A LOCAL consumer watchdog, Poverty Reduction Forum Trust (PRTF), has said the newly-introduced bond coins have eased small-value transactions, but made no significant impact on household expenditures driven by accommodation and utility prices.

BY PHILLIP CHIDAVAENZI

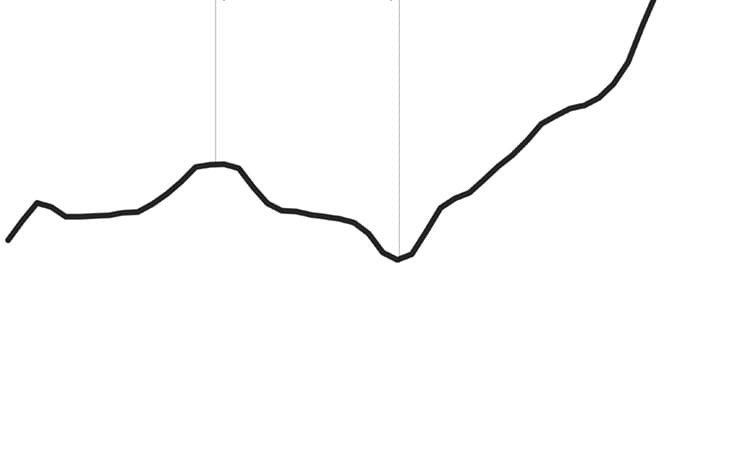

In a report accompanying PRTF’s January 2015 Basic Needs Basket (BNB), the trust’s executive director Judith Kaulem said the benefits that could have been derived from the introduction of the bond coins were being eroded by increasing unemployment and high household expenditure drivers.

“The policy benefits can be very short term in nature if there are no long-term solutions to critical problems of employment and uncertainty of income streams,” Kaulen said.

She said they conducted an in-depth evaluation of the commodity price changes and noted that these were necessitated by several factors including the introduction of the bond coins, reduction in fuel prices and the ongoing price competition among retailers.

“Although the price of fuel has gone down by 8% to 10%, the Basic Needs Basket analysis shows that the effect of this change on the prices of basic commodities is insignificant,” she said.

The price of petrol decreased from $1,52 in November 2014 to around $1,32 per litre in January 2015 while in Bulawayo, the petrol price fell from around $1,54 per litre to around $1,41 during the same time frame.

“The effect of fuel price change to the general price trend of locally-manufactured commodities can be insignificant because Zimbabwean manufacturers still face high costs of production emanating from high water tariffs, use of obsolete equipment and power cuts,” Kaulem said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Reserve Bank of Zimbabwe governor John Mangudya last week said the economy could not afford salary hikes and called on retailers to rationalise their pricing models.

“We need to move away from the psychology or concept of money illusion, which states that people think in terms of the amount of money they have, rather than in terms of its value,” Mangudya said while presenting the monetary policy statement.

“We now need to think in terms of value. This is why even those not working would have their welfare raised as they would be able to buy more from a US dollar.”