not alone in making these mistakes. Around the world media organisations everywhere are searching for the perfect solution for a commercially viable digital media publication.

Every publisher I know can relate to our own experiences – they too have embarked on digital paths that seemed so promising yet generally ended in failure.

This was the fate of our strategy to create a Pan-African platform that focused on telling the African story from an African perspective. Remember the extent to which the Africa Rising euphoria seemed to confirm this as a logical strategy.

Sadly the reality was somewhat different and we incurred losses from the M&G Africa venture.This was to have a knock on effect on the Mail & Guardian that, coupled with declining revenues in our core market, tested our ability to function effectively.

I have always believed that the M&G should remain a pillar of the South African democracy, and it should exist well beyond any single individual or shareholder.

Regrettably – much as I would have loved to – I am no longer in a position to invest in the M&G.

My partner of 14 years, the Media Development Investment Fund(MDIF), under the leadership of Harlan Mandel have put forward a compelling plan that will ensure the survival of the M&G well into the future. As part of this deal MDIF will be exiting from my media interests in Zimbabwe namely Alpha Media Holdings (AMH).

Ownership of the M&G is equivalent to carrying a baton that gets passed on from generation to generation with just this underlying principle: Editorial independence is sacrosanct. I have often said my role over the past 15 years has been more of a custodian of a great South African asset, than an owner.

When l took over the M&G its circulation was around 38 000 copies a week. The readership of the M&G was to peak at an all-time record of over 58 000 copies a week. In the time that I owned this important institution, I have had the pleasure of hiring and working with some of the most outstanding editors. In many ways, the M&G has prepared them for leadership in media.

Looking back on the decade and a half that I was at the helm of the M&G, I can say without a doubt that this august newspaper broke many of the stories that at the time seemed against the spirit of the rainbow nation. But as we now know with the State Capture series of stories, the M&G was brave enough to report on the stories that should have warned all of us not to assume that a pretty constitution was enough of a safeguard against greed and corruption.

I would like to thank all those who have supported my vision and to acknowledge and celebrate those who have been a part of this institution during my tenure. A big thank you to the entire M&G board and to Peter Vundla who chaired the board with firmness and gentle wisdom.

I have known Hoosain Karjieker for more than 15 years and I am pleased that he has been chosen as the BEE partner of the M&G as it charts a new path.

Change is what keeps us media people awake at night. I am glad that the end of my stewardship of the M&G coincides with changing fortunes in my beloved homeland of Zimbabwe. You couldn’t script this kind of scenario. Thank you to everyone who has been part of this incredible journey.

Full MDIF statement

MDIF acquires majority stake in South Africa’s Mail & Guardian

(New York, 12 December 2017) Media Development Investment Fund, a New York-based not-for-profit investment fund for independent media in emerging markets, today announced that it has acquired a majority stake in South African media company Mail & Guardian.

The restructured ownership also sees M&G’s Chief Executive Officer, Hoosain Karjieker, acquire a minority stake in the business as part of a Black Economic Empowerment (BEE) transaction. The former majority shareholder, Trevor Ncube, has disposed of his equity interest in M&G.

“MDIF has worked with M&G for more than a decade and knows the company intimately,” said CEO Harlan Mandel. “We have invested in M&G because it is a uniquely important media organization with a great future. Its independent reporting has a profound impact on the national debate and it is a beacon for independent journalism across the continent, and indeed the world. We are committed to building on this legacy and re-establishing M&G as a commercially and journalistically dynamic institution at this important time in South African politics.”

MDIF has a 22-year history of helping to build print, digital and broadcast media companies in emerging markets.

Since 1996, it has invested in more than 100 media companies in 39 countries on five continents.

Mr. Karjieker said the MDIF’s knowledge of the M&G would provide a good foundation for the future of the company.

“This new structure bodes well for the long term sustainability of the M&G,” he said.

MDIF Deputy CEO Mohamed Nanabhay said: “We are excited about this new chapter for M&G, and are looking forward to working with management, editorial and other staff to revive this great and relevant company’s fortunes. M&G is rightly recognized as one of Africa’s great media brands and we are thrilled to be able to bring our expertise in helping to build media companies to such an iconic institution.”

MDIF first provided a loan to M&G in 2003 when Mr. Ncube purchased a controlling interest from the UK’s Guardian Media Group at a time when the company was in a perilous financial position. Further debt and equity investment helped stabilise the company, build its distribution network and develop its award-winning digital news site.

Mr. Mandel said: “Trevor Ncube has played a vital role in the history of M&G, demonstrating an unwavering commitment to its editorial independence and high standards of journalism. He deserves enormous credit for successfully turning around a failing paper and charting a new strategy with new relevance for post-apartheid South Africa.”

About MDIF

MDIF is a New York-based not-for-profit investment fund for independent media in countries where independent media are under threat. It has more than 20 years’ experience of helping build quality, news and information companies – print, digital and broadcast – in emerging markets. It has:

●invested more than $163 million in 113 media companies ●worked in 39 countries on 5 continents ●a current portfolio of more than $60 million invested in over 50 media organizations

In South Africa, MDIF manages the South Africa Media Innovation Program (SAMIP) – a three year, US$4m initiative to accelerate digital media innovation among independent media outlets and encourage new entrants.